Program Description

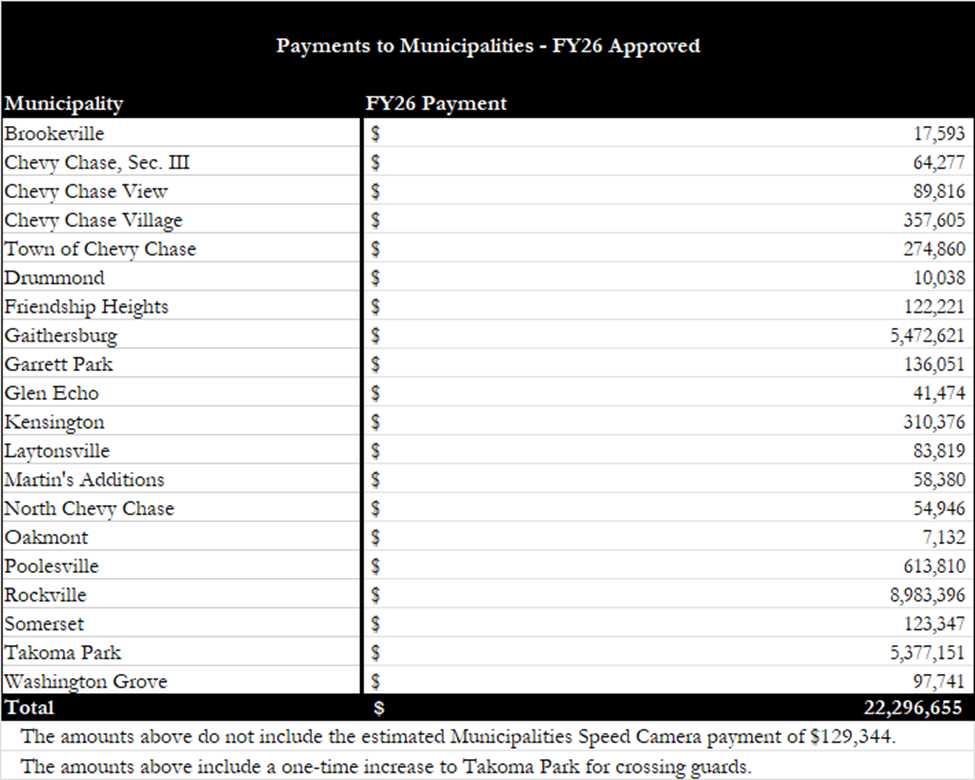

Payments to Municipalities

The Montgomery County Municipal Revenue Program, authorized by Chapter 30A of the Montgomery County Code, reimburses municipalities for those public services they

provide that would otherwise be provided by the County. The current reimbursement policy goes beyond State law, Section 6-305 of the Tax-Property Article,

which requires the County to provide to municipalities only the Property Tax-funded portion of those costs. The County Executive negotiated a new formula w

ith the County's municipal partners over the course of 2021. Changes to the calculation formula were adopted by the County Council on March 1, 2022, with the enac

tment of Expedited Bill 2-22.

Expedited Bill 2-22 established that municipalities are to be reimbursed by the County based upon the County Executive's appro

ximation of the costs that the County would incur if it were to provide the municipalities with transportation, police, crossing guards, and park maintenance servi

ces. Specifically, as the exact payment amount for a current year cannot be determined until County books are closed, reimbursements are based on the final audited

cost of performing eligible services during the fiscal period two years prior to the budget year.