INTRODUCTION

This chapter describes the revenue sources, both tax-supported and non-tax supported, used to fund the County Executive's Recommended FY26 Operating Budget, and the amount of revenue the County anticipates receiving from those sources. The chapter details the demographic and economic assumptions, including discussions of the national, State, and local economies, that were made in the development of the revenue forecast.

REVENUE FORECAST ASSUMPTIONS

Policy Assumptions

Revenue and resource estimates presented are the result of the recommended policies of the County Executive for the FY26 budget. Even though it is assumed that these policies will be effective throughout the six-year period, subsequent Council actions, State law and budgetary changes, actual economic conditions, and revised revenue projections may result in policy changes in later years.

Demographic Assumptions

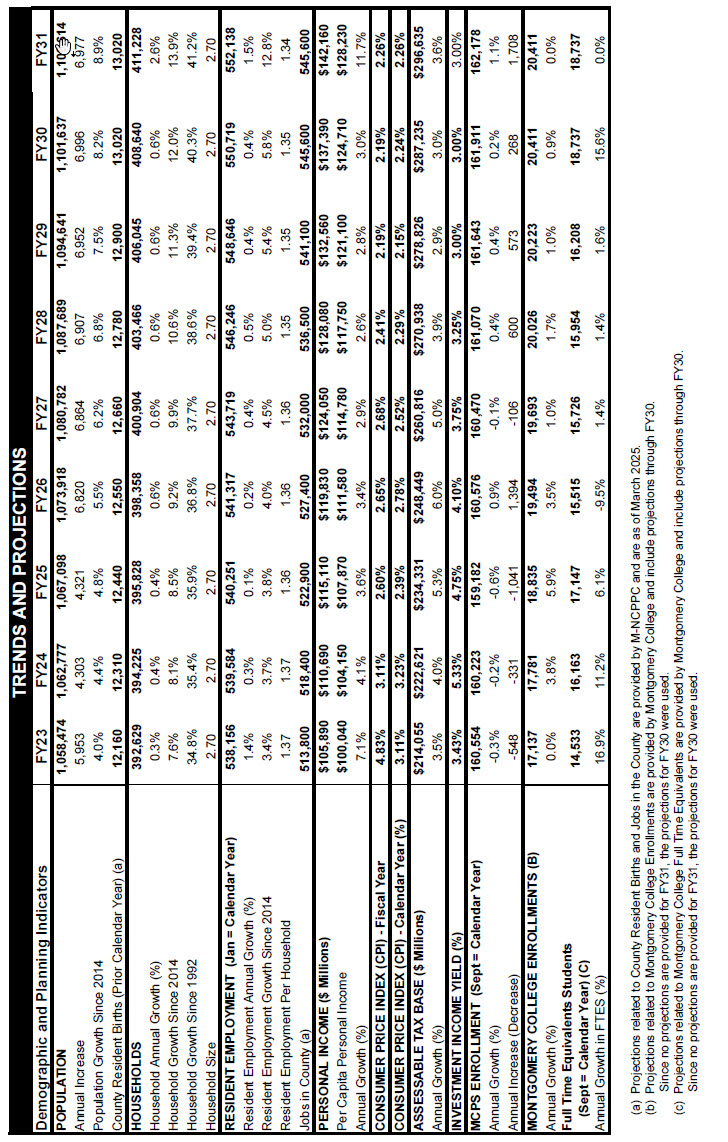

The revenue projections of the Public Services Program (PSP) incorporate demographic assumptions based on data from Moody's Analytics and the Metropolitan Washington Council of Governments (COG) and are based on fiscal and economic data and analyses used or prepared by the Department of Finance (FIN). A Demographic and Economic Assumptions chart located at the end of this chapter provides several demographic and planning indicators.

- The County population will continue to increase from 1,058,474 in 2023 to 1,129,811 by 2034. This reflects an average annual growth rate of 0.6 percent.

- Current projections estimate the number of households to increase from 392,629 in 2023 to 419,091 by 2034. Household growth over that period is projected to grow at an average annual rate of 0.6 percent.

- County births, which are one indicator of future elementary school populations and childcare demand, are projected to gradually increase from an estimated 12,310 in 2024 to 13,020 by 2031.

- The County expects Montgomery County Public School student enrollment to increase by 3,564 between FY25 and FY31.

- Montgomery College full-time equivalent student enrollments are projected to decrease from 17,147 in FY25 to 16,208 in FY29.

Economic Assumptions

Montgomery County's economy continued to experience mixed economic performance during calendar year (CY) 2024, with growth in resident income levels and mildly improved home sales, but flat resident employment, as well as a notable decrease in the number and value of construction projects. These mixed signals provide support for continued revenue growth in the short term, but possibly warn that in the long term this growth may not be sustainable.

The economic assumptions presume that the United States will not experience a recession in the coming year. Despite considerable uncertainty in Federal policies and actions, economic indicators as yet do not broadly signal a potential slow-down in economic activity, supporting the decision not to incorporate a recession and the accompanying reduced level of revenue growth into the projections.

However, unanticipated and unmeasurable events can affect long-term revenue and expenditure projections. These potential factors include the following.

- Changes in the level of local economic activity;

- Federal economic and workforce changes;

- State tax and expenditure policies;

- Federal and State mandates requiring local government expenses;

- Devolution of Federal responsibilities to State and local governments;

- Changes in financial markets;

- Major demographic changes;

- Military conflicts and acts of terrorism;

- Domestic or global health incidences; and

- Major international economic and political changes.

ECONOMIC OUTLOOK

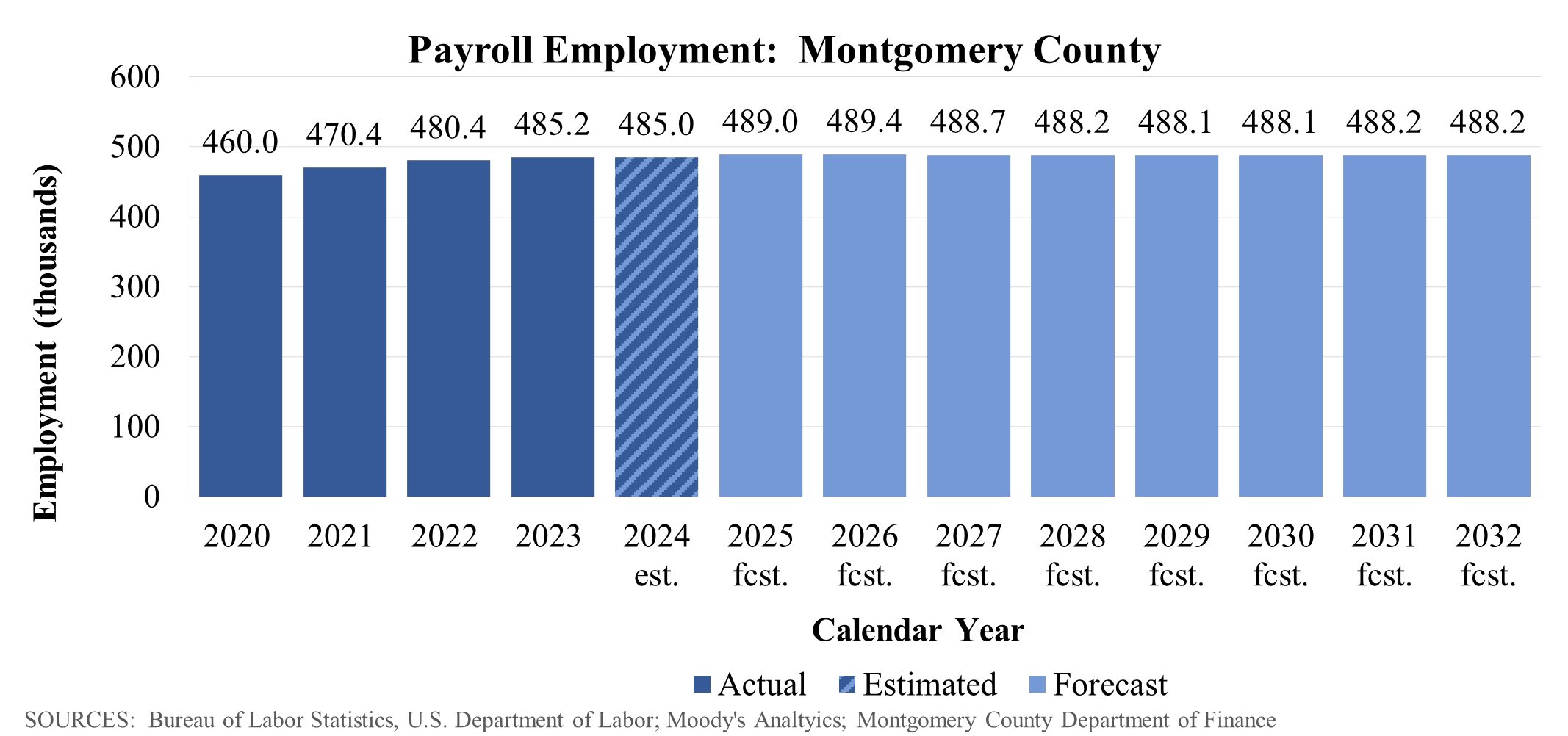

The future forecast for the local Montgomery County economy is mixed. While resident income levels are anticipated to experience positive growth consistent with long term trends, resident employment and jobs located in Montgomery County (payroll employment) are expected to grow slower than past trends, by less than 1 percent each. The slow growth in both resident employment and payroll employment could generate considerable headwinds that limit local economic activity and, ultimately, revenue growth. The Montgomery County economic outlook incorporates the assumption that the economy will experience stable conditions and continue to grow at a moderate pace.

Revenue projections over the six-year horizon depend on the current and projected indicators of the national, regional, and local economy. National indicators include short-term interest rates, mortgage interest rates, and the stock market. Local economic indicators include residential (labor force survey) and payroll (establishment survey) employment, residential and nonresidential construction, housing sales, and inflation. Economic indicator projections are dependent on several factors - fiscal and monetary policy, real estate, employment, consumer and business confidence, the stock market, mortgage interest rates, and geopolitical risks.

Employment

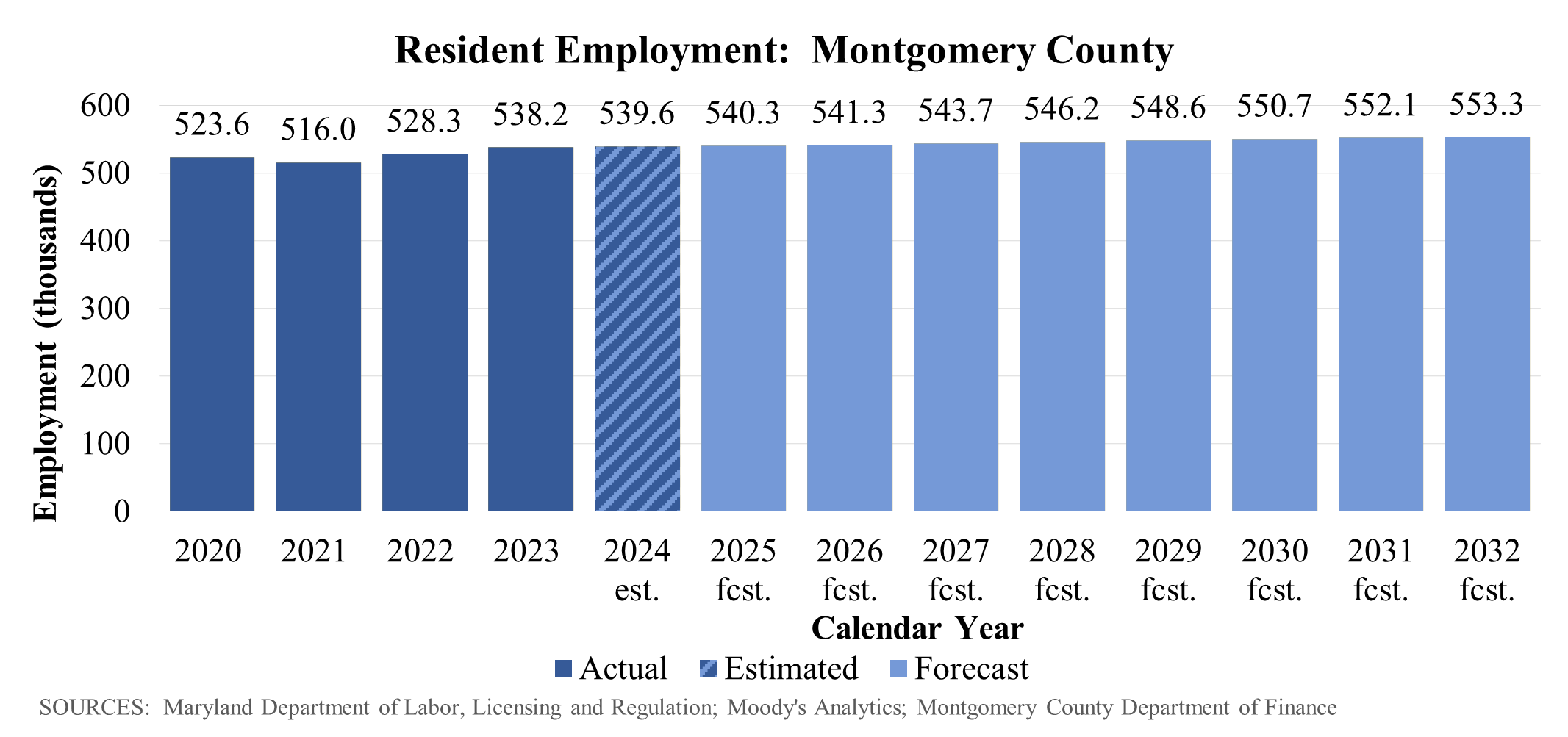

Resident employment refers to the number of residents employed, regardless of whether that job is located in Montgomery County or elsewhere. Montgomery County receives income tax on resident income regardless of where income is earned and thus resident employment is a key indicator for income tax revenues.

Based on data from the Maryland Department of Labor, Licensing and Regulation (DLLR) and the U.S. Department of Labor, Bureau of Labor Statistics, resident employment grew by 0.27 percent from CY2023 to CY2024, a slowdown from the prior two years. FIN forecasts that resident employment will increase at an average annual rate of 0.3 percent from CY2024 to CY2032. Resident employment is expected to attain its pre-pandemic levels by CY2030, a full decade after the pandemic occurred.

Payroll employment refers to the number of jobs located in Montgomery County and its growth is a result of business development and job creation locally, which is indicative of the strength of the local economy. FIN assumes that payroll employment will remain essentially unchanged from CY2025 to CY2032.

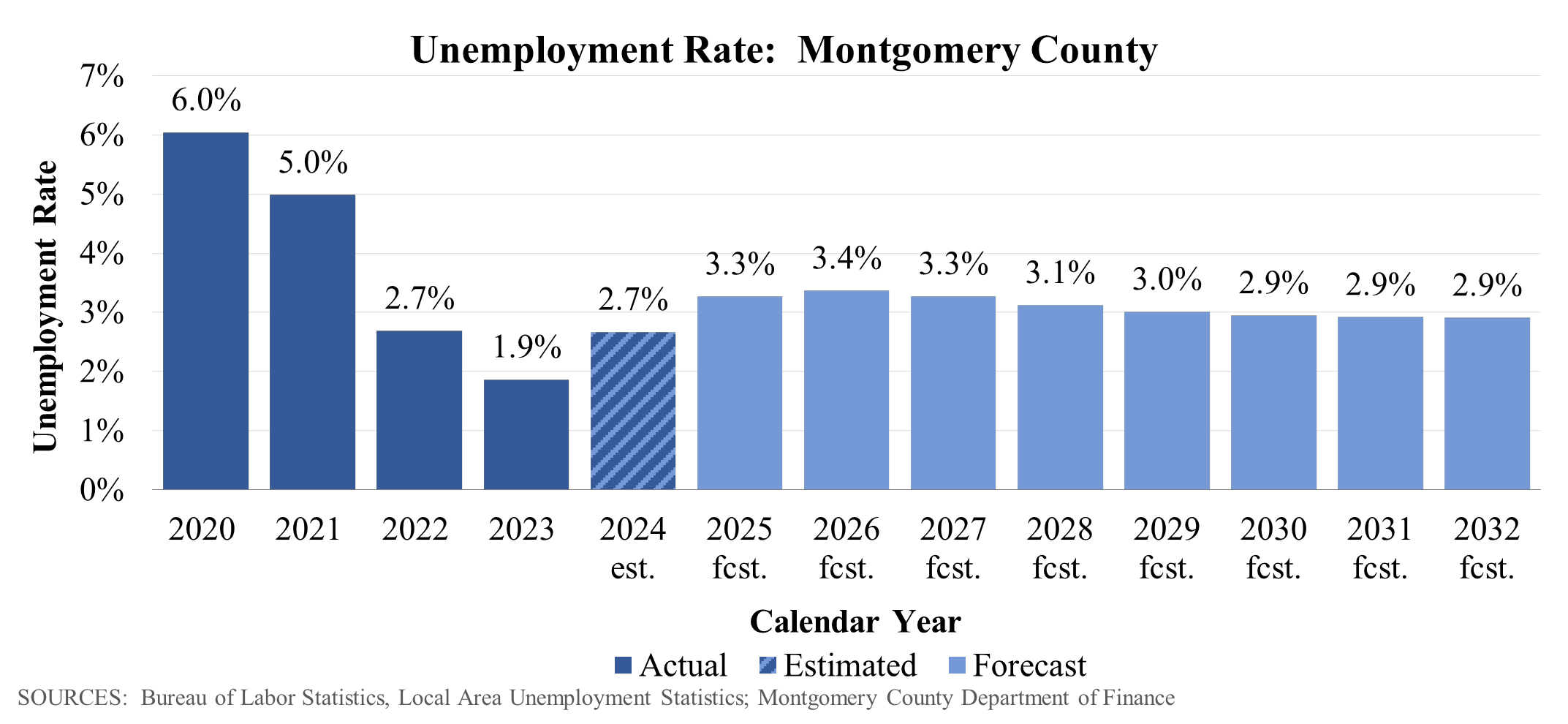

The unemployment rate is an indicator of general economic strength as a lower rate is usually associated with strong employment and with increasing wage income. In CY2024, the County's unemployment rate climbed from 1.9 percent to 2.7 percent, the result of an increase in the labor force by 5,999 people but an increase of 1,428 employed residents. FIN assumes that the economy will remain at or near full employment, with unemployment between 2.9 percent and 3.4 percent, throughout the forecast period.

Resident Income

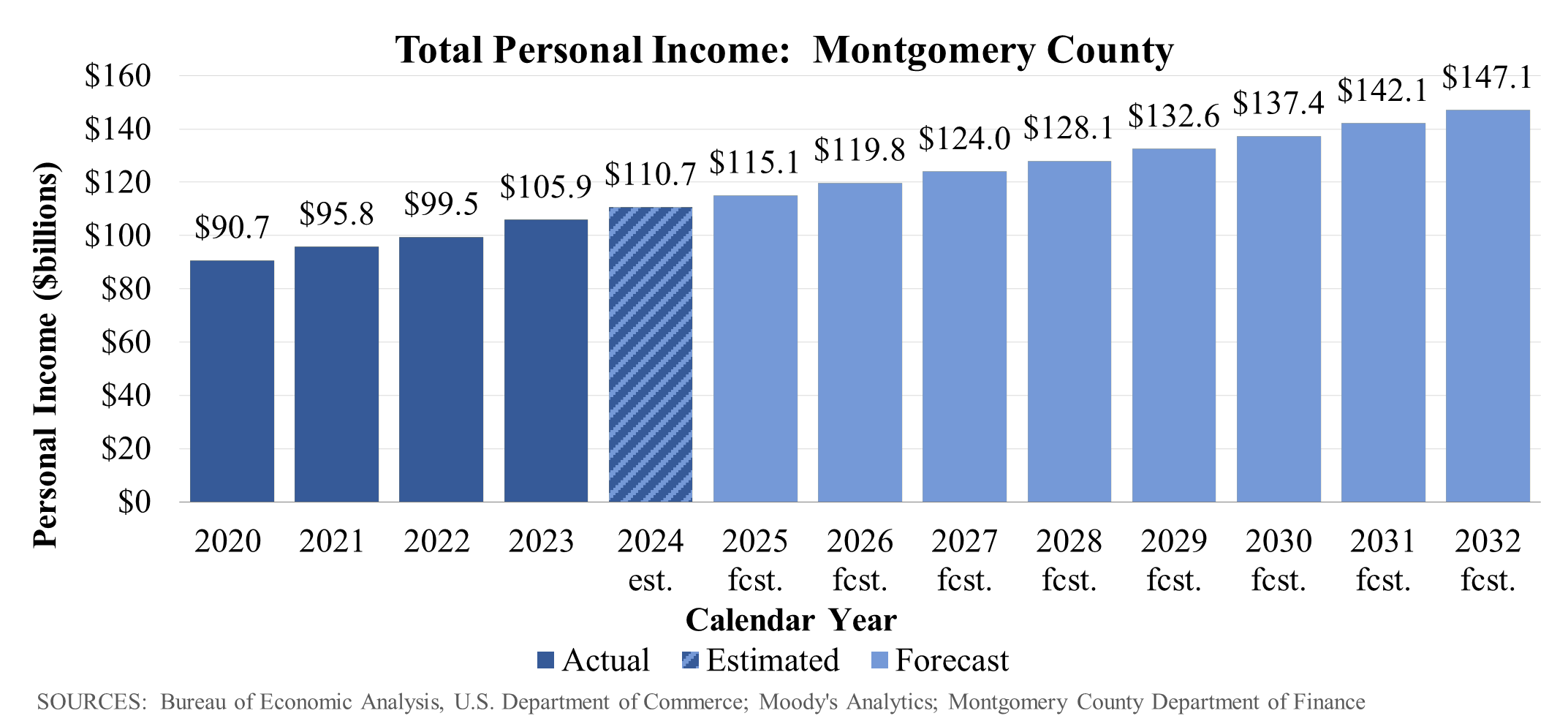

Total personal income refers to the sum of wage and salary income and non-wage income, which includes transfer payments, proprietor's income, and dividends/interest/rental income, but excludes capital gains. Total personal income and its components are key factors for income tax revenues and the forecast growth in that revenue source.

Total personal income grew steadily coming out of the pandemic, at an annualized 4.25 percent pace from CY2019 to CY2024, reflecting the strength in the regional labor market and growth in household finances during this period. FIN assumes that total personal income in Montgomery County will continue to grow, increasing at an average annual rate of 3.6 percent from CY2024 to CY2032, an indication that income tax may continue increasing at a similar pace in nominal terms.

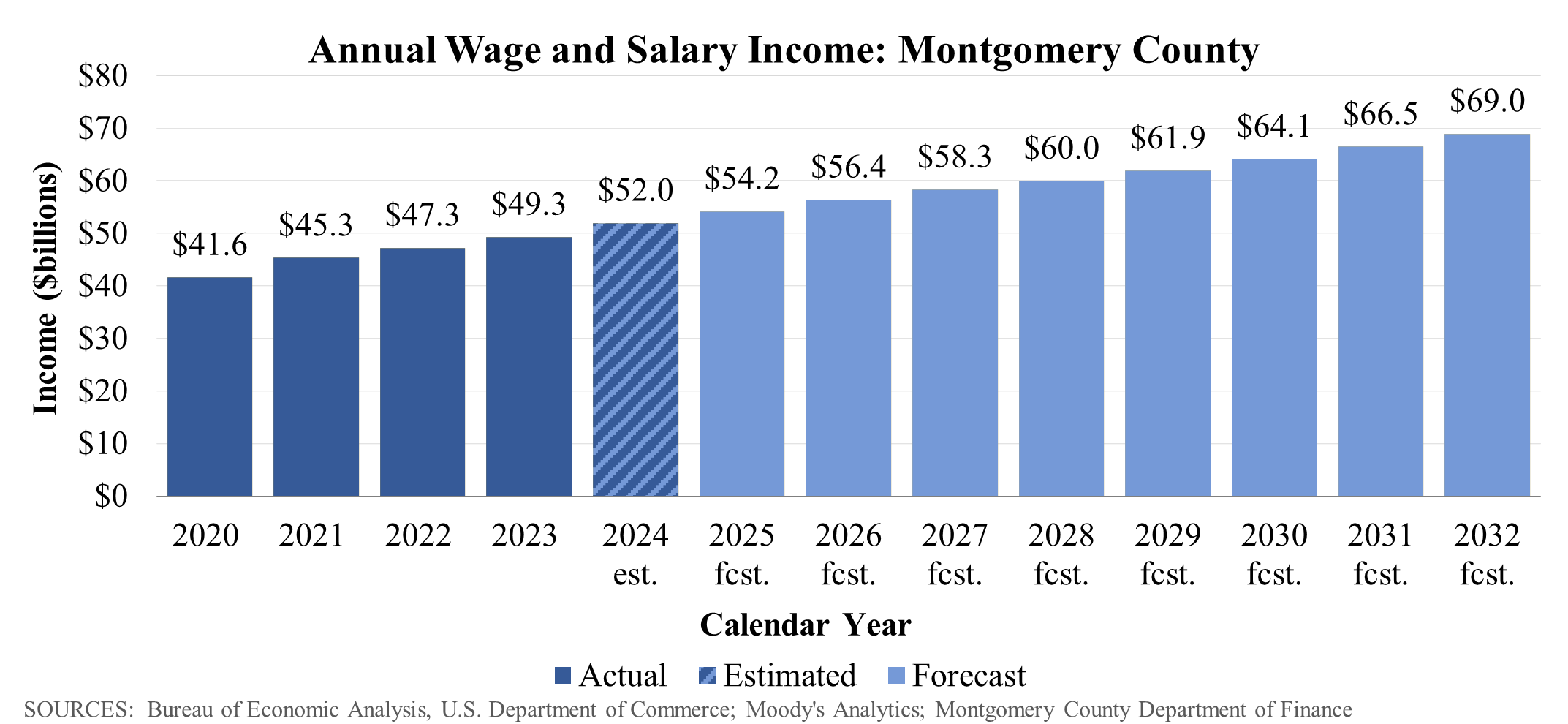

Wage and salary income refers to employment income earned by salaried and waged employees and is impacted by labor market conditions, inflation patterns, and population growth/demographic changes in Montgomery County. FIN assumes wage and salary income will continue growing but at a slightly reduced pace from the recent past; wage and salary income grew at a 5.0 percent annualized pace from CY2019 to CY2024 and is expected to continue growing at a 3.6 percent annualized pace from CY2024 to CY2032. This growth rate is despite the fact that the number of employed residents is expected to stagnate, and thus reflects an increase in nominal terms in the wage per hour of employee labor.

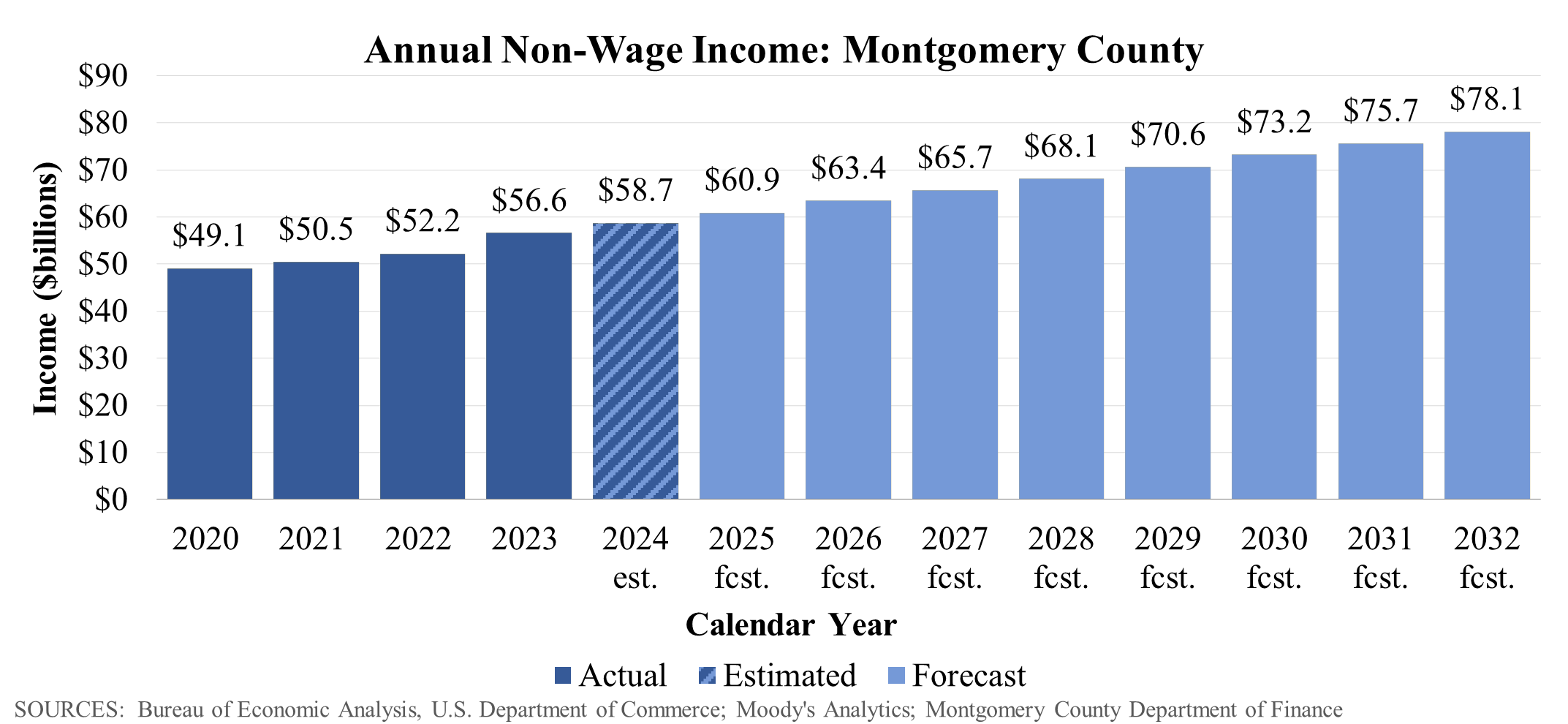

Non-wage income1 refers to various types of income not obtained through wages and salary, such as retirement and health benefits (see note below for specific components). FIN forecasts that non-wage income in Montgomery County will increase at an average annual rate of 3.6 percent from CY2024 to CY2032, unchanged from the 3.6 percent average annual growth from CY2019 to CY2024.

1Non-wage income is the sum of proprietor's income, supplements to wages and salaries, transfer receipts, dividends/interest/rents, and adjustment for residence, less contributions for government social insurance.

Residential Real Estate

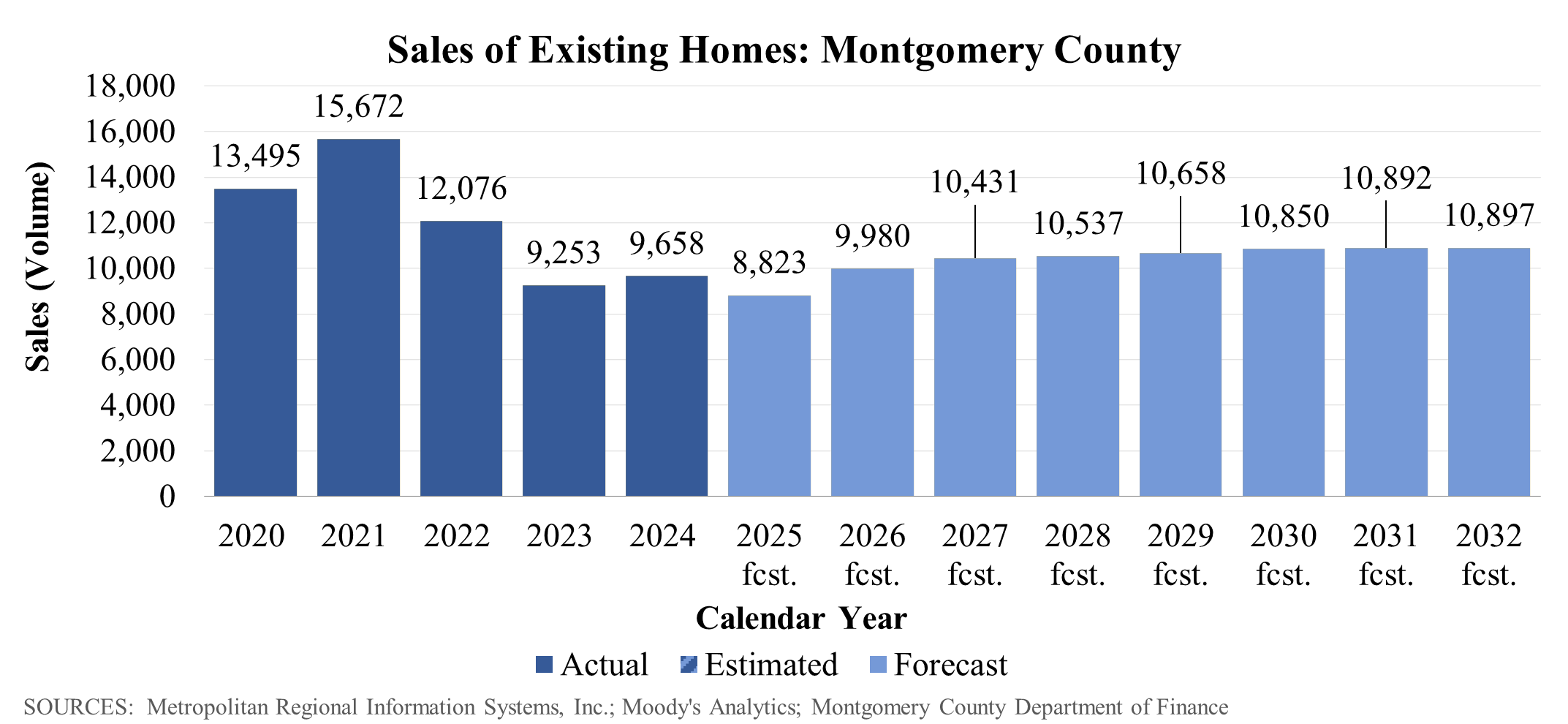

The sales of existing homes in Montgomery County influences the amount of transfer and recordation tax revenue. The number of homes sold reflects dynamics in the real estate market, the demand and supply of homes for sale, and is highly influenced by the level of interest rates.

Finance anticipates that sales of existing homes will continue at the reduced pace experienced since CY2023 when the Federal Reserve began raising interest rates, and that during the forecast period sales will not again attain the elevated levels experienced during the pandemic. While interest rates have come down recently, the cost of new mortgages remains high and as a result the supply of homes for sale remains suppressed. FIN anticipates another downturn in home sales in CY2025 as the Federal Reserve pauses its recent downward movement of interest rates, followed by an uptick in home sales in CY2026 and CY2027 to levels similar to CY2024.

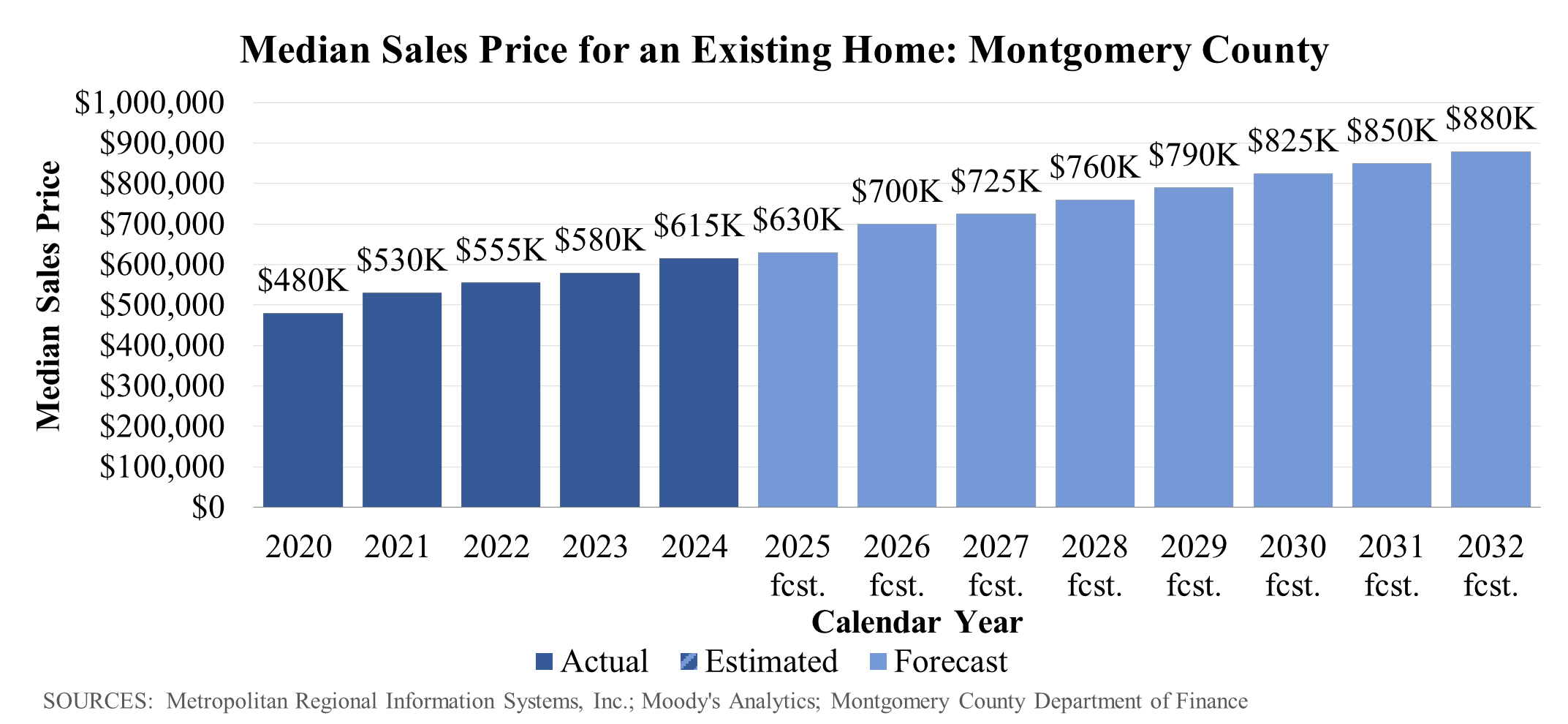

The median sales price for housing in Montgomery County reflects the value residents place on living within the County. The price of homes sold directly affects transfer and recordation tax revenues and influences the assessed value of property which in turn determines property tax revenues.

Home prices continue to reflect elevated desire to live in Montgomery County and the relative lack of supply of homes for sale, with prices increasing at a 6.5 percent average annualized pace since CY2019. FIN expects that growth to moderate only slightly to a 4.6 percent average annualized pace of growth from CY2024 to CY2032.

Construction Activity

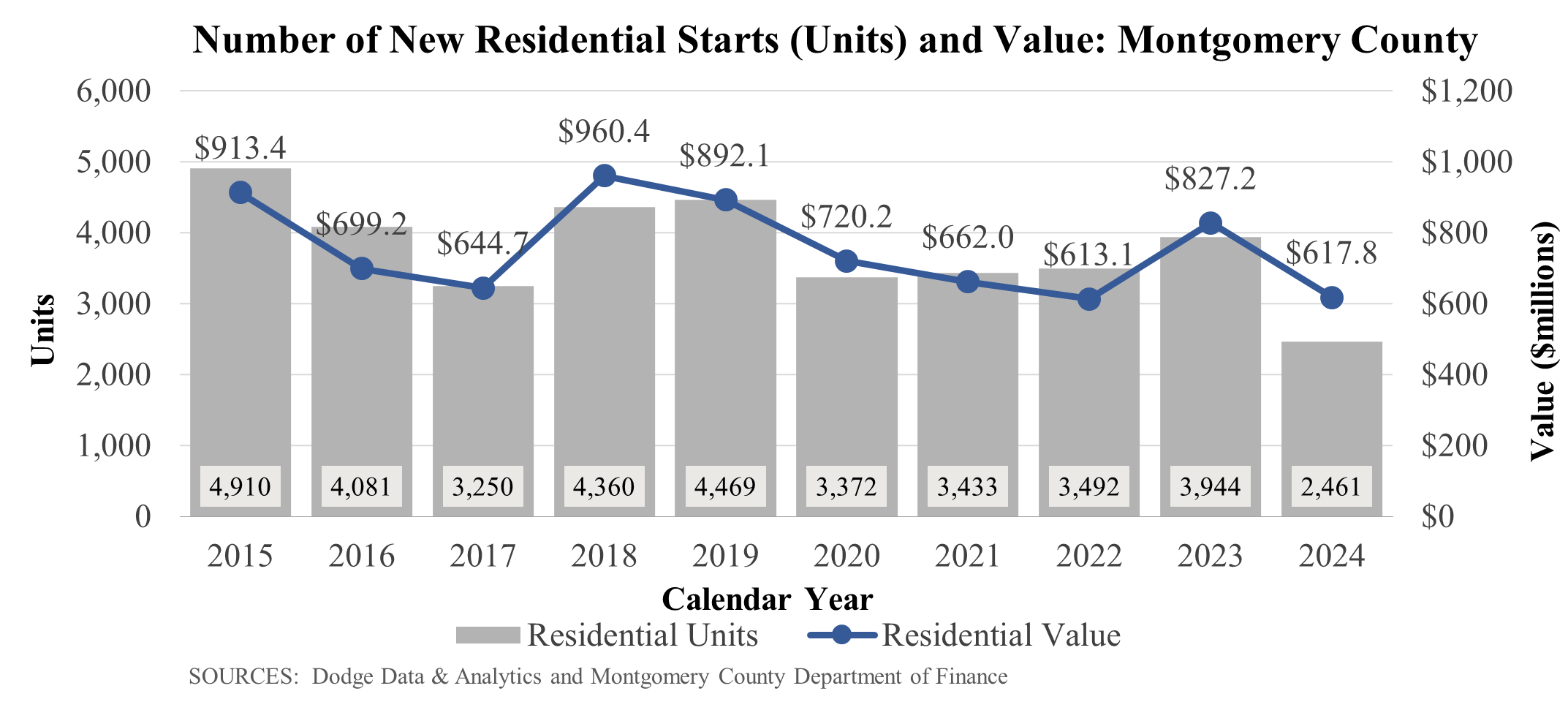

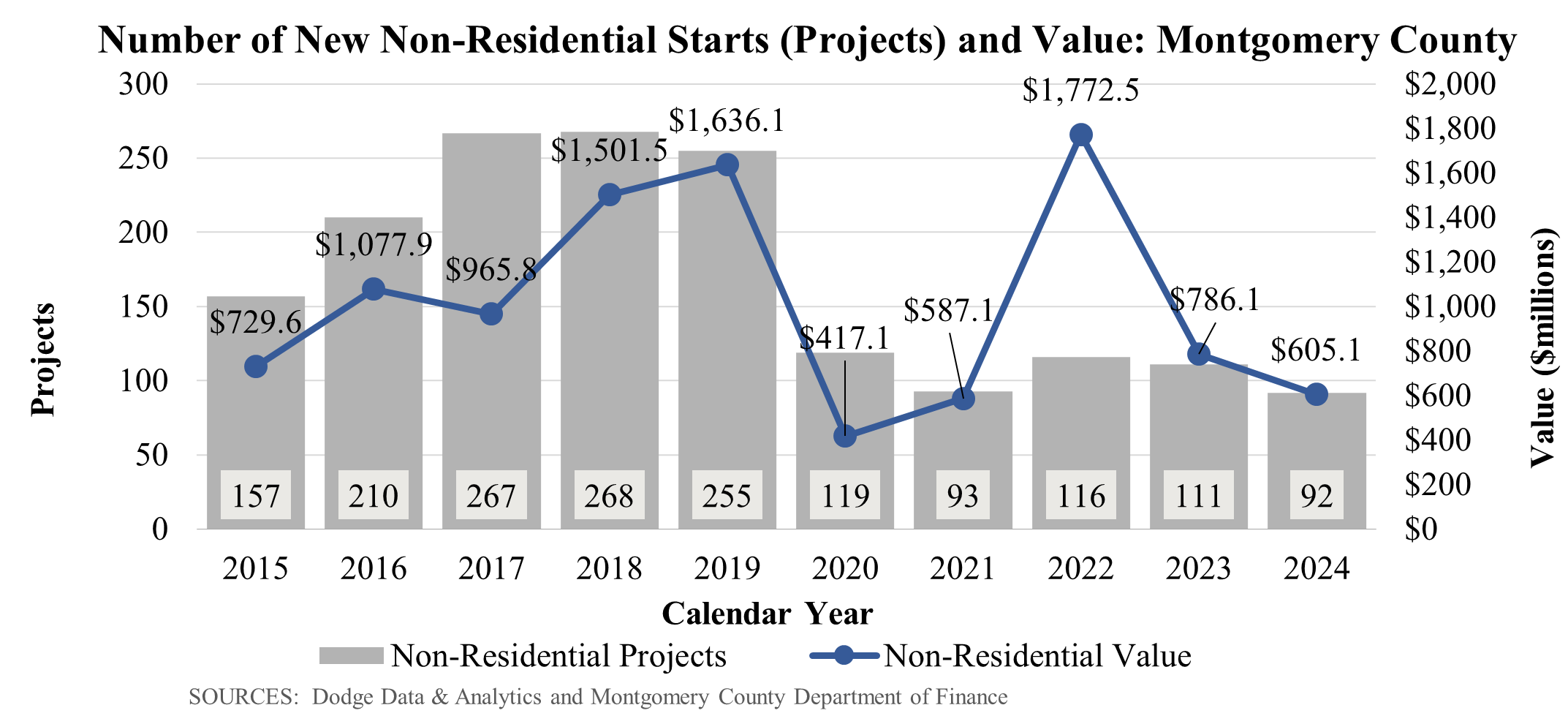

Construction is one of the driving forces of the economy and provides insight into the future trajectory of assessed values of properties and by extension property tax revenues.

The number of new residential units and the total value of those units dropped notably in CY2024, by 37.6 percent and by 25.3 percent respectively. This comes after a 5-year period during which the amount and value of new residential units remained relatively constant, potentially indicating that high interest rates and increased construction costs are affecting the ability to finance new projects. Montgomery County does not forecast future construction activity.

The number of projects and the value of new non-residential constructions projects in Montgomery County dropped notably after CY2019, a decline FIN attributes to the disruption COVID-19 caused to the use of space and by extension the non-residential real estate market. Non-residential projects continued at this lower rate in CY2024 with little change since CY2019 in number of projects and, except in CY2022, in the value of those projects.

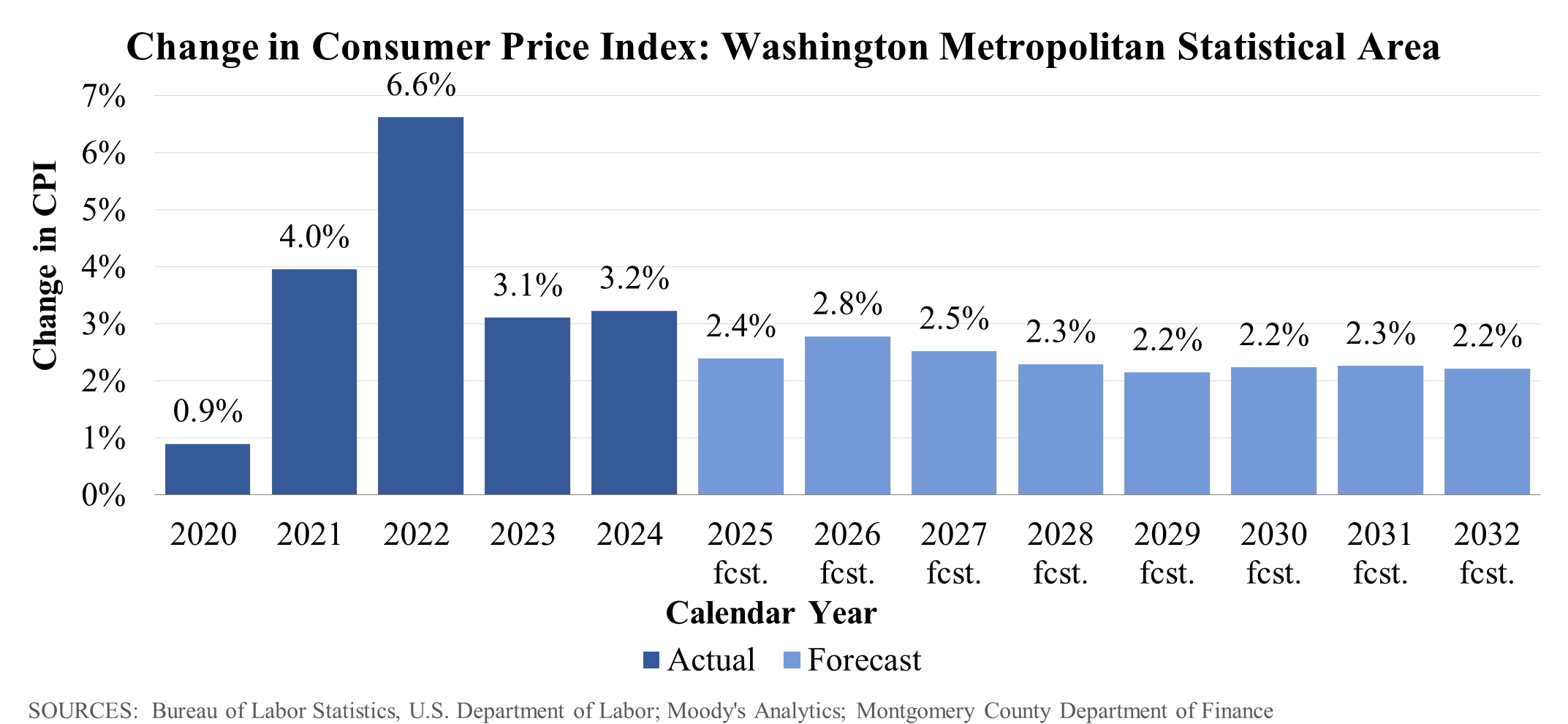

Inflation

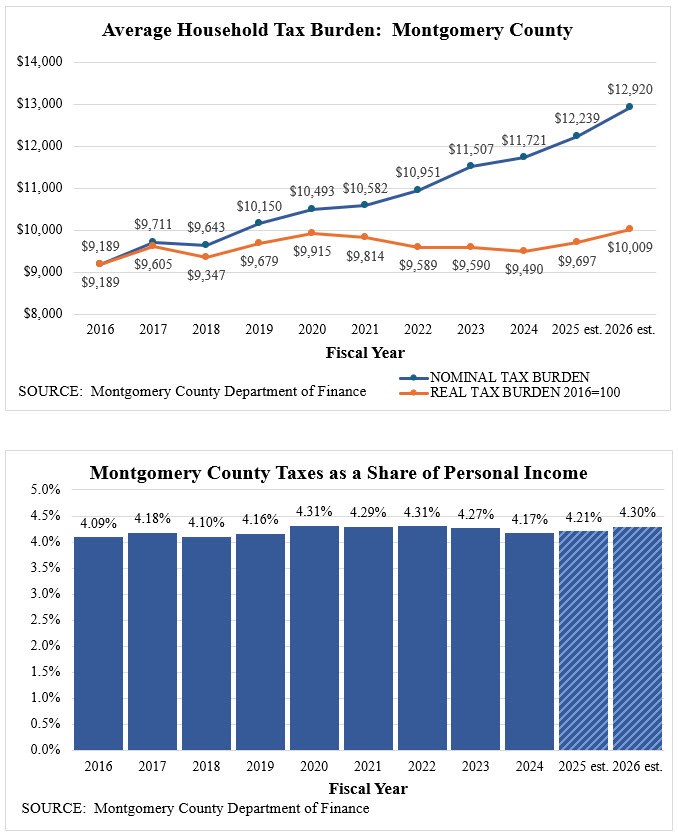

The Consumer Price Index (CPI) is based on the prices of goods and services, both domestic and imported, that consumers purchase. Inflation is influenced by trends in labor costs and simultaneously influences future wage and salary demands, which in turn impacts the County's income tax revenues. The change in home values is also influenced by the pace of inflation, indirectly influencing the County's property tax revenues.

FIN assumes that while inflation in the Washington-Arlington-Alexandria, DC-VA-MD-WV metropolitan statistical area will not return to the heights experienced during the pandemic during the forecast period, Federal policies related to immigration and tariffs will cause a slight bump in inflation in CY2026. FIN expects that inflation will then moderate downward to 2.3 percent in CY2028 and stay at that general level until CY2032.

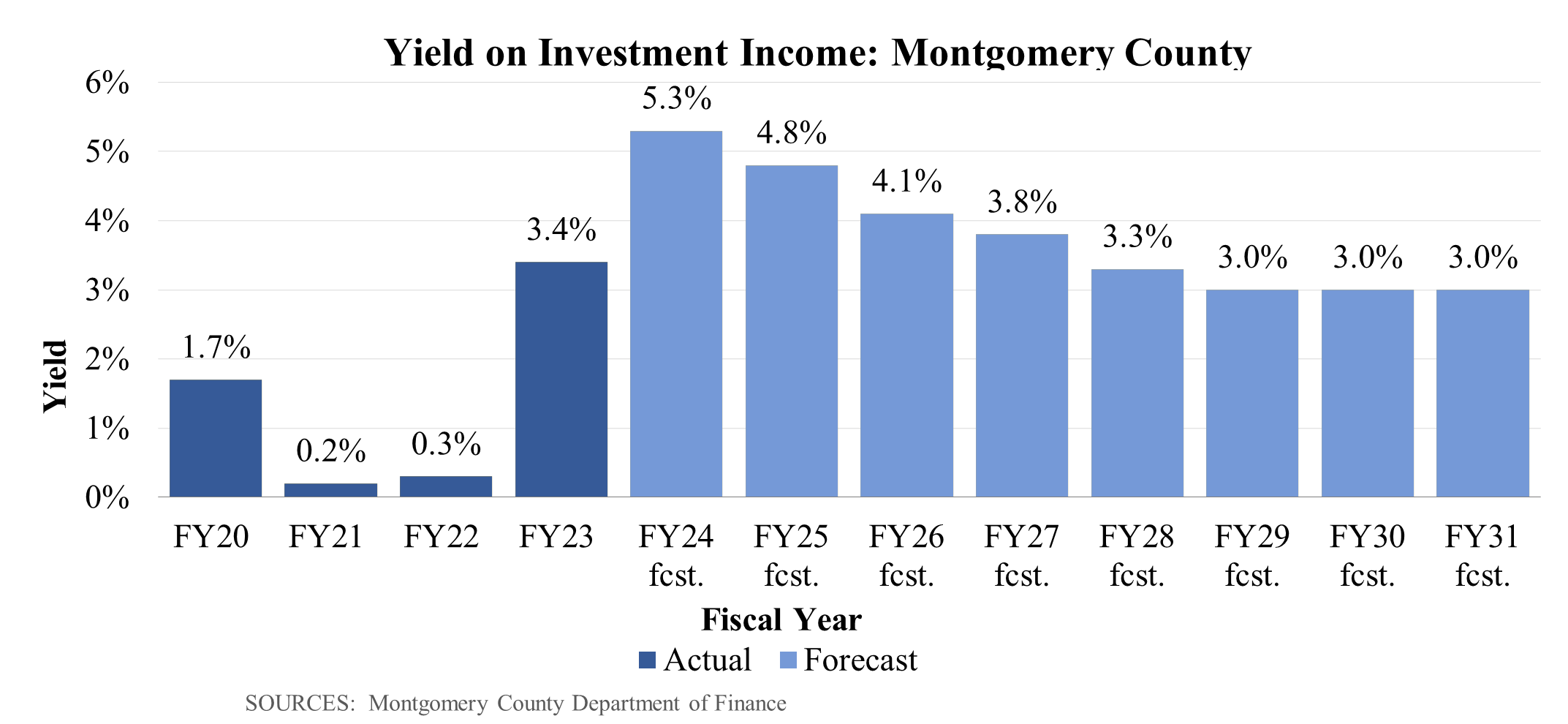

Interest Rates

Montgomery County invests public funds that are not needed for immediate expenditures in short-term investments whose return is highly correlated with the Federal funds rate. The County's yield on investment income drives the amount of revenue produced from the investment of operating cash and is also conversely an indicator of the rates the County must pay to borrow money.

Increases in the targeted Federal funds rate from FY22 to FY24 increased investment yields, with the County earning a 5.3 percent rate on its short-term portfolio for FY24. The Federal Reserve has since lowered interest rates during 2024 and Montgomery County's investment yield has already begun to fall. FIN expects to receive a yield of 4.8 percent in FY25, falling to 4.1 percent in FY26, and then moderating down further in FY27 and FY28 before reaching an assumed level of 3 percent from FY29 to the end of the forecast period.

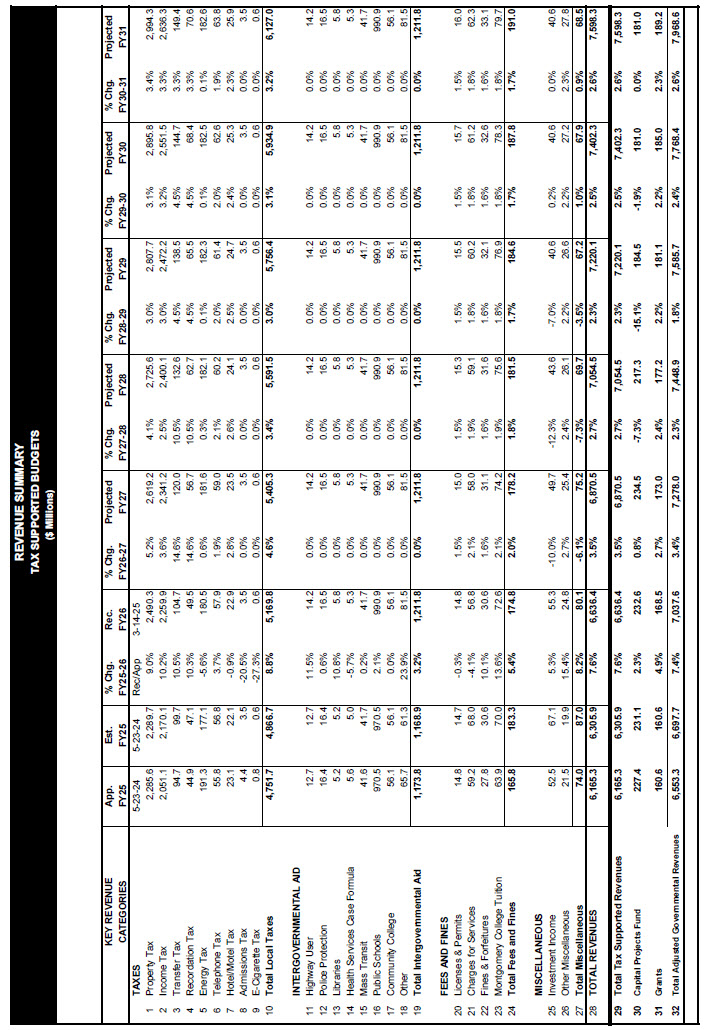

TOTAL REVENUES IN TAX-SUPPORTED FUNDS

The major revenue sources for all County funds of the operating budget and the Public Services Program (PSP) are described below. Revenue sources which fund department and agency budgets are included in the respective budget presentations. Six-year projections for all County funds are based on estimates of County income from its own sources such as taxes, user fees, charges, and fines, and State and Federal government assistance. This section displays projections and descriptions of total revenues available for the "tax-supported" portions of the program, which are subject to the Spending Affordability Guideline (SAG) limitations. Total tax-supported revenues consist of both tax revenues (i.e., property tax, income tax, etc.) and non-tax revenues (i.e., intergovernmental revenues, fees, licenses, etc.). Details on non-tax revenues in the tax-supported funds can be found in the "Other Revenues in Tax-Supported Funds" section of this chapter.

Non-tax supported funds represent another type of financial burden on households and businesses and are therefore considered in determining the affordability of all services that affect most of the County's population. Projections for non-tax supported funds within County government are presented in the budget section for each of those funds.

Revenue Assumptions

Projections for revenues are included in six-year schedules for County Government Special Funds and for Montgomery College, Maryland-National Capital Park and Planning Commission (M-NCPPC), and WSSC Water (WSSC) in the relevant sections of this document. See the Montgomery County Public Schools (MCPS) Budget Document for six-year projections of MCPS funds. Projections for revenues funding County government appropriations are provided to the Council and public as fiscal projections. Such projections are based on estimates of County income from its own sources such as taxes, user fees, charges, and fines, as well as expectations of other assistance from the State and Federal government. The most likely economic, demographic, and governmental policy assumptions that will cause a change in revenue projections are included in this section.

Projections for revenues are included in six-year schedules for County Government Special Funds and for Montgomery College, M-NCPPC, and WSSC in the relevant sections of this document. See the MCPS budget document for six-year projections of MCPS funds. The most likely economic, demographic, and governmental policy assumptions that will cause a change in revenue projections are included in this section.

TAX-SUPPORTED REVENUES

This section discusses the tax-specific portion of revenues from the total tax-supported fund. Each tax includes relevant fiscal policy considerations that directly affect the FY26 estimates, while also discussing crucial economic indicators driving the forecasts.

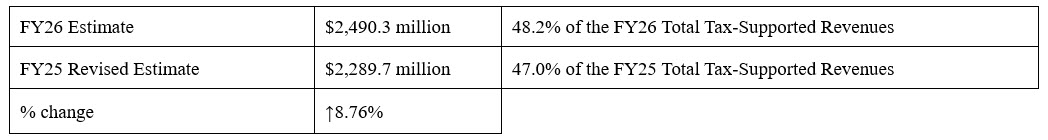

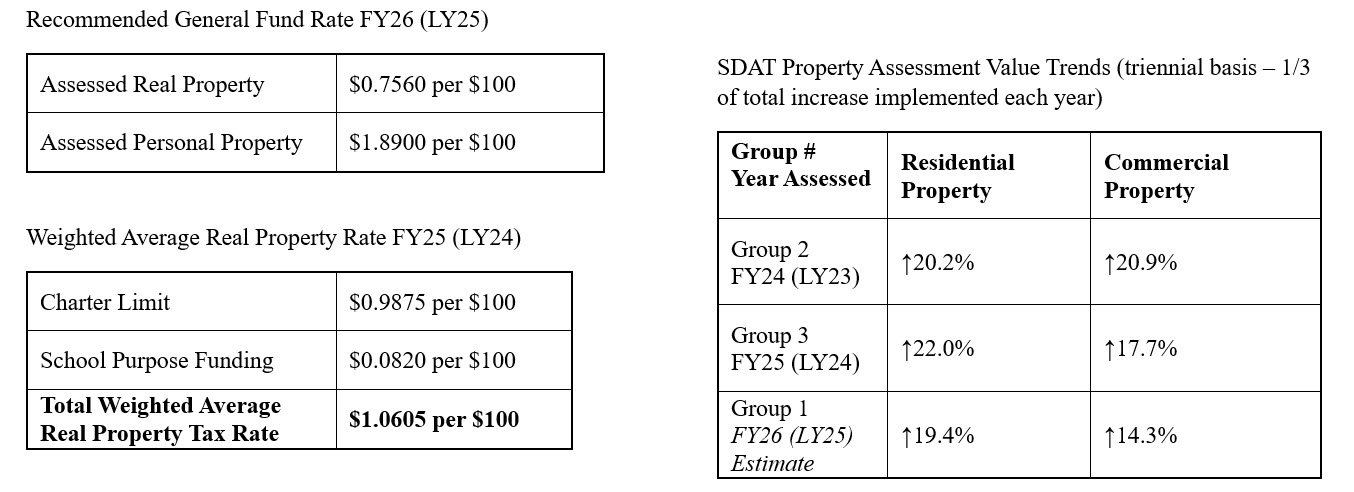

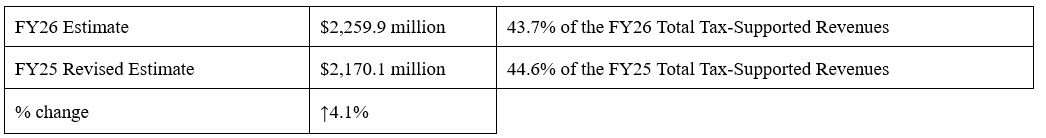

Property Tax

Property taxes are the largest source of revenue for the County and exhibits the least volatility to market conditions due to the reassessment process. The State Department of Assessments and Taxation (SDAT) holds the responsibility of assessing the market taxable value of Maryland properties, which are divided into three groups. Each year, the State reassesses one group, resulting in a complete reassessment of the County triennially (every three years). Increases in value of the assessments are phased over the three-year period, while decreases are effective in the first year. The "levy year" refers to the specific year for which the assessments are analyzed to set the tax rates for the upcoming fiscal year.

In addition to the general Countywide tax rate, there are special district tax rates, such as certain urban areas and recreation. The weighted average tax rate for FY26 includes a $0.0820 general fund property tax for school purposes pursuant to Maryland Code, Education § 5-104 (d)(1). In November 2020, County residents voted to amend Section 305 of the County Charter to prohibit the County Council from adopting a tax rate on real property that exceeds the tax rate on real property approved the previous year, unless all current Councilmembers vote affirmatively for the increase. The FY24 approved budget included a $0.0470 general fund property tax for school purposes, and the recommended FY26 budget incorporates an additional $0.0350 property tax for school purposes. The resulting proposed $0.0820 property tax dedicated to school funding is not included in the charter limit pursuant to § 5-104 of the State Education Article, which allows a County to set a property tax rate greater than would otherwise be allowed under the County's charter limit and may be approved by a majority of the number of councilmembers.

Income Tax

Income tax revenues are affected by resident employment, as well as wage and salary income trends. The base for Montgomery County's income tax is Maryland net taxable income (NTI). NTI is Federal adjusted gross income, as determined by the Internal Revenue Code, with Maryland-specific adjustments, and the subtraction of Maryland standard or itemized deductions and personal exemptions. The Maryland Comptroller's Office administers the local income tax as part of the State income tax. The County receives its income tax revenues largely through quarterly distributions from withholding and estimated payments that are sent to the State. Additional distributions reconcile the quarterly distributions from the previous tax year and distribute delinquent payments, interest and penalties and other collections.

On May 8, 2020, the Maryland General Assembly enacted SB523 that amended Article II, Section 17(c), of the Maryland Constitution - Chapter 641. Specifically, the bill authorized a PTE (partnerships, limited liability companies, S- corporations, and business trusts) to elect to be taxed at the entity level for the income tax. Also, an individual or corporation may claim a tax credit against the State income tax equal to the tax paid by the PTE on the member's share of the PTE's taxable income. Because of this option to pay at the entity level, future patterns of estimated and final payments may be impacted.

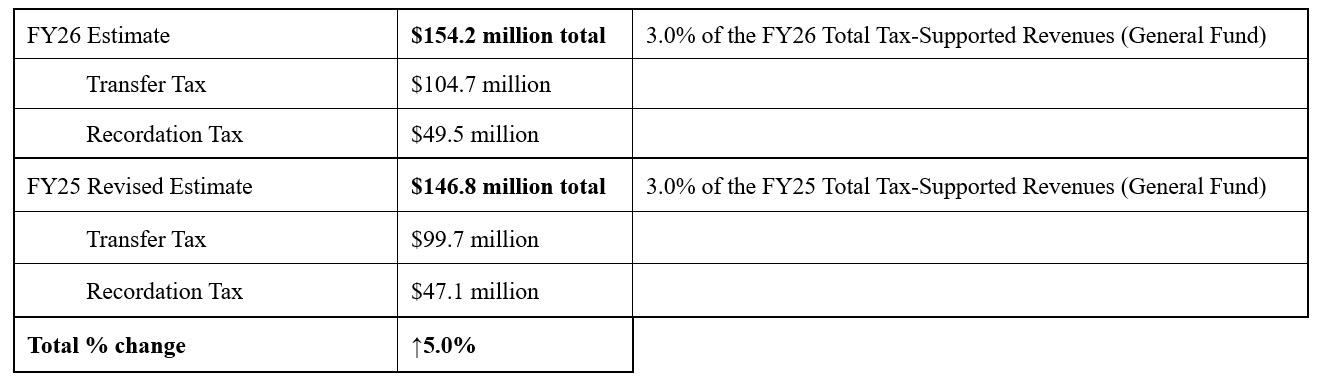

Transfer and Recordation Taxes

Transfer tax revenues are derived from the legal transfer of property; recordation tax is an excise tax imposed as compensation for registering the purchase or sale of property as public record. The revenues received strongly correlate with real estate trends, which are highly volatile. Economic indicators such as growth in personal income, formation of households, and mortgage interest rates can cause significant changes in the number of residential home sales. The volume and value of commercial property sales are affected by business activity and investment, office vacancy rates, property values, and financing costs.

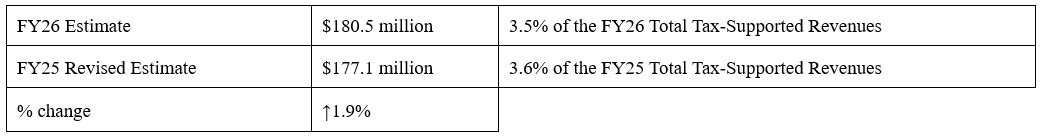

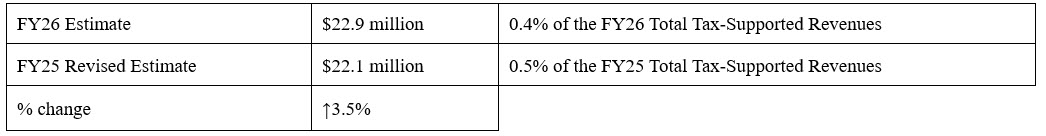

Fuel-Energy Tax

The fuel-energy tax is imposed on persons or entities transmitting, distributing, manufacturing, producing, or supplying electricity, gas, steam, coal, fuel oil, or liquefied petroleum gas. Different rates apply to residential and nonresidential consumption and to the various types of fuel-energy. Since the rates per unit of energy consumed are fixed, collections change only with shifts in energy consumption and not with changes in the price of the energy product.

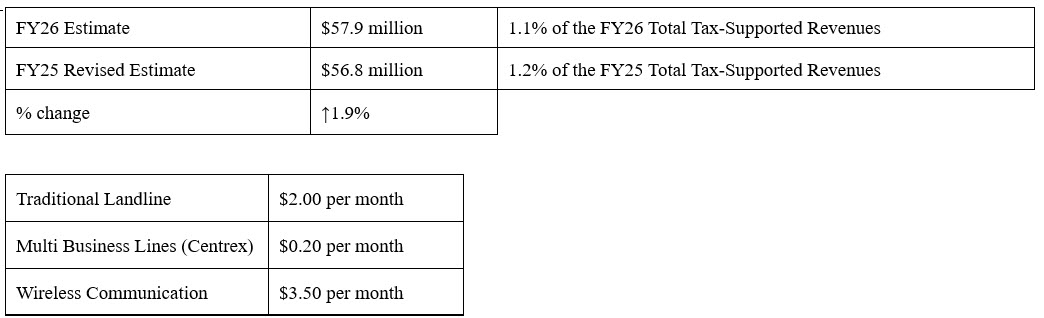

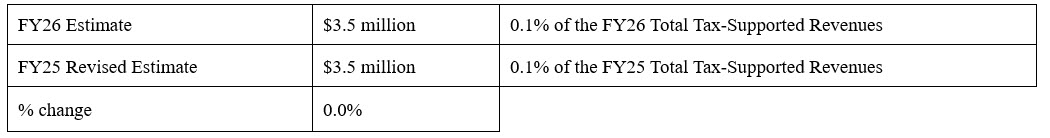

Telephone Tax

The telephone tax is levied as a fixed amount per landline, wireless communications, and other communication devices. Revenues from this tax are driven primarily by modest growth in wireless communications such as cell phones and by voice-over internet protocol. Over the past decade, approximately 80 percent of the gross telephone tax is attributed to growth in the cellular wireless component, the growth of which has moderated over the past couple of years.

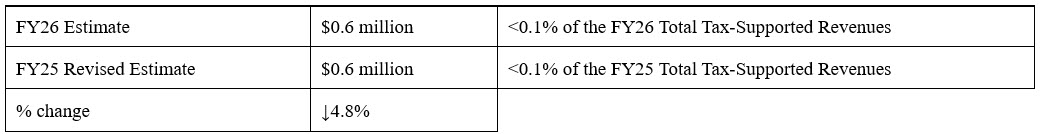

Hotel/Motel Tax

The hotel/motel tax is levied as a percentage of the hotel bill including online room rental organizations such as Airbnb; the current tax rate is 7.0 percent. Occupancy rates in the County are generally the highest in the spring (April and May) and autumn (September and October) as tourists, schools, and organizations visit the nation's capital for various events; many visitors to Washington, D.C. use hotels in the County, especially those in the southern portion of the County.

Admissions/Amusement Tax

Admissions and amusement taxes are State-administered local taxes on the gross receipts of various categories of amusement, recreation, and sports activities. Taxpayers are required to file a return and pay the tax monthly while the County receives quarterly distributions of the receipts from the State. Montgomery County levies a 7 percent tax, except for categories subject to State sales and use tax, where the County rate would be lower. Such categories include rentals of athletic equipment, boats, golf carts, skates, skis, horses, and sales related to entertainment. Gross receipts are exempt from the County tax when a municipal admissions and amusement tax is in effect.

E-Cigarettes Tax

The electronic cigarette tax is a tax on any product containing or delivering nicotine or any other substance intended for human consumption that can be used by a person to simulate smoking through inhalation of vapor or aerosol from the product. On March 31, 2020, the Montgomery County Council enacted legislation that prohibited an electronic devices manufacturer from distributing flavored electronic cigarettes to certain retail stores in Montgomery County. This has resulted in e-cigarette tax revenues declining each year from the peak of $1.4 million in FY20.

OTHER REVENUES IN TAX-SUPPORTED FUNDS

General Intergovernmental Revenues

Intergovernmental revenues are received from the State or Federal governments as general aid for certain purposes, not tied, like grants, to particular expenditures. The majority of this money comes from the State based on particular formulas set in law. Total aid is specified in the Governor's annual budget. Since the final results are not known until the Maryland General Assembly session is completed and the State budget is adopted, estimates in the March 15 County Executive's Recommended Public Services Program are generally based on the Governor's budget estimates for FY26. If additional information on the State budget is available to the County Executive, this information will be incorporated into the budgeted projection of State aid. The County Executive's FY26 Recommended Budget assumes a $42.9 million, or 3.7 percent, increase in intergovernmental revenues from the revised FY25 estimate, of which 81.8 percent of the $1.212 billion in revenues would be allocated to the Montgomery County Public Schools, 6.7 percent to other intergovernmental, 4.6 percent to Montgomery College, and 3.4 percent to mass transit, and 3.4 percent to the remaining intergovernmental revenues.

Licenses and Permits

Licenses and permits include General Fund business licenses (primarily public health, traders, and liquor licenses) and non-business licenses (primarily marriage licenses and Clerk of the Court business licenses). Licenses and permits in the Permitting Services Enterprise Fund, which include building, electrical, and sediment control permits, are enterprise funds and thus not included in tax-supported projections. The FY26 Recommended Budget assumes a 0.5 percent increase over the revised estimates for FY25, resulting in $14.8 million in available resources in FY26.

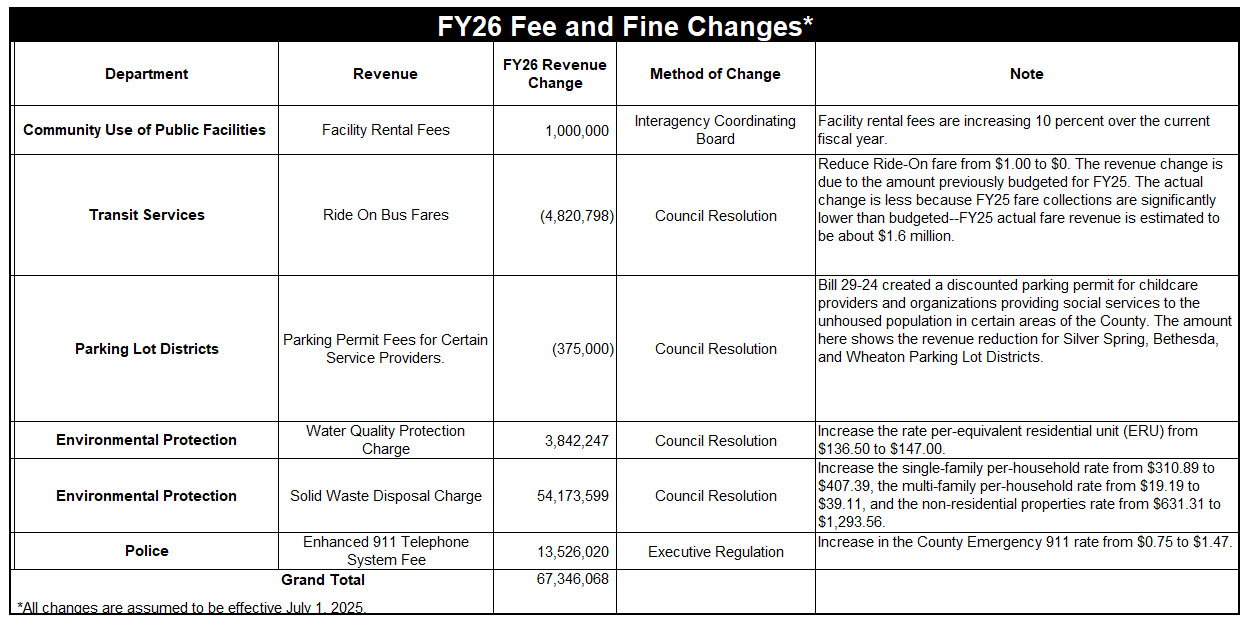

Charges for Services

Excluding intergovernmental revenues to Montgomery County Public Schools and Montgomery College, and college tuition, charges for services, or user fees, are revenues collected that come primarily from fees imposed on the recipients of certain County services including mass transit, human services, use of facilities, and recreation services and are included in the tax-supported funds. The FY26 Recommended Budget assumes a decrease of 16.5 percent as compared to the revised estimates for FY25, resulting in $56.8 million in available resources in FY26.

Fines and Forfeitures

Revenues from fines and forfeitures relate primarily to photo red light and speed camera citations, and parking fines (excluding the County's four Parking Districts). The FY26 Recommended Budget assumes that fines and forfeitures will increase 0.0 percent from the revised estimates for FY25, resulting in $30.6 million in available resources in FY26.

College Tuition

Although College tuition is not included in the County Council's Spending Affordability Guidelines (SAG), it remains in the tax-supported College Current Fund. Calculation of the aggregate operating budget is under the SAG limits. Tuition revenue depends on the number of registered students and the tuition rate. The FY26 Recommended Budget assumes a 3.7 percent increase in tuition (revenues) from an estimated $70.0 million in FY25 to $72.6 million in FY26.

Investment Income

Investment income includes the County's pooled investment and non-pooled investment and interest income of other County agencies and funds. The County operates an investment pool directed by an investment manager who invests all County operating funds using an approved, prudent, County Council-adopted investment policy. The pool includes funds from tax-supported funds as well as from enterprise funds, municipal taxing districts, and other governmental agencies. Two major factors that determine pooled investment income are: (1) the average daily investment balance which is affected by the level of revenues and expenditures, fund balances, and the timing of bond and commercial paper issues; and (2) the average yield percentage which reflects short-term interest rates and may vary considerably during the year.

The Federal Open Market Committee (FOMC) began increasing the targeted Federal funds rate starting on March 17, 2022, in response to the rapid growth in the rate of inflation and increased the rate a total of eleven times, reaching an effective rate of 5.33 percent by August 2023. The FOMC subsequently made several reductions to the effective rate in the fall of 2024. The forecast incorporates expectations that the FOMC will pause the reduction in the targeted Federal fund rate for 2025, resulting in an effective rate of between 4.25 and 4.5 percent for the remainder of CY2025.

The revised FY25 tax-supported investment income estimate of $67.1 million assumes a yield of 4.75 percent and an average daily portfolio balance of $2.050 billion. The FY26 projected estimate of tax-supported investment income of $56.6 million assumes a yield of 4.10 percent and an average daily portfolio balance of $2.000 billion.

Other Miscellaneous

The County receives miscellaneous revenues from a variety of sources. For the FY26 Recommended Budget, miscellaneous revenues will increase 24.6 percent from the revised estimates for FY25, resulting in $24.8 million in available resources in FY26.

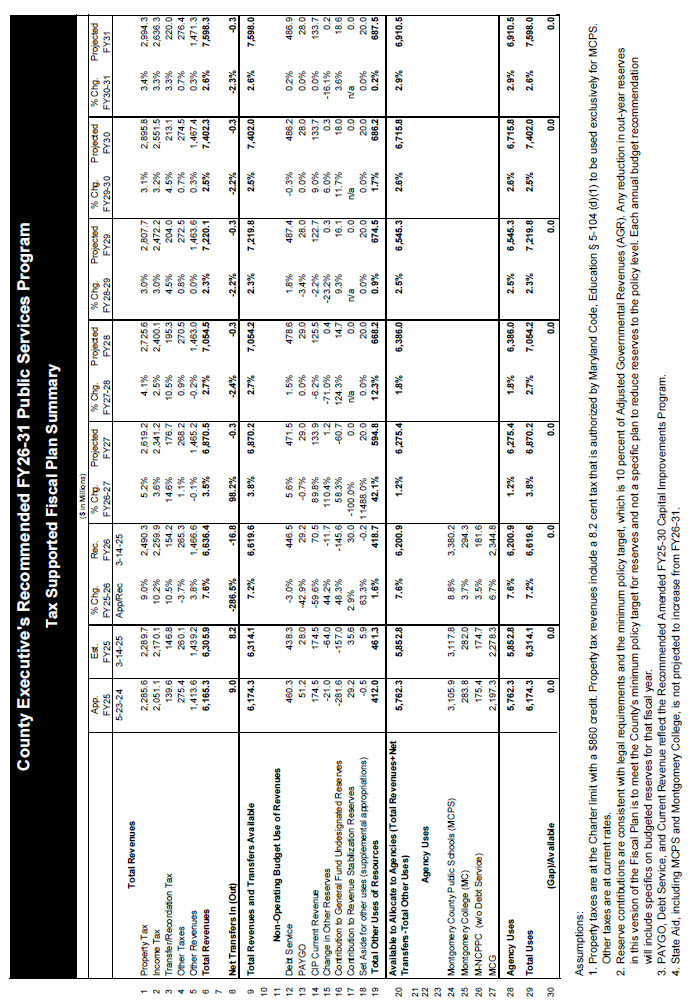

IMPACT ON REVENUES AND THE CAPITAL BUDGET

The use of resources represented in this section includes appropriations to the operating funds of the various agencies of the County as well as other resource requirements, such as current revenue funding of the capital budget, debt service, and fund balance. These other uses, commonly called "Non-Agency Uses of Resources," affect the total level of resources available for allocation to agency programs. Some of these factors are determined by County policy or law; others depend, in part, on actual revenue receipts and expenditure patterns.

The level of PSP-related spending indirectly impacts the local economy and, hence, the level of County revenues. However, the effect on revenues from expenditures of the recommended operating budget and PSP are expected to be minimal. The PSP also impacts revenues available to fund the capital budget. The revenue projections included in this section subtract projected uses of current revenues for both debt eligible and non-debt eligible capital investments. Therefore, the recommended operating budget and PSP provide the allocations of annual resources to the capital budget as planned for in the County Executive's Amended FY25-30 CIP. Anticipated current revenue adjustments to the County Executive's Amended FY25-30 CIP have been made as part of the recommended operating budget.

Prior Year Fund Balance

The prior year fund balance for the previous fiscal year is the audited FY24 closing fund balance for all tax-supported funds. The current year fund balance results from an analysis of revenues and expenditures for the balance of the fiscal year. Prior year fund balance for future fiscal years is assumed to equal the fund balance for the preceding year.

Net Transfers

Net transfers are the net of transfers in and transfers out between all tax supported and non-tax supported funds in all agencies. The largest single transfer to the General Fund is the earnings transfer from the Liquor Control Fund to the General Fund. The transfer from the General Fund to Montgomery Housing Initiative to support the County Executive's housing policy is the largest transfer to a non-tax supported fund. The payment from the General Fund to the Solid Waste Disposal Fund for disposal of solid waste collected at County facilities is the next largest transfer to a non-tax supported fund. The level of transfers is an estimate based on individual estimates of component transfers.

Debt Service Obligations

Debt service estimates are those made to support the County Executive's Amended FY25-30 CIP. Debt service obligations over the six years are based on servicing debt issued to fund planned capital projects, as well as amounts necessary for short-term and long-term leases. Debt service requirements have the single largest impact on the operating budget/Public Services Program by the CIP. The Charter-required CIP contains a plan or schedule of project expenditures for schools, transportation, and infrastructure modernization. Approximately 27.0 percent of the CIP is funded with General Obligation (GO) bonds. Each GO bond issue used to fund the CIP translates to a draw against the operating budget each year for 20 years. Debt requirements for past and future GO bond issues are calculated each fiscal year, and provision for the payment of Debt Service is included as part of the annual estimation of resources available for other operating budget requirements. As Debt Service grows over the years, increased pressures are placed on other PSP programs competing for scarce resources.

The State authorizes borrowing of funds and issuance of bonds up to a maximum of 6.0 percent of the assessed valuation of all real property and 15.0 percent of the assessed value of all personal property within the County. The County's outstanding GO debt plus short-term commercial paper as of June 30, 2024, is 1.62 percent of assessed value, well within the legal debt limit and safely within the County's financial capabilities.

Capital Improvements Program (CIP) Current Revenue and PAYGO

Estimates of transfers of current revenue and PAYGO to the CIP are based on the most recent County Executive recommendations for the capital budget and CIP. These estimates are based on programmed current revenue and PAYGO funding in the six years, as well as additional current revenue amounts allocated to the CIP for future projects and inflation.

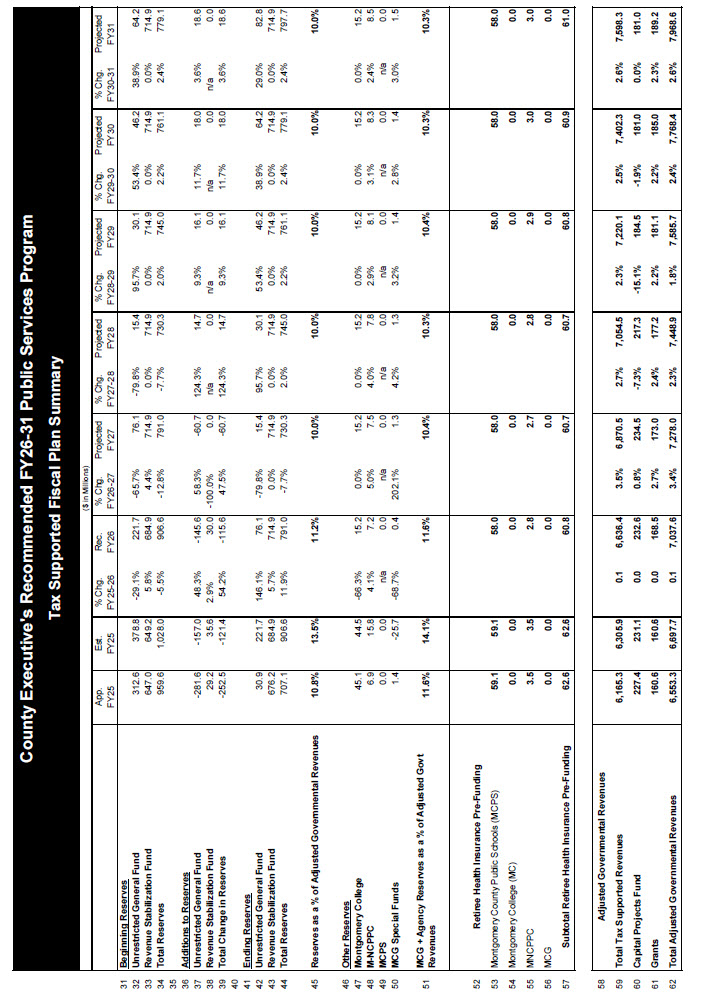

Revenue Stabilization

On June 29, 2010, the Montgomery County Council enacted Bill 36-10 amending the Montgomery County Code (Chapter 20, Finance, Article XII) that repealed the limit on the size of the Revenue Stabilization Fund, modified the requirement for mandatory County contributions to the fund, and amended the law governing the fund. Mandatory contributions to the fund are the greater of 50 percent of any excess revenue, or an amount equal to the lesser of 0.5 percent of the Adjusted Governmental Revenues (AGR) or the amount needed to obtain a total reserve of 10 percent of the Adjusted Governmental Revenues. Adjusted Governmental Revenues include tax-supported County governmental revenues plus revenues of the County Grants Fund and County Capital Projects Fund; tax-supported revenues of the Montgomery County Public Schools, not including the County's local contribution; tax supported revenues of Montgomery College, not including the County's local contribution; and tax-supported revenues of the Montgomery County portion of the Maryland-National Capital Park and Planning Commission. All interest earned on the fund must be added to the fund. The FY26 Recommended Budget estimates that the Revenue Stabilization Fund balance will be $684.9 million in FY25 and the balance is estimated to increase to $714.9 million in FY26.

Other Uses

This category is used to set aside funds for such items as possible legal settlement payments and other special circumstances such as set-aside of revenues to fund future years.

Reserves

The County may maintain an unrestricted General Fund balance of up to five percent of prior year's General Fund revenues (pursuant to Charter § 310) and a combined unrestricted General Fund balance plus the Revenue Stabilization Fund balance of 10 percent of AGR. This budget more than satisfies the County's policy to maintain the budgeted total reserve of the unrestricted General Fund and Revenue Stabilization Fund at 10 percent of Adjusted Governmental Revenues with a projected combined balance of 11.2 percent. This leaves sufficient capacity in FY26 to address budget issues that may arise from State and Federal budget actions.