SUMMARY OF FY26 RECOMMENDATIONS

A. SUMMARY OF AGENCY REQUESTS

Montgomery County Public Schools (MCPS): The MCPS workforce for FY26, as recommended by the Board of Education (BOE), is 25,387.3207 FTEs, or 939.6972 FTEs greater than the Board of Education adopted FY25 workforce of 24,447.6235 FTEs. In September 2024, MCPS began negotiations with the public schools' bargaining units, the Service Employees International Union (SEIU), the Montgomery County Education Association (MCEA), the Montgomery County Association of Administrators and Personnel (MCAAP), and the Montgomery County Business and Operations Administrators (MCBOA). At this time, tentative agreements regarding compensation and benefits have been reached with the associations to be effective July 1,2025. The Board's requested budget includes $186.2 million in funds to support the tentative agreements. For more information on compensation and workforce changes, please see the Board of Education's FY26 Operating Budget Tentatively Adopted.

Montgomery College (MC): The College and its Board of Trustees adopted a fiscally conservative maintenance-of-effort budget that provides wage increases for the College's dedicated faculty and staff. The FY26 Current Fund increase in personnel costs is roughly $9.2 million. Negotiations with the bargaining units are nearly complete. For more information on compensation and workforce changes, please consult the Adopted FY26 Montgomery College Operating Budget Request, available on the College's website.

Maryland-National Capital Park and Planning Commission (M-NCPPC): The net impact on the M-NCPPC workforce for FY26, as recommended by the Montgomery County Planning Board, is an increase of 19.08 FTEs. The Commission's requested budget includes an increase in personnel costs of $8.3 million. The increase also includes retirement and group insurance adjustments, a compensation placeholder (to address collectively bargained compensation increases and pass-through costs), and a reclassification placeholder. For more information on compensation and workforce changes, please see the M-NCPPC FY26 Proposed Annual Budget.

Montgomery County Government (MCG): When looking at headcount, the net impact on the County government workforce for FY26, as recommended by the Executive, is an increase of 156 positions. This increase consists of 122 tax supported positions and an increase of 34 non-tax supported positions.

The recommended budget contains an increase in total personnel costs of $123.2 million, or 8.1 percent. The increase in FY26 related only to FY26 compensation and benefits adjustments totaled $80.0 million, or 5.3 percent. The primary factors in these changes are:

| Factor | Millions |

|---|

| General Wage Adjustment (GWA) | $36.5 |

| Increase in required retirement contribution | $9.6 |

Increase in group insurance

| $20.7 |

| Service increments and longevity | $9.4 |

| Annualization of FY25 Compensation Adjustments | $22.1 |

| Other FY26 Compensation Adjustments | $3.9 |

| New positions in FY26 | $10.8 |

| Position eliminations in FY26 | -$1.8 |

| Other changes in personnel costs, including turnover savings and annualization of positions | $12.1 |

The recommendations in the remainder of this section are for the County government and are based upon the bargained agreements with the United Food and Commercial Workers, Local 1994 (Municipal and County Government Employees Organization - MCGEO); the International Association of Fire Fighters (IAFF), Local 1664; the Fraternal Order of Police (FOP), Lodge 35; and the Montgomery County Volunteer Fire and Rescue Association (MCVFRA). Certain provisions of the agreements have been extended to unrepresented employees, as noted below.

B. COUNTY GOVERNMENT SALARY AND WAGES

General Wage Adjustment: The Executive recommends the following general wage adjustments (GWA) in FY26: 4.85 percent effective the first full pay period after July 1, 2025, for all employees in the Police bargaining unit and Police Leadership Service (PLS); 3.25 percent effective the first full pay period after July 1, 2025, for all employees in the Fire and Rescue bargaining unit and Fire and Rescue uniformed management; 3 percent effective the first full pay period after July 1, 2025 for all employees in the Office, Professional, and Technical (OPT), and Service, Labor, and Trades (SLT) units, as well as all employees on the Transit Bus Operators and Transit Coordinators Salary Schedules, Deputy Sheriffs and Correctional Officers Uniform Salary Schedules, and all non-represented employees, including Management Leadership Service (MLS).

FY26 salary schedules can be found on the County's website at:

http://www.montgomerycountymd.gov/HR/compensation/Compensation.html.

(Note: FY26 salary schedules will be available after Council approval of the FY26 budget)

Service Increments: The Executive recommends service increments of 3.5 percent for all eligible employees.

Longevity Increments: The Executive recommends longevity increments in FY26 for all eligible employees.

Performance-Based Pay: The Executive recommends $2,500,000 in the Compensation Adjustment and Employee Benefits NDA to fund performance-based pay increases for MLS and PLS employees.

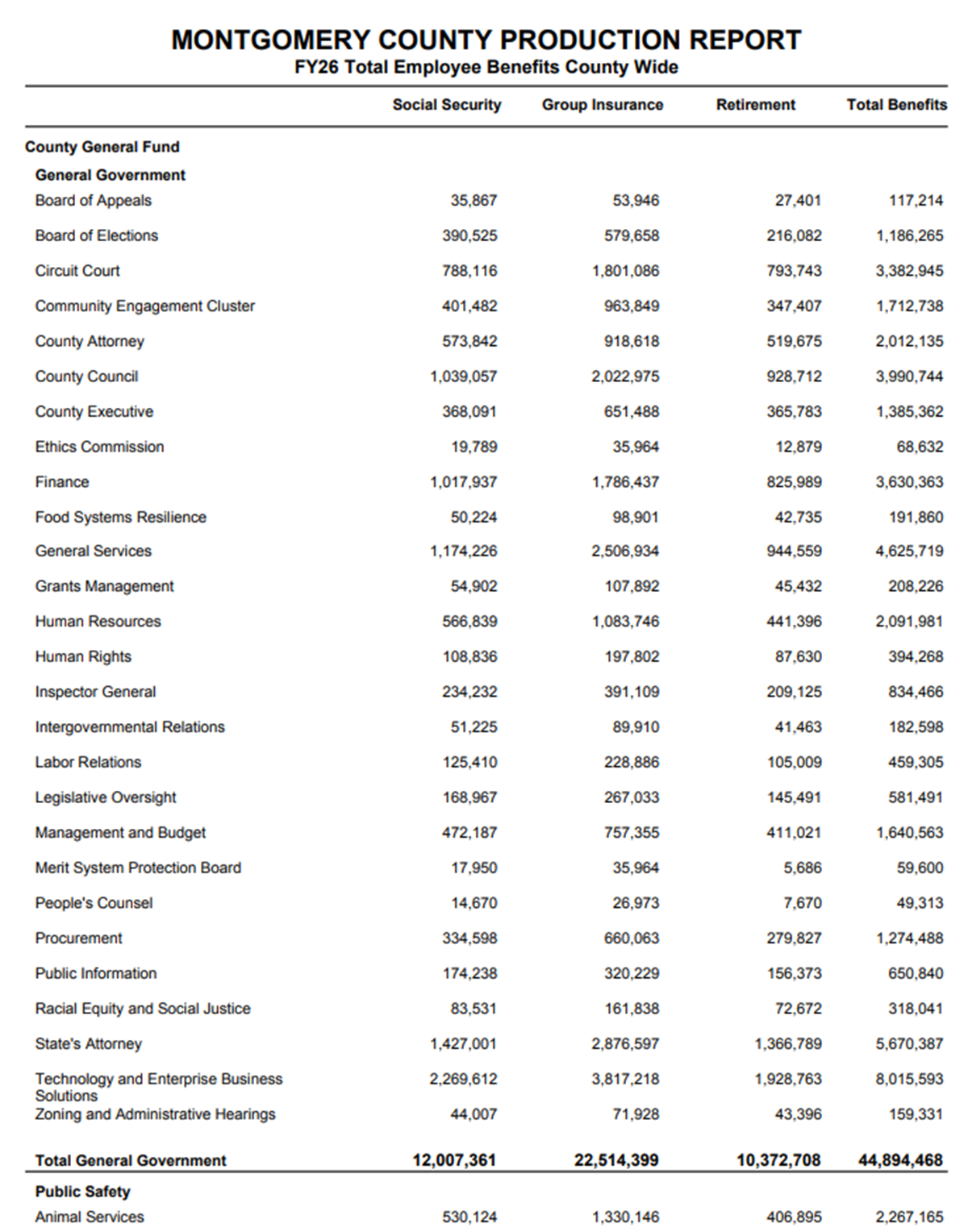

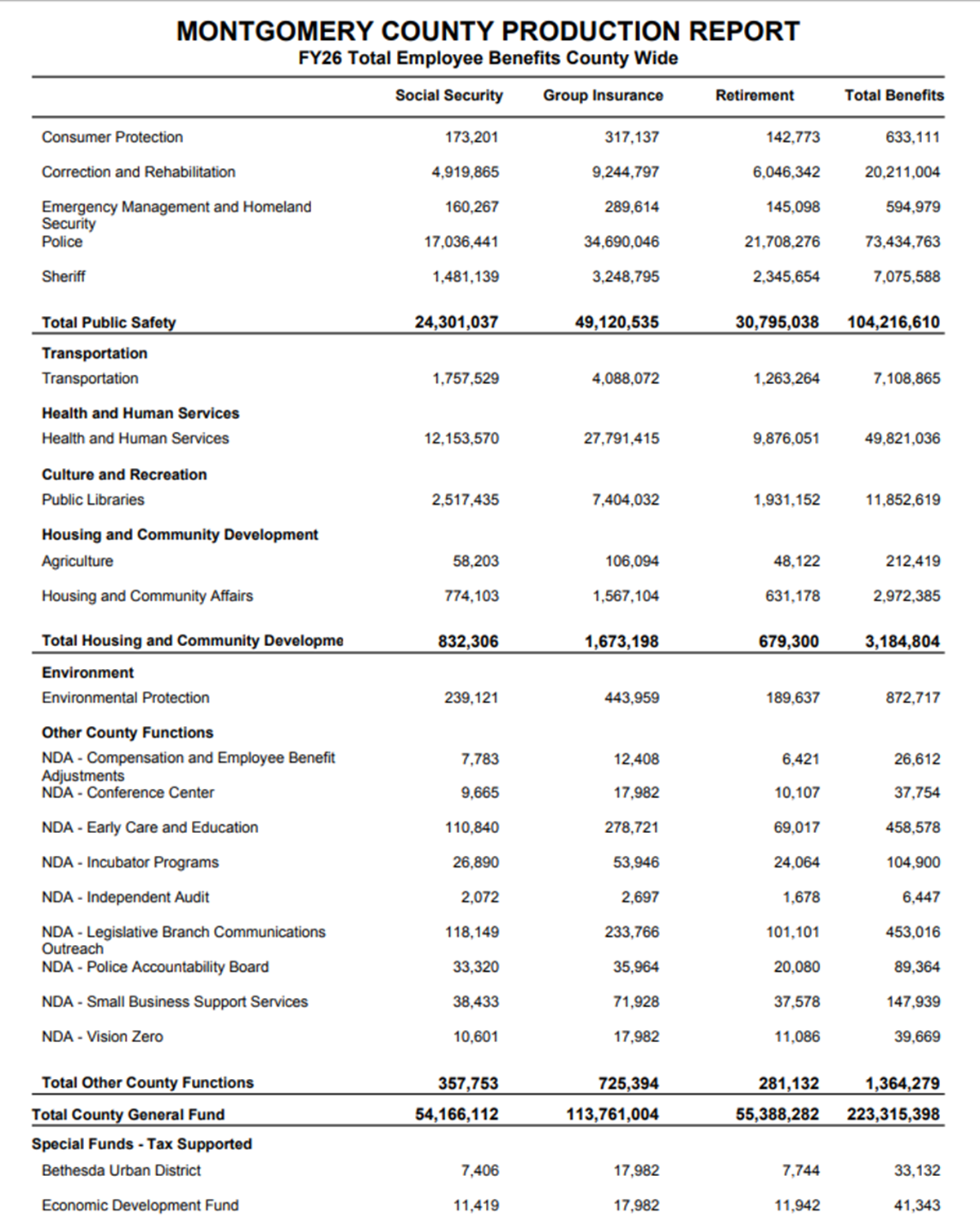

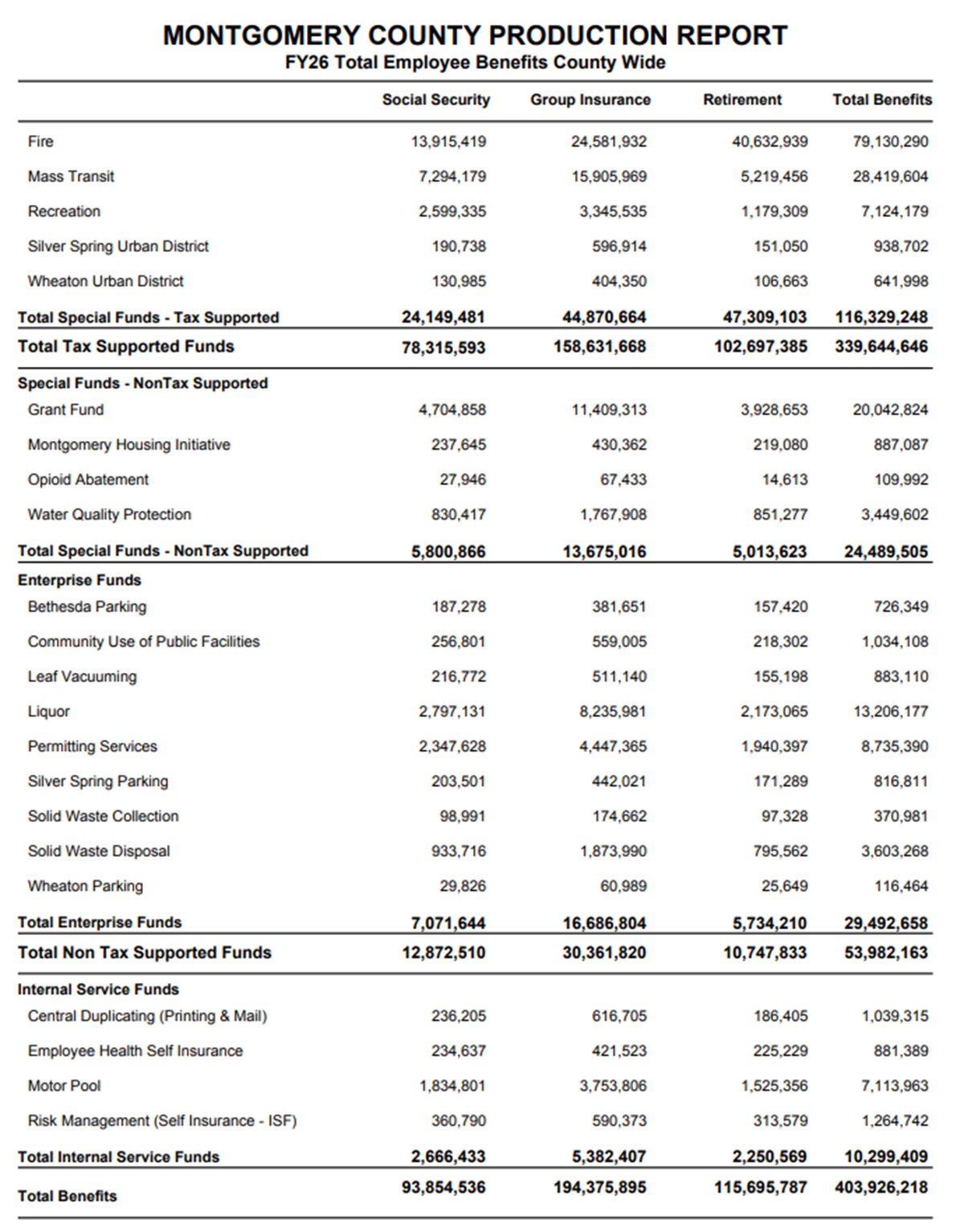

C. COUNTY GOVERNMENT: EMPLOYEE BENEFITS

The following employee benefits are funded in the Executive's recommended budget through a combination of lump-sum or payroll-based contributions.

- FICA (Social Security & Medicare)

- Workers' Compensation

- Group Insurance

- Employees' Retirement System

- Retirement Savings Plan

FICA (Social Security and Medicare): Contributions are collected from County departments and agencies each payday based on actual payroll. Since contribution rates and salary maximums change at the start of the calendar year, figures used in the recommended fiscal year budget represent an average of the rates set for 2025 and projected changes for 2026. The employer rates of 6.2 percent for social security and 1.45 percent for Medicare are not expected to change.

Workers' Compensation: This is handled through the County's Risk Management program under the Department of Finance. Departments with significant non-tax revenues make annual contributions to the Liability and Property Coverage Self-Insurance Fund. A lump-sum contribution to the fund for insurance for the remaining County departments is made annually through the Risk Management (General Fund portion) Non-Departmental Account. Participating County agencies also make annual lump-sum contributions. Contributions for all members are set each year based on an actuarial valuation of exposures, and past and projected claims experience along with administrative expenses.

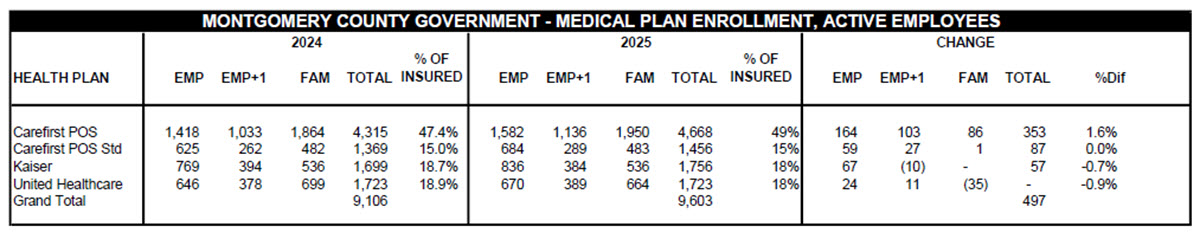

Group Insurance Benefits: The contributions for health insurance are based on an actuarially determined Countywide average fixed rate of $17,982 per position, and the contribution for life insurance is based on fixed rates per coverage amounts based on an employee's salary.

It is projected for the long-term that the annual cost of group insurance for the County, including active employees and retirees, could increase an average of approximately nine percent annually between FY26 and FY31. Contribution rates during this period will be set based on various factors, including the fund balance in the Health Insurance Fund and claims cost experience.

Consolidated Retiree Health Benefits Trust: Beginning in FY08, the County implemented a plan to set aside funds for retiree health benefits, similar to the County's 50-year-old practice of pre-funding for retiree pension benefits. Due to exponential growth in expected retiree health costs, the County had determined the cost of funding these benefits, which were being paid out as the bills came due, would become unaffordable. Setting aside money now and investing it in a Trust Fund, which is invested in a similar manner as the pension fund, is a prudent and responsible approach that will result in significant savings over the long-term.

County agencies develop current estimates of the costs of health benefits for current and future retirees each year. These estimates, made by actuarial consultants, concluded that the County's total future cost of retiree health benefits if paid out today, and in today's dollars, is $1.9 billion as of the FY end 2023 GASB 74 Report - approximately 23.1 percent of the total FY26 budget for all agencies.

The County's approach to address retiree health benefits funding has been to determine an amount which, if set aside on an annual basis and actively invested through a trust vehicle, will build up over time and provide sufficient funds to pay future retiree health benefits and any accrued interest on unfunded liability. This amount, known as an Actuarially Determined Contribution or "ADC", is estimated at $72.5 million. This amount normally consists of two pieces - the annual amount the County would usually pay out for health benefits for current retirees (the pay-as-you-go amount), plus the additional amount estimated to fund retirees' future health benefits (the pre-funding portion). The pay-as-you-go amount can be reasonably projected based on known facts about current retirees, and the pre-funding portion is estimated on an actuarial basis.

The County's approach to address retiree health benefits funding has been to determine an amount which, if set aside on an annual basis and actively invested through a trust vehicle, will build up over time and provide sufficient funds to pay future retiree health benefits and any accrued interest on unfunded liability. This amount, known as an Actuarially Determined Contribution or "ADC", is estimated at $72.5 million. This amount normally consists of two pieces - the annual amount the County would usually pay out for health benefits for current retirees (the pay-as-you-go amount), plus the additional amount estimated to fund retirees' future health benefits (the pre-funding portion). The pay-as-you-go amount can be reasonably projected based on known facts about current retirees, and the pre-funding portion is estimated on an actuarial basis.

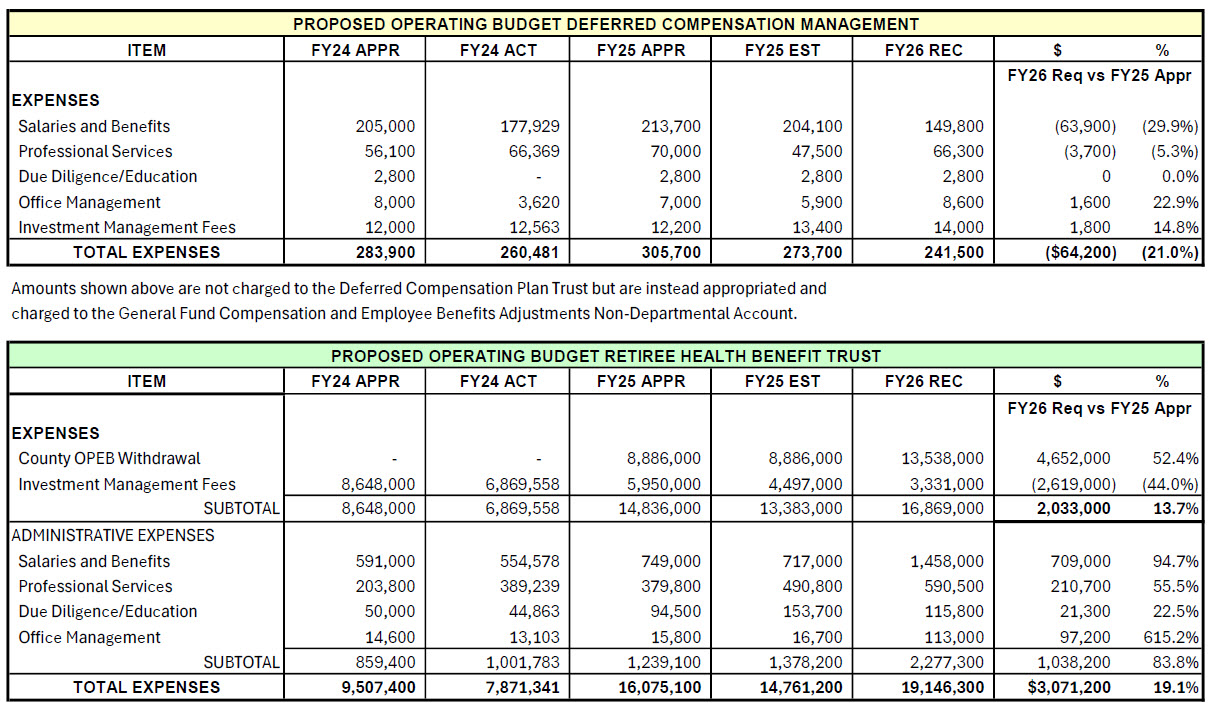

The County's policy has been to pay the full amount of ADC each year. In FY11, the County Council enacted Bill 17-11 which established the Consolidated Retiree Health Benefits Trust. The Bill amended existing law and provided a funding mechanism to pay for other post employment benefits (OPEB) for employees of MCPS and MC. In FY15, the County and all other agencies implemented the Medicare Part D Employer Group Waiver Program for Medicare eligible retirees/survivors effective January 1, 2015. This has reduced retiree drug insurance costs and the County's OPEB liability. The County achieved full pre-funding in FY15, consistent with Council resolution No. 16-555. In December 2023, the County Council passed Resolution No. 20-337, establishing an updated OPEB funding policy. In FY25, in accordance with this funding policy, $8.9 million has been utilized to pay for a portion of the County's retiree health insurance claims. The prefunding contributions were budgeted at $59.1 million for the MCPS Consolidated Trust. No prefunding amount was required for Montgomery County Government or the MC Consolidated Trust.

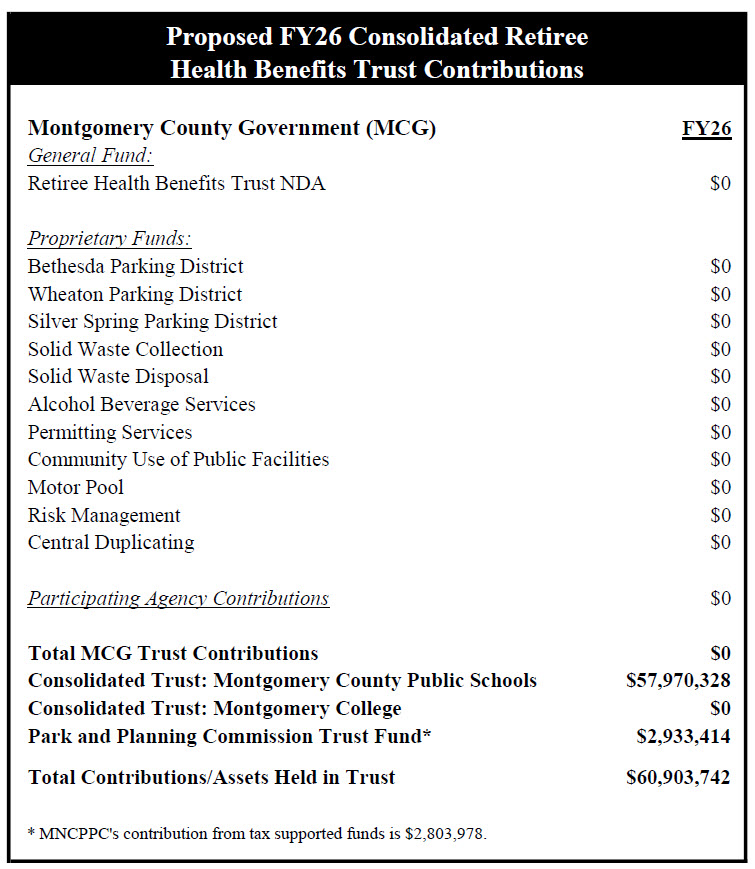

The actuarial valuation used for the FY26 budget resulted in an ADC that was $13.5 million less than the pay-as-you-go amount, and the FY26 budget assumes the utilization of this $13.5 million for payment of a portion of the County's retiree health insurance claims. A detailed breakdown of FY26 recommended contributions to the Consolidated Retiree Health Benefit Trust for County government tax supported agencies, participating agencies, MCPS, and MC is displayed in the table above. The County Executive is recommending that the Retiree Health Benefits Trust provide $27.2 million to MCPS for the payment of retiree health insurance claims in FY26.

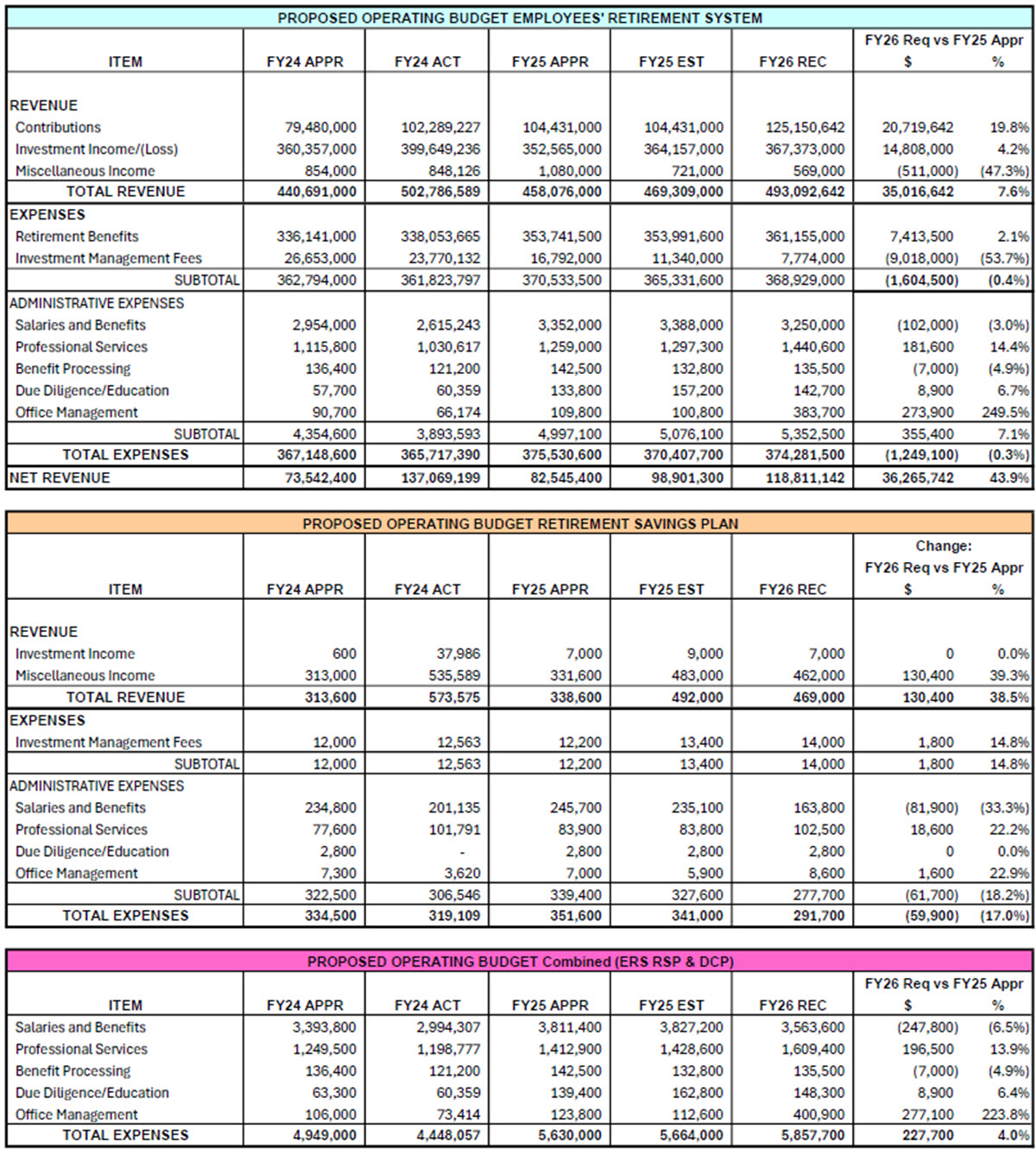

Retirement Benefits: : Montgomery County Government maintains a system of retirement pay and benefits for its employees which is intended to provide income during their retirement years. The Employees' Retirement System, which currently provides benefits to approximately 6,972 retirees and survivors, is administered by the Montgomery County Employee Retirement Plans (MCERP). MCERP oversees all facets of the retirement plans including investments, administration, and accounting. Retirement plan design changes occurring through the collective bargaining process and by other means are coordinated with MCERP in consultation with the Office of Human Resources, the County's actuaries, the Department of Finance, and the Office of Management and Budget.

Retirement Plans: Montgomery County Government maintains three retirement plans for its employees: a defined benefit pension plan, a defined contribution plan, and a deferred compensation plan for its employees and participating agencies.

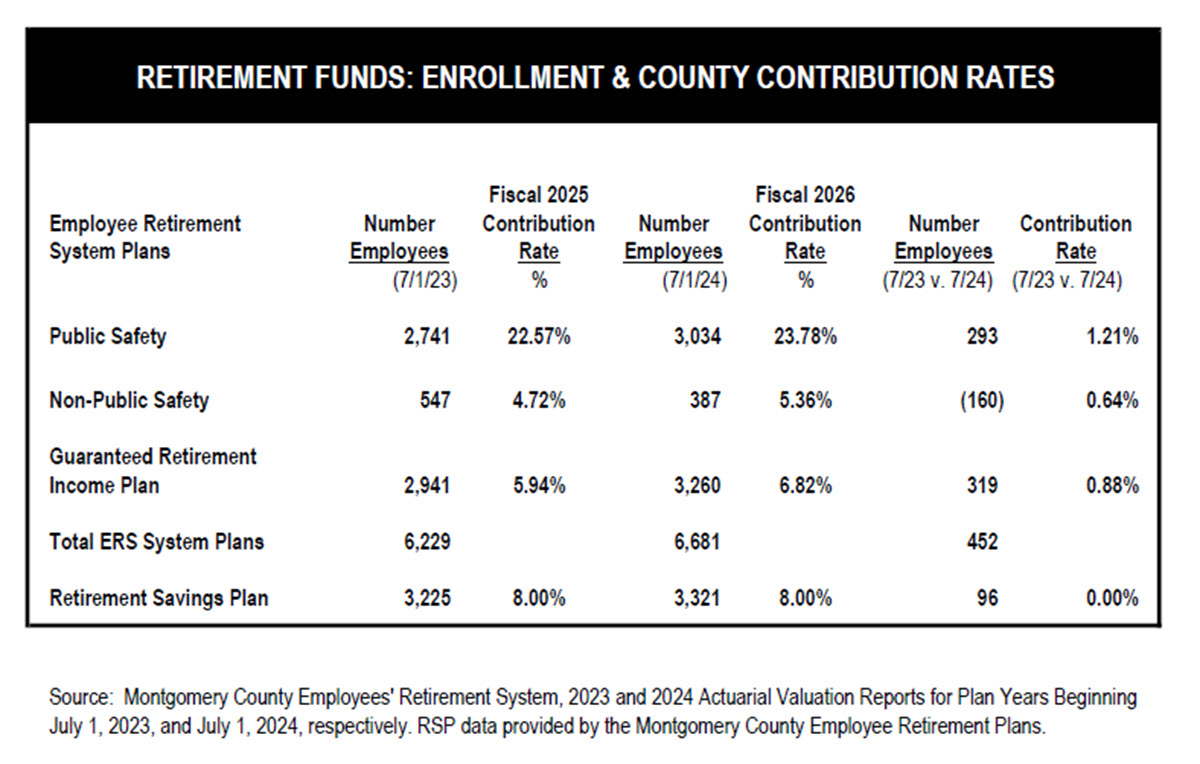

The Employees' Retirement System (ERS), a defined benefit pension plan, was established through legislation in 1965 and is described in the Montgomery County Code, Section 33. As of June 30, 2024, there were 6,972 retirees and survivors and 6,681 active members, including 3,260 in the Guaranteed Retirement Income Plan (GRIP). Retirement plan design changes occurring through the collective bargaining process and by other means are coordinated by the MCERP staff, in consultation with the County's actuaries, the Office of Human Resources, the Department of Finance, and the Office of Management and Budget.

The ERS consists of four plans including a Mandatory Integrated Retirement Plan, an Optional Non-Integrated Retirement Plan, an Optional Integrated Plan, and a Guaranteed Retirement Income Plan. The GRIP is a Cash Balance Plan that began in FY10 as a result of negotiations between Montgomery County and United Food and Commercial Workers Local 1994 MCGEO. Eligibility to participate has been passed through to non-represented employees and participants of participating agencies. All full-time and part-time non-public safety employees hired before January 1, 2009, enrolled in the RSP were eligible to make a one-time irrevocable election to transfer to the GRIP by June 1, 2009. Eligible employees hired after January 1, 2009, have the option to participate in either the RSP or the GRIP. As with the RSP, the County and employee each make contributions at a set percentage of pay. The salient feature of the GRIP is that the plan provides guaranteed annual earnings of 7.25%, credited monthly.

-

The Retirement Savings Plan (RSP), a defined contribution plan, was established for all new OPT/SLT (non-public safety) and non-represented employees hired on or after October 1, 1994. Eligible employees hired after January 1, 2009, have the option to participate in either the RSP or the GRIP. Eligible employees in the ERS are allowed to transfer to the Retirement Savings Plan. Both regular full-time and part-time employees can participate. Under this plan, the County and employee each make contributions at a set percentage of pay. These monies are deposited into employee accounts and invested based on each employee's selection of an investment vehicle(s) established by the Board of Investment Trustees.

-

The Montgomery County Deferred Compensation Plan (DCP) was established by the County to make a deferred compensation plan available pursuant to Section 457 of the Internal Revenue Code. Employee contributions are made on a voluntary basis with the monies deposited into employee accounts and invested based on each employee's selection of an investment vehicle(s) established by the Board of Investment Trustees. In FY05, the County established the Montgomery County Union Employees Deferred Compensation Plan for employees covered by a collective bargaining agreement. This Plan is administered by the three unions representing Montgomery County employees.

The Board of Investment Trustees manages the assets of the ERS through its investment managers in accordance with the Board's asset allocation strategy. The Board also administers the investment program for the Retirement Savings Plan and the Montgomery County Deferred Compensation Plan. The Montgomery County Union Employees Deferred Compensation Plan is administered by the three unions representing Montgomery County employees. The Board currently consists of 13 trustees, including: the Chief Labor Relations Officer, Director of Finance, and Director of Management and Budget; the County Council Executive Director; one member recommended by each employee organization; one active employee not represented by an employee organization; one retired employee; two members of the public recommended by the County Council; and two members of the general public.

Change in Retirement System Membership: The number of active non-public safety in the ERS decreased by 160 and the number of public safety employees increased by 293, for a combined total active enrollment of 3,421 in FY25. GRIP membership increased by 319 employees to 3,260 in FY25. The RSP saw an increase of 96 active employees enrolled, for a total FY25 enrollment of 3,321. Funds for the County's contribution to the ERS for each member employee are included in the appropriate Montgomery County Government departmental budget or agency budget. The County uses multiple contribution rates designating the percentage of payroll for the various employee groups to determine the retirement contribution.

Funds for the County's contribution to the ERS for each member employee are included in the appropriate Montgomery County Government departmental budget or agency budget. The County uses multiple contribution rates designating the percentage of payroll for the various employee groups to determine the retirement contribution.

County contributions are determined using actuarially sound assumptions to assure the financial health of the fund. Factors that affect the County's contributions include the impact of compensation adjustments, changes in the size of the workforce, investment returns, and collectively bargained benefit changes. The ERS contribution rates reflect projections of revenues and expenses to the fund. Revenues include County and member contributions which are set at fixed percentages of salaries and investment income, which is driven by both earnings in the various financial markets and the size of the fund balance invested.

Expenses of the fund include pension payments, which are affected by mandated cost-of-living increases and changes in the number of retirees and survivors; administrative and operational expenses of the fund managers and financial consultants, and charges for services provided by the MCERP staff as well as staff from Finance and Human Resources.

COLLECTIVE BARGAINING

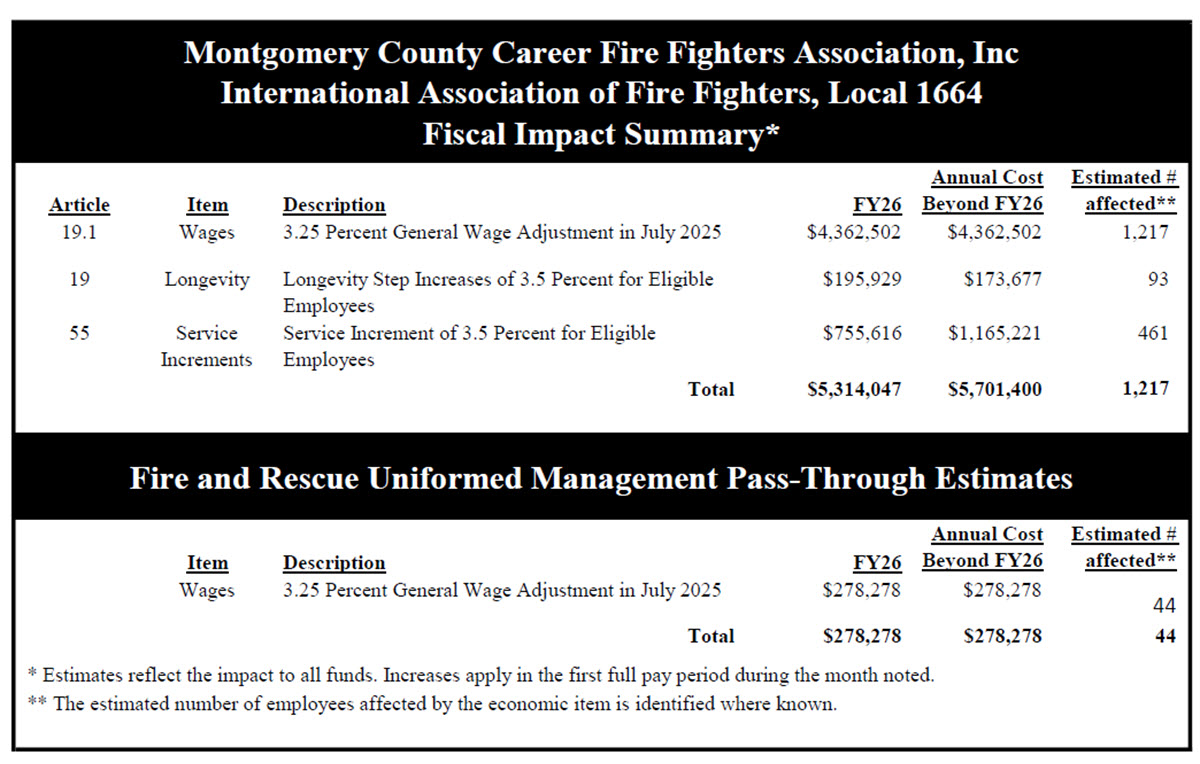

Fire and Rescue Bargaining Unit: The current agreement became effective July 1, 2024, and expires on June 30, 2026. The agreement's salient economic terms include:

- General Wage Adjustment. A 3.25 percent GWA will be paid in July 2025.

- Service Increments. A service increment of 3.5 percent will be paid in FY26 up to the maximum base salary for the grade for eligible unit members.

- Longevity step increases. Longevity step increases will be paid to eligible employees; effective July 2025.

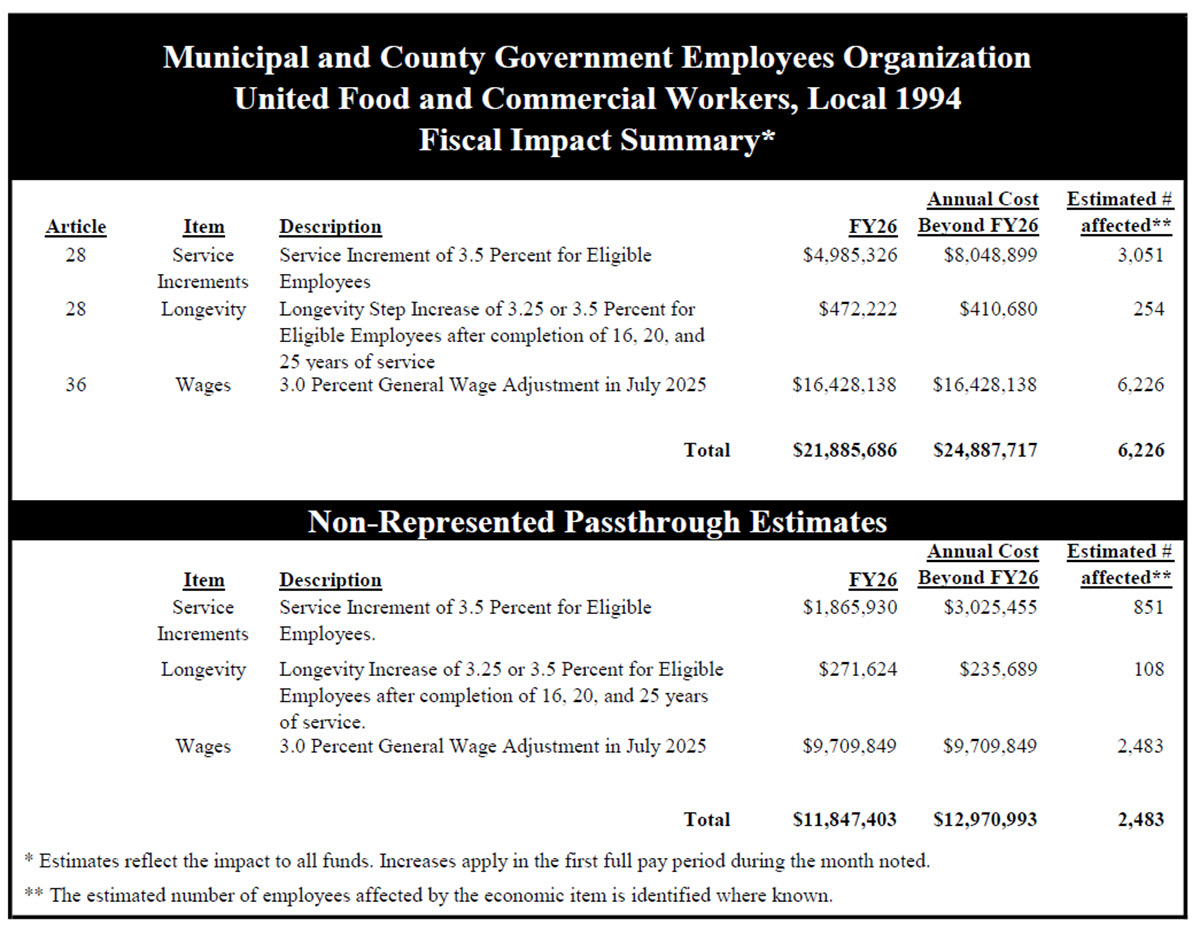

MCGEO Bargaining Unit: The current agreement became effective July 1, 2023, and expires on June 30, 2026. The agreement's salient economic terms for FY26 include:

- General Wage Adjustment. A 3 percent GWA will be paid in July.

- Service Increments. A service increment of 3.5 percent will be paid in FY26 up to the maximum base salary for the grade for eligible unit members.

- Longevity Step Increases. Longevity step increases will be paid to eligible employees; effective July 2025.

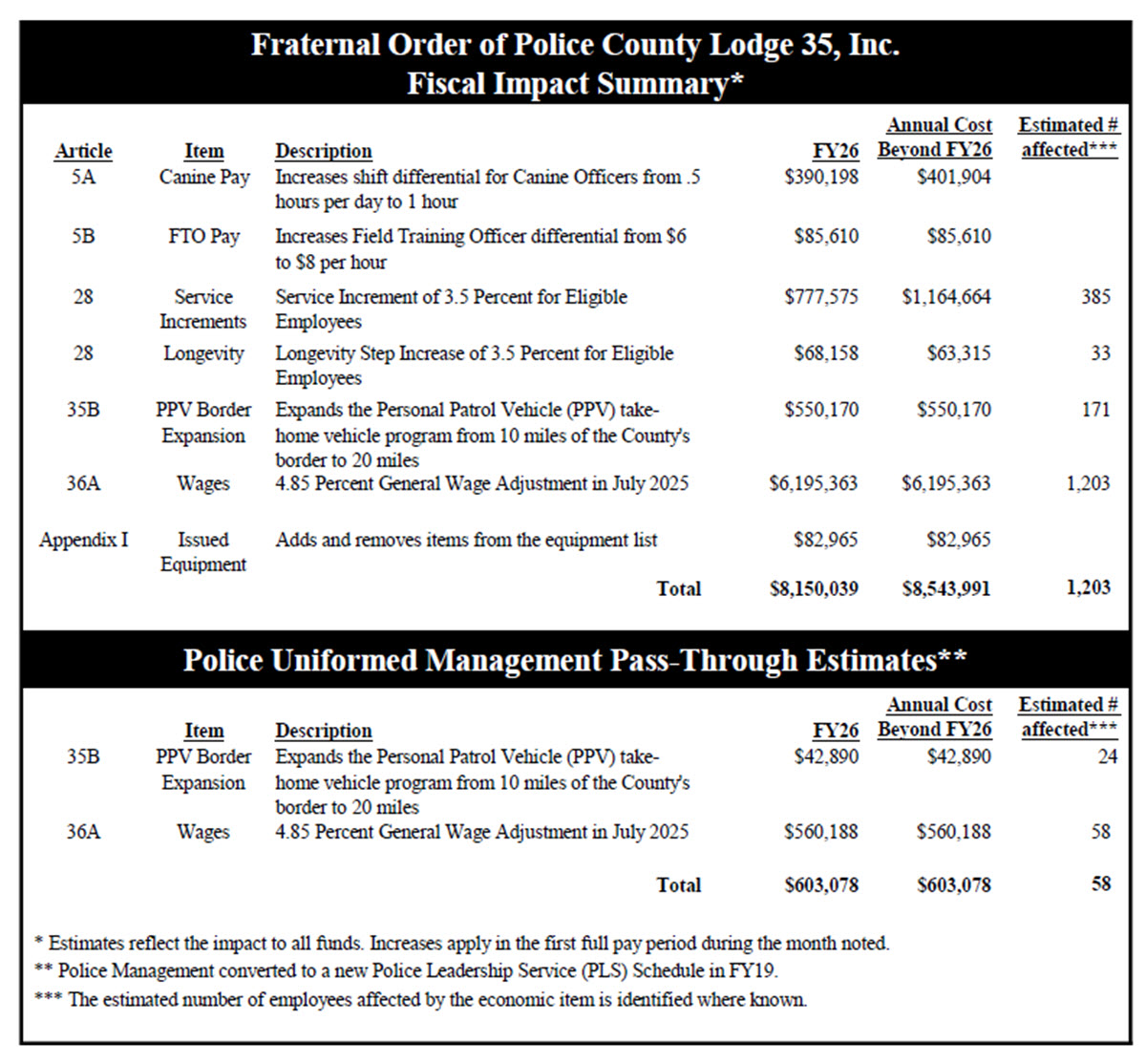

Police Bargaining Unit: The current agreement became effective July 1, 2023, and expires on June 30, 2025. The negotiated agreement becomes effective July 1, 2025, and expires on June 30, 2027. The agreement's salient economic terms for FY26 include:

- General Wage Adjustment. A 4.85 percent GWA will be paid in July 2025.

- Service Increments. A service increment of 3.5 percent will be paid in FY26 up to the maximum base salary for the grade for eligible unit members.

- Longevity step increases. Longevity step increases will be paid to eligible employees; effective July 2025.

- Canine Officer Pay. Increases shift differential for Canine Officers from .5 hours per day to 1 hour.

- FTO Pay. Increases Field Training Officer differential from $6 to $8 per hour.

- Personal Patrol Vehicle (PPV) Border Expansion. Expands the PPV take-home vehicle program from 10 miles of the County's border to 20 miles.

- Appendix I. Adds and removes items from the equipment list.

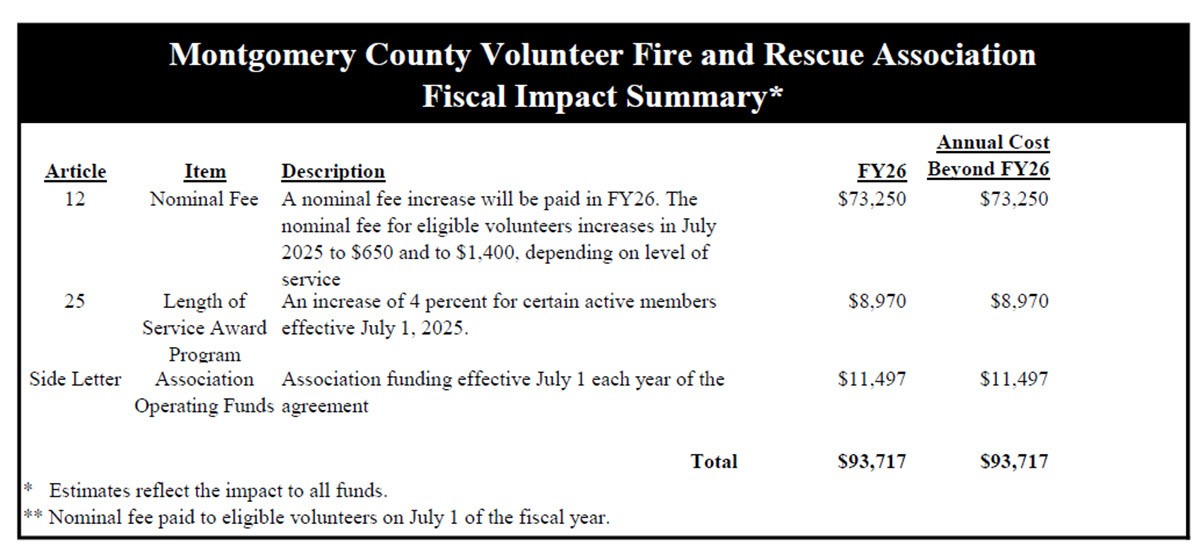

Volunteer Fire and Rescue Bargaining Unit: The current agreement became effective on July 1, 2023, and expires on June 30, 2026. MCG is in negotiations with MCVFRA on certain reopener provisions. The potential impact on the FY26 budget is unknown at this time.

- Nominal Fee. A nominal fee increase will be paid in FY26. The nominal fee for eligible volunteers increases in July 2025 to $650 and to $1,400, depending on level of service.

- Association Funding. Funding for the Association will increase to $24,564 on July 1, 2025.

- Length of Service Award Program (LOSAP). An increase in LOSAP of 4 percent will be made for certain active members, on July 1, 2025. MCG is in negotiations with MCVFRA and the potential impact on the FY26 budget is unknown at this time

WORKFORCE ANALYSIS

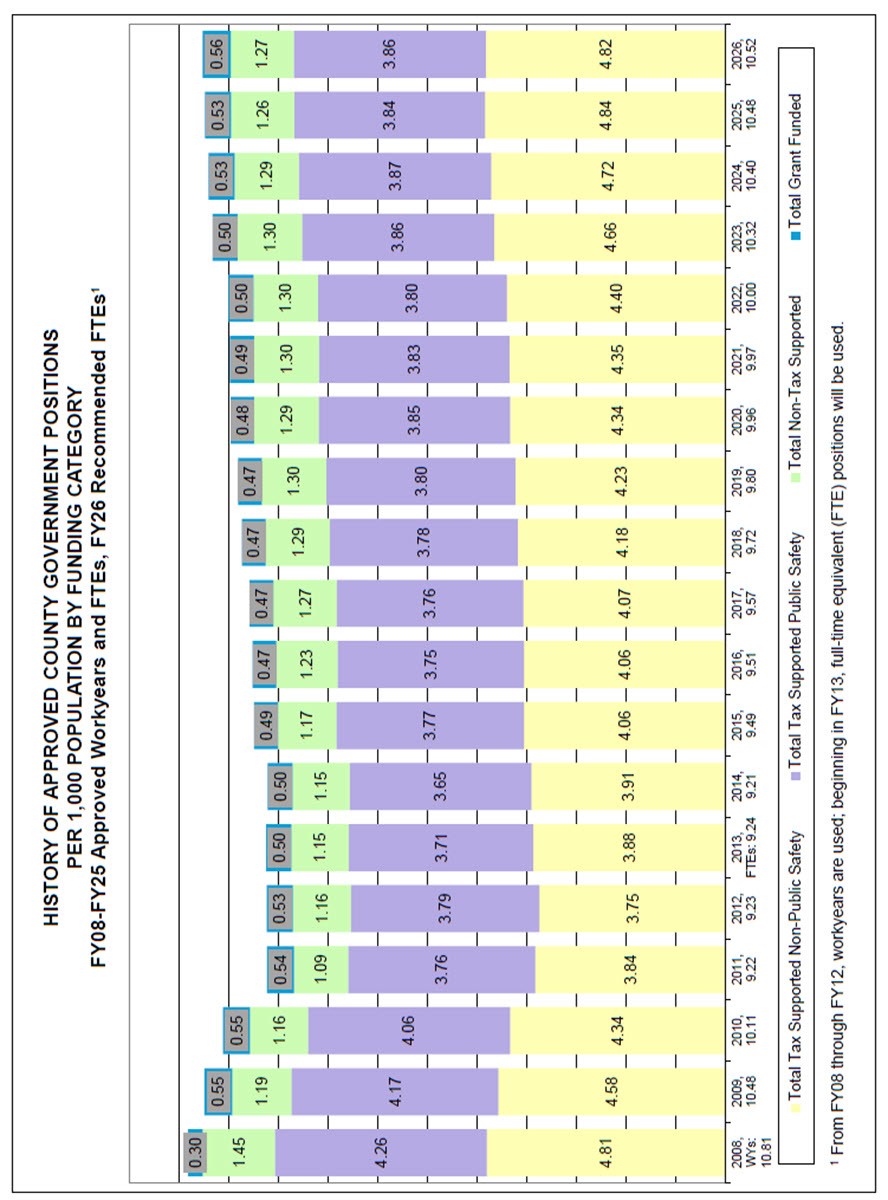

Basis: Workforce analysis has been performed on changes to tax supported and non-tax supported full-time equivalent (FTE) positions in the Executive's Recommended FY26 Operating Budget for Montgomery County Government.

Overall changes are calculated in comparison to the Approved Personnel Complement for FY25, which began on July 1, 2024. Changes shown reflect the addition of grant-funded positions, abolishments and creations to implement approved job-sharing agreements, and other miscellaneous changes. Changes recommended by the County Executive for FY26 are in three categories: current year position changes due to supplemental appropriations or other actions, new fiscal year position changes scheduled to take effect July 1, 2024, and technical changes.

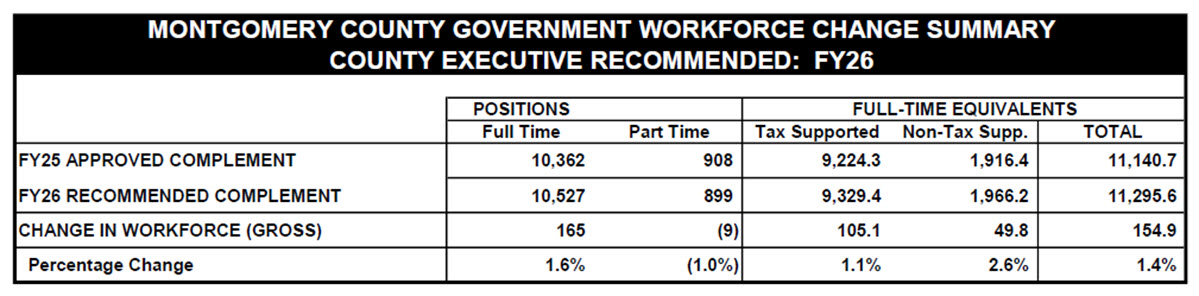

Summary: The recommended budget includes funding for 10,527 full-time positions, a net increase of 165 from the approved FY25 Personnel Complement of 10,362 full-time positions. Funding for 899 part-time positions is also included, a net decrease of 9 positions from the approved FY25 Personnel Complement of 908 positions. The net impact on FTEs is an increase of 154.91 to 11,295.57.

Detailed below are the significant net changes in the number of positions in the FY26 Recommended Operating Budget.

| Workforce Changes | Position Change |

|---|

Health and Human Services - Change is related to staff added to support the Lighthouse Initiative, Blueprint for Maryland's Future, abuse intervention services, dental program staff, school health nurse managers, annualization of infrastructure positions from Supplemental Appropriation #25-35, term positions for the Consolidated Local Implementation Grant, and miscellaneous technical adjustments. | 55 |

| Police - Change is due to the Drone as a First Responder Program, adding Security Officers at Progress Place, the Real-Time Program, and technical adjustments related to the tracking of Cadets. | 54 |

| Transportation - Change is due to expanding Flash BRT Service to Howard County. These positions will be added in mid-FY26, assuming the new service remains on schedule to begin in spring of 2026. Two positions related to Ride On fare collection were abolished as they are no longer needed, and one position was eliminated in FY25 due to consolidation of duties. | 14 |

| Fire and Rescue Services - Change is due to adding firefighter positions, and additional support for the Community Action Coordinator and the High School Cadet program. | 13 |