INTRODUCTION

The Approved Operating Budget and Public Services Program (PSP) contains a comprehensive picture of the County's budget year beginning July 1, including changes from the previous fiscal year, department accomplishments and initiatives, and performance measures.

**NOTE** Throughout this publication you will see the following fiscal year references, the specific years are listed below:

- Last Year / Prior Year - Fiscal Year 2024

- Current Year - Fiscal Year 2025

- Next Year - Fiscal Year 2026

Consistent with the County Charter, the County Executive makes recommendations on the operating budget for all County departments, offices, and agencies. However, recognizing the Charter-defined roles, the Executive defers significantly to Legislative and Judicial Branch agencies on those budgets. Questions regarding the recommended budgets for Legislative Branch departments should be directed to Sandra Marin, 240-777-7923.

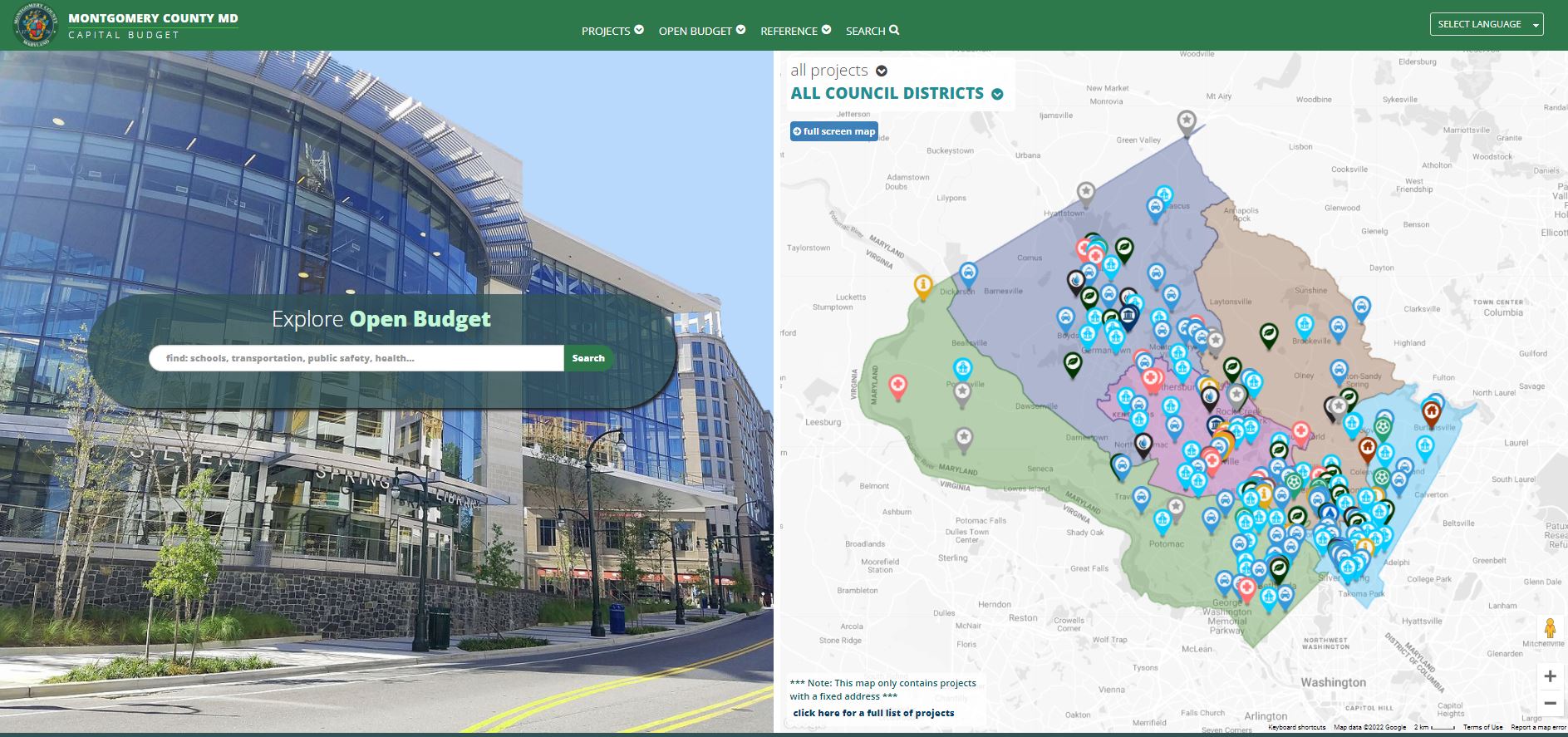

OPEN BUDGET

To replace, consolidate, and enhance numerous failing legacy financial systems, the Office of Management and Budget (OMB) developed an in-house budget analysis and statistical information application called BASIS. Using an intuitive and accessible user-interface design, BASIS provides residents, analysts, departments, and management with instant access to budget and performance data in a clear and concise fashion. This scalable solution ensures evolving budget needs are met in a cost-effective manner.

Open BASIS Budget Features include:

- Interactive charts, visualizations, tables, maps and videos;

- A Custom Google Search Engine for fast results finding;

- Downloadable Publications, Individual Sections/Chapters;

- Filter Previous Years' data and content;

- Export and discover data, tables and visualizations;

- Mobile (works on smartphones, tablets and desktops);

- American with Disabilities Act (ADA) compliant; and

- Instantly translatable into 90+ languages.

For more information, please visit the following website: http://montgomerycountymd.gov/openbudget.

CONTENTS OF THE OPERATING BUDGET DOCUMENT

The major components of the Approved Operating Budget and Public Services Program are described below in order of appearance in this document.

County Executive's Budget Message

The County Executive's message summarizes the financial status of the County, major approved expenditure priorities for the upcoming fiscal year, and how the budget is funded.

Council President's Budget Message

The County Council President's message summarizes the Council's approval of the comprehensive six-year program for public services and fiscal policy.

Operating Budget Process**

This chapter provides a brief introduction and refers to the legal requirements for the annual budget process and includes descriptions of government structure and government accounting methods and funds.

Fiscal Policy**

This chapter describes the policies of Montgomery County Government with respect to taxes, spending, and debt management, including short-term policies and initiatives. The purpose of fiscal policy is to provide guidance for sound public practice in the planning and financing of public expenditures, including the policy assumptions under which budget and tax decisions are made.

Revenues**

This chapter provides assumptions used to project revenues for funding the budget, including:

- demographic, economic, and fiscal trends that identify potential impacts on the County's overall expenditure requirements and revenues over the next six years; and

- detailed information and estimates on revenue categories and major sources of funds.

Capital Improvements Program (CIP)**

This chapter describes the impacts of the annual capital budget and biennial capital improvements program (CIP) on the operating budget and six-year public services program (PSP), including a list of major CIP projects and funding sources for all agencies. The six-year CIP implies on-going commitment of resources in the PSP for long- and short-term debt service; cash for non-debt eligible expenditures and debt avoidance; and costs to equip, open, staff, and maintain newly constructed facilities.

If you are interested in information about the capital budget, please use our Open Capital Budget website which includes the following features:

- A breakdown of projects by category, sub-category, council district, planning area, regional service area and status;

- Interactive map with filtering capabilities by project type and location;

- Complete project details filterable by year and version, including downloadable Project Description Forms (PDF) and data;

- Comprehensive capital budget schedules, reports, and chapters;

- Robust Search Engine for quickly finding results; and

- ADA compliant, works on any device / browser.

The information is available at montgomerycountymd.gov/capitalbudget.

Debt Service

Debt service is the amount the County must pay each year for the principal and interest on the County's bonded and other indebtedness. Debt service is presented both in terms of the specific bond allocations by category and fund and by sources of revenue, including six-year projections of debt service requirements.

Workforce/Compensation**

This chapter includes detailed information about negotiated settlements with certified employee bargaining units and unrepresented employees. General data related to group insurance, disability protection, and employee retirement plans are also presented.

Agency Summaries

The County Executive is required by the County Charter to include recommendations on agency budgets for which the County Council sets tax rates or approves budgets. The Executive recommends expenditure levels and funding support, where applicable, for the budgets of the Montgomery County Public Schools, Montgomery College, the Montgomery County and bi-county (central administration) portions of the Maryland-National Capital Park and Planning Commission (M-NCPPC), and the Montgomery County and bi-county portions of WSSC Water. A summary of the Housing Opportunities Commission budget is also included, containing the approved operating budget appropriation. In addition, a section describing the Montgomery County Revenue Authority is provided, as copies of the Revenue Authority budget are not available until after May 1 of each calendar year, as required by County Code.

County Government Approved Department Budgets

The approved budgets for departments and offices of the Montgomery County Government are provided for the following:

- Legislative Branch (the County Council and legislative offices and boards);

- Judicial Branch (Circuit Court, Sheriff, and State's Attorney); and

- Executive Branch (departments with functions related to general government; public safety; transportation; health and human services; libraries, culture, and recreation; community development and housing; environment; and other county functions).

The presentations include: the department's mission statement; the relationship to the County's priority outcomes; policy goals; initiatives; program performance measures; description and cost of programs; approved expenditure, revenue, and workforce allocations for the department; approved changes from the previous fiscal year's budget; charges to other departments; and information about future funding parameter items. For more detailed information about department displays, see the section on Department Budget Presentations below.

Non-Departmental Accounts (NDAs)

The Non-Departmental Accounts section contains expenses essential to the operation of the County government which either do not fall within the functional assignment of any department or agency or provide for expenditures related to more than one department or agency. Examples include various grants to municipal governments, contributions to other funds, County government memberships (e.g., Maryland Association of Counties), and certain legally mandated programs. Responsibility for administration of NDAs is assigned by the Chief Administrative Officer to specific departments. Although classified as an NDA, all utilities expenditures of the County government are displayed in a separate section to provide combined data on costs by energy type and user departments.

Budget Summary Schedules

The Summary Schedules section contains aggregate fiscal data for all agencies for which the County Council sets tax rates, makes levies, or approves programs and/or budgets. The schedules include expenditure and funding totals by agency, department, government function, and source of funding, with both dollar amounts and staffing (i.e., full-time equivalents (FTEs) and positions). Revenues are described and detailed by agency, fund, and type. Ten-year historical trends are also included for major expenditure categories, revenue sources, the government workforce, and tax rates.

Glossary

The Glossary contains definitions of terms and acronyms commonly used throughout both the PSP and CIP budget documents.

DEPARTMENT BUDGET PRESENTATIONS

For each department within Montgomery County Government and for most agency summaries, the budget presentation includes:

Mission Statement: the overall purpose of the department (or major division), including the goals or results it expects to achieve for the community or its function in the County government.

Budget Overview: approved appropriations for the department, with changes from the prior fiscal year, in dollars, full-time equivalents, and percentage change.

County Priority Outcomes: denotes which of the County Executive's seven priority outcomes relate to the department.

Initiatives: provides anticipated results of the approved funding for next fiscal year.

Innovation & Productivity Improvements: provides a summary of major department innovations and operational efficiencies completed in the last year.

Program Contacts: department and Office of Management and Budget (OMB) contacts for the budget, including phone numbers.

Program Descriptions: provides a descriptive narrative of the program, including, as applicable:

- nature, functions, and features of program activity;

- the public need to which the program responds;

- who or what benefits from the program activity; and

- what the resources allocated will provide to the community.

Program Performance Measures: Lists performance measures that are aligned to each relevant program. Actual performance data are shown for the previous two fiscal years, as well as estimates for the current fiscal year and projections for the next two fiscal years. The FY25 figures and some of the FY26 figures represent projections for the relevant program.

Program Approved Changes: A table displays the approved program expenditures and FTEs compared to the prior fiscal year, including an itemization of key changes within individual programs based on approved budget actions. Budget changes that relate to a unique program are listed individually within each program approved changes chart. Budget changes that affect more than one program, such as compensation changes, are summarized in a multi-program adjustment item for each affected program.

Budget Summary: Summary data for the department, including actual expenditures for the prior fiscal year, the approved budget and estimated expenditures for the current fiscal year, and the approved budget for the coming fiscal year. The presentation includes by fund: expenditures within appropriation category (Personnel Costs, Operating Expenses, Capital Outlay, and Debt Service); personnel requirements (full-time and part-time positions and FTEs); and related revenue sources. Appropriation categories and related components within the Budget Summary include:

- Salaries and Wages: The cost of all salary expenses for both full-time and part-time positions, including other personnel cost adjustments (e.g., overtime, shift differential, multilingual pay, etc.).

- Employee Benefits: Social security, group insurance, and retirement. Additional information regarding employee benefits may be found in the Workforce/Compensation chapter of this document.

- Operating Expenses: Those costs required to support the operations of the agency, including such items as contracted services, printing, motor pool, and office supplies.

- Debt Service (for M-NCPPC, Parking Lot Districts, Solid Waste Disposal, Alcohol Beverage Service Fund, and Montgomery Housing Initiative funds only): The annual payment of principal and interest on bonded indebtedness (for both general obligation and other debt) incurred by departments/agencies funded by a Special or Enterprise fund.

- Capital Outlay: Funding for the acquisition of fixed assets that have a value of $10,000 or more and a useful life of more than one year.

Personnel categories within the Budget Summary include full- and part-time positions as well as full-time equivalents (FTEs). FTEs reflect staff time charged to the department's operating budget. One FTE is the equivalent to 2,080 work hours or 260 workdays.

Related revenues listed in the Budget Summary are generated or received by the department as a direct result of its activities. These include user fees, permits and licenses, grants, intergovernmental aid and reimbursements, and other miscellaneous revenues.

Approved Changes: Describes department-wide expenditure and FTE changes from the current year's approved budget to next fiscal year's approved budget. The crosswalk includes:

- Additional items funded in next year's approved budget for new or expanded services;

- Decreases from last year's approved budget relating to reduction in service or elimination of one-time funding in the base budget (e.g., for printers, servers, implementation of new system where hardware costs are one-time expenses, costs for vehicles for new police officers, etc.);

- Proposed compensation adjustments;

- Group insurance and retirement rate adjustments;

- Rate adjustments for other expenses such as motor pool, printing and mail, risk management, etc.;

- Increases or reductions in charges to or from other departments (including charges to the CIP);

- Shifts in resources to another department;

- Other personnel cost adjustments, including changes related to annualization of current year increments; position or job class reclassifications; staff turnover; and lapse changes; and

- Other operating expense changes, including inflation adjustments for contracts, rent, etc.

The presentation is organized under two categories: first by items with service impacts, then by other adjustments with no service impacts. Under each category, the items are organized by largest to smallest dollar value change. For items that affect a single program, the name of the relevant program is shown in parentheses. If no program is shown, the adjustment affects several programs.

Verb and Definition {Service Impact Changes}: a verb precedes each approved crosswalk item. Through verb choice, service impacts are distinguished from other budget changes that are simply the result of cost increase or decreases (including other technical adjustments). The following verbs describe service impact changes:

- Add - New funding for services that presently do not exist

- Enhance - More funding for an existing service (delivery of more of the same service) or improvement to the quality of an existing service

- Eliminate - Total elimination of an existing service, with no anticipation of the service being provided by another entity

- Reduce - Reduction in funding, but not elimination of an existing service

- Restore - To reverse a previous recommendation to Shift or Reduce a service

- Replace - County assumption of responsibilities previously provided by a non-County entity or funded by a restricted grant (e.g. Federal/State/private)

Verb and Definition {No Service Impact Change}: a verb precedes each approved crosswalk item. Through verb choice, service impacts are distinguished from other budget changes that are simply the result of cost increase or decreases (including other technical adjustments). The following verbs describe other service adjustment with no service impact change:

- Increase Cost - Additional expenditures to provide the same quantity and scope of existing services (e.g., compensation or benefit increases)

- Decrease Cost - Reduction in cost without service impact (e.g., elimination of one-time items approved in the current fiscal year)

- Re-align - Budget adjustment with no impact on service due to more efficient service delivery or change in service demand

- Shift - The transfer of service delivery and attendant costs between County government departments; the transfer of service delivery and attendant costs to another program within the same department; or the elimination or reduction of a service with the anticipation that the service will be provided by another entity (e.g., State, private sector)

- Technical Adjustment - Used to indicate shifts between expenditure categories or changes in FTEs with no net budget impact

Program Summary: listing of each program, including current fiscal year approved and next fiscal year's approved expenditures and FTEs.

Charges to Other Departments: provides listing of personnel and operating expenses charged to other departments or to the capital budget. The amounts in the table are not reflected in the expenditure or FTE figures displayed in the Budget Summary.

Funding Parameter Items: provides potential future fiscal impacts of the department's programs by fund over a six-year period when measured against the approved budget for the next fiscal year.

Annualization of Personnel Costs: identifies next fiscal year's annualized cost for the lapsed portion of new approved positions, as most new positions are budgeted for only a portion of the fiscal year.

Six-Year Public Services Fiscal Plan: estimates of costs over the six-year planning period are included as overall projections of total resources and use of resources for many Montgomery County non-tax supported funds such as the Permitting Services Fund and Solid Waste Disposal and Collection Funds. These figures are based on major known commitments, and the projected assumptions are explained.

Service Maps and Other Exhibits: additional information (e.g., location of Police, Fire, Library, or Recreation facilities) relevant to the department is provided, as applicable.

** Included only in the recommended version of the budget publication