INTRODUCTION

The Montgomery County Charter, approved by the voters in 1968 and implemented in 1970, provides for a County Council/Executive form of government. Under this form of government, the Executive develops and recommends budget proposals; the Council then authorizes expenditures and sets property tax rates. The Charter also provides for an annual six-year Public Services Program (PSP), Operating Budget, and Capital Budget and a biennial six-year Capital Improvements Program (CIP). These budgets and related fiscal and programmatic plans provide the basis for understanding, coordinating, and controlling County government programs and expenditures.

This section provides a brief introduction and refers to the legal requirements for the annual budget process and includes descriptions of government structure and government accounting methods and funds.

THE BUDGET PROCESS

Fiscal Year

The 12-month period used to account for revenues and expenditures in Montgomery County commences on July 1 of each year and ends on June 30 of the following year. A budget process timeline appears later in this section, which displays the relationships between the Capital Budget/CIP, Operating Budget/PSP, and Growth Policy processes across the year.

Operating and Capital Budgets

Under the County Charter (Section 303), the complete County Executive's Recommended Budget includes the CIP, published by January 15 in even-numbered calendar years; the Capital Budget, published annually by January 15; and this document, the Operating Budget and PSP, published annually by March 15.

Further information about the PSP can be found later in this section. For further information about the Capital Budget/CIP, please refer to the Capital Improvements Program section of this document.

Spending Affordability Process

The Spending Affordability process for the Operating Budget is required by Section 305 of the County Charter and Chapter 20 of the Montgomery County Code.

The County Council must set Spending Affordability Guidelines (SAG) for the Operating Budget by the second Tuesday in February after a public hearing. The guidelines must specify a ceiling on funding from property tax revenues and a ceiling on the aggregate operating budget. In adopting SAG, the Council considers the condition of the economy, the level of economic activity in the County, personal income levels, and the impact of economic and population growth on projected revenues among other relevant factors.

Along with the guidelines, the Council also adopts recommended spending allocations for the tax-supported budgets of County Government, the Board of Education, Montgomery College, the Maryland-National Capital Park and Planning Commission, debt service, and current revenue funding for the CIP.

By March 31, the governing board of each agency and the Executive must also specify how, if necessary, they would reduce the budget request to comply with the Council adopted budget allocation.

The Charter requires the Council to approve the Operating and Capital Budgets by June 1. An aggregate operating budget which exceeds the spending affordability guideline ceiling on the aggregate operating budget then in effect requires the affirmative vote of eight Councilmembers for approval. The Council approved spending affordability guidelines and allocations are displayed in the Spending Affordability Comparison chart at the end of this chapter.

Limits on Revenues

Section 305 of the County Charter includes a limit on the annual increase in property tax revenues. Section 305 was amended in the November 2020 election to prohibit the County Council from adopting a tax rate on real property that exceeds the tax rate on real property approved for the previous year.

The County Charter was amended in 2020 to include a cap on the annual increase in the weighted property tax rate. The weighted real property tax rate may not exceed the weighted tax rate on real property approved for the previous year, unless all current Councilmembers vote to exceed that cap. In addition, the County Council must adopt annual spending affordability guidelines for both the operating and capital budgets which can only be exceeded prior to setting appropriations by an affirmative vote of eight Councilmembers for approval.

This amendment replaces the previous property tax limit, which required an affirmative vote of all current Councilmembers to levy a tax on real property that would produce total revenue that exceeded the total revenue produced by the tax on real property in the preceding fiscal year plus any increase in the Consumer Price Index (CPI-U for the Washington Metropolitan Statistical Area). The previous property tax limit exempted real property tax revenue derived from (1) newly constructed property; (2) newly rezoned property; (3) certain property assessed differently under State law; (4) property that had undergone a change in use; and (5) property in a development tax district to provide funding for capital improvements.

Operating Budget Forums

The Executive sponsors budget forums to give County residents an opportunity to provide their input on the County's operating budget priorities, have their voices heard, contribute ideas that could be used in the development of the budget, advocate for funds that impact their community, as well as learn about the County's operating budget and get answers to their questions. During the FY25 Operating Budget development season, the County Executive conducted an historic number of operating budget forums, including the first forum to be conducted in Amharic; the second forum conducted in Chinese and the third forum conducted in Spanish, making these forums more accessible and interactive.

Operating Budget Preparation and Executive Review

Requirements for submission of, and action on, County budgets are contained in Article 3 of the County Charter. Departments and agencies prepare budget requests within guidelines established by the Executive (for the departments) and by law (for other agencies of government). These are submitted on scheduled dates for analysis by the Office of Management and Budget (OMB) and are reviewed by the Executive during the period January-March. The Executive recommends a budget which balances all agency expenditures with projected revenues to the Council by March 15.

Racial Equity & Social Justice

During the FY25 Operating Budget development season, the County continued investing in efforts to normalize, organize, and operationalize for racial equity and social justice. Incorporating lessons learned from previous budget development seasons, the Office of Racial Equity and Social Justice's (ORESJ) Director and policy analysis staff developed a tool, training, and guidance manual to support the use of a racial equity lens throughout the budget development process. These resources support the County's implementation of the Racial Equity and Social Justice Act and bring into focus how the budget impacts racial disparities and inequities in the County.

Like FY24, the FY25 Operating Budget development season involved the use of the Operating Budget Equity Tool (OBET) by departments and ORESJ. The tool was incorporated into the Office of Management and Budget's oversight of the budget process. Responses to the tool and analysis of those responses provided decisionmakers with new insights and pathways for allocating resources in ways that contribute to reducing and ultimately eliminating racial disparities and inequities in the County.

For the FY25 budget development season, the OBET included department- and program-level questions. All departments were required to answer the department-level questions. Department-level questions provided departments an opportunity to:

- Explain how their proposed budget will support the department's commitment to advancing racial equity and social justice. Using the GARE (Government Alliance on Racial Equity) framework (Normalize, Organize, and Operationalize), departments could select from a number of best practices (and share additional activities) that demonstrate department-level commitments to racial equity and social justice.

- Normalize-Establish racial equity as a key value by developing a shared understanding of key concepts across the department and create a sense of urgency to make changes.

- Organize-Build staff and organizational capacity, skills, and competencies through training while also building infrastructure to support the work, like internal organizational change teams and external partnerships with other institutions and community.

- Operationalize-Put theory into action by implementing new tools for decision-making, measurement, and accountability like a Racial Equity Tool and developing a Racial Equity Action Plan.

- Explain the department's approach to mitigating the impact of proposed budget reductions on racial disparities and inequities in the County.

- Describe persistent gaps or limitations that could inhibit the department's ability to advance racial equity and social justice.

Program-level questions were answered by ten departments whose budgets make up the largest share of the County's overall budget. The program-level questions asked departments to:

- Explain the purpose of the program, including envisioned outcomes, as well as identify primary or targeted beneficiaries;

- Identify disparities and/or inequities that are targeted by the program;

- Describe how the program will impact the people most negatively affected/harmed by the challenges the program seeks to address; and

- Explain how the needs of specific communities or stakeholders informed the program request.

The program-level questions also gave departments an opportunity to describe how any proposed program reductions could impact beneficiaries as well as the department's approach to mitigating unintended consequences.

ORESJ will continue its forward momentum in the following activities:

- conduct Racial Equity Impact Assessments of supplemental and special appropriation requests;

- train all Montgomery County employees on racial equity and social justice;

- guide County departments' examination of policies, procedures, and practices to determine if they create or exacerbate racial disparities in the County;

- facilitate planning and development of Racial Equity Action Plans with departments; and

- build capacity across departments to disaggregate data by race and ethnicity; develop metrics to measure the success of County government programs, short-term and long-term goals.

See Chapter 42 for a discussion on the Office of Racial Equity and Social Justice. See Chapter 79 for a discussion of the County's initiatives related to racial equity and social justice.

See the "Amending the Approved Operating and Capital Budgets" section below regarding racial equity and supplemental/special appropriation requests to operating budgets, capital budgets, and the capital improvements program.

Background

During the FY21 Operating Budget development season, racial equity was part of the discussions at the budget meetings with the Office of Management and Budget (OMB), departments, and the County Executive as recommendations were developed and made.

As part of the FY22 Operating Budget development season, OMB requested the department users to include a brief explanation in their program proposal (budget submission) on how their programs promote racial equity. OMB also included a definition in the guidance document for the department users to reference during the development season.

Enhancements were established for the FY22 Operating Budget development season including:

- Information provided to the public attending the operating budget forums on the County's efforts to advance racial equity as a part of the operating budget development process; and

- Dedicated a section of the form in one of the County's budgeting systems to collect information on the topic of racial equity.

OMB requested departments/analysts identify requests that should be aligned with a racial equity characteristic in an attempt to determine which community residents will potentially benefit the most from the department's program proposal or be burdened by the department's program proposal.

The County integrated these considerations as part of the budget process. As an initial step, the County's Office of Racial Equity and Social Justice:

- performed an equity assessment to identify policies that do not advance equity;

- made progress in providing training to all Montgomery County employees on racial equity and social justice;

- guided County departments to examine policies, procedures, and practices to determine if they create or exacerbate racial disparities in the County; and

- developed metrics to measure the success of County government programs, short-term and long-term goals.

Climate Change

During the FY25 Operating Budget development season, the County Executive, the Office of Management and Budget (OMB), the County's Climate Change Officer (CCO), and relevant departments, integrated considering climate change into the process. Climate change questions within the budget system facilitated consideration as recommendations were developed, and before decisions were made.

Departments were also asked to include information in their budget submission that identifies:

- the projects' impact on greenhouse gas emissions;

- how the project will increase the use or generation of renewable energy;

- aspects of the project that will help the County withstand future impacts of climate change (e.g., high heat days, severe storms, flooding, and high winds); and

- departmental Climate Change Ambassadors who will mobilize staff to green their department's day-to-day operations, build resiliency among vulnerable community members, and work as a team with other department Ambassadors to facilitate deep emission reductions across all departments.

Background

Enhancements were established starting in the FY22 Operating Budget development season to incorporate climate change considerations including:

- Information provided to the public attending the operating budget forums on the County's efforts to tackle climate change as a part of the operating budget development process

- Dedicated a section of the form in one of the County's budgeting systems to collect information on the topic of climate change

OMB requested departments/analysts to identify requests that are climate change related to doing the following:

- Reduce greenhouse gas emissions (Examples include: energy efficiency, use of renewable energy, reduce consumption of resources, increase tree cover. For more detailed examples, see below.)

- Increase the resiliency of County infrastructure or County residents to withstand the future impacts of climate change such as severe storms, flooding, heat, and damaging winds. (Examples include: outreach about climate hazards, install green infrastructure, increase tree cover. (Provided more detailed examples for department users.)

- Sequester carbon. Carbon sequestration is the removal and storage of carbon dioxide from the atmosphere in carbon sinks (such as forests or soils). (Examples include: protection and restoration of forests and wetlands; increase tree cover through planting; promote regenerative agriculture).

The Climate Change Officer then led a Climate Budget Committee to review these climate-related budget requests and provided input to the County Executive and OMB on the requested funds affect in meeting the County's climate change goals and implementing the County's Climate Action Plan.

Additionally, the County Executive announced his interest in having at least one Climate Change Ambassador from each department to mobilize staff to green their department's day-to-day operations, build resiliency among vulnerable community members, and work as a team with other department Ambassadors to facilitate deep emission reductions across all departments.

See Chapter 76 for a discussion on the County's climate change goals.

Public Hearings

Citizen participation is essential to a fair and effective budget process. Many citizens and advisory groups work with specific departments to ensure that their concerns are addressed in departmental requests. The County Charter requires the Council to hold a public hearing not earlier than 21 days after receipt of the recommended operating budget from the Executive.

Public hearings are advertised in County newspapers. Speakers must register with the Council Office to testify at the public hearings (www.montgomerycountymd.gov/council). Persons wishing to testify should call the Council Office at 240.777.7803 to register. If it is not possible to testify in person at the hearings, written testimony is acceptable and encouraged. For further information and dates of the Council's public hearings on the County Executive's Recommended Operating Budget, contact the Council's Legislative Information Services Office at 240.777.7910. Hearings are held in the Council Hearing Room of the Stella B. Werner Council Office Building, unless otherwise specified.

Council Budget Review

After receiving input from the public, the Council begins its review of the County Executive's Recommended Operating Budget. Each department budget is reviewed by a designated Council committee. Representatives from each department and Office of Management and Budget (OMB) meet with these committees to provide information and clarification concerning the recommended budget and agency programs. In April and May, the full Council meets in regular sessions, reviews the recommendations of its committees, and takes final action on each agency budget.

Operating and Capital Budget Approval

The Charter requires that the Council approve and make appropriations annually for the operating and capital budgets by June 1. In even-numbered calendar years, the Council also approves a six-year CIP. Prior to June 30, the Council must set the property tax levies necessary to finance the budgets. Other sections of the Charter provide for Executive veto or reduction of items in the budget approved by the Council. The Charter prohibits expenditure of County funds in excess of available unencumbered appropriations.

Amending the Approved Operating and Capital Budgets

The Operating and Capital Budgets may be amended at any time after adoption by the Council.

Supplemental appropriations are recommended by the County Executive, specify the source of funds to finance the additional expenditures, and may occur any time after July 1 of the fiscal year. A supplemental appropriation that would comply with, avail the County of, or put into effect a grant or a Federal, State, or County law or regulation, or one that is approved after January 1 of any fiscal year, requires an affirmative vote of six Councilmembers. A supplemental appropriation for any other purpose that is approved before January 1 of any fiscal year requires an affirmative vote of seven Councilmembers. The Executive may disapprove or reduce a supplemental appropriation, and the Council may reapprove the appropriation, as if it were an item in the annual budget.

Special appropriations are recommended by either the County Executive or County Council, specify the source of funds to finance the additional expenditures, and are used when it is necessary to meet an unforeseen disaster or other emergency or to act without delay in the public interest. The Council may approve a special appropriation after public notice by news release, and each special appropriation must be approved by not less than seven Councilmembers.

Transfers of appropriation which do not exceed ten percent of the original County Council appropriation, may be accomplished by either: the County Executive, for transfers within or between divisions of the same department; or by the County Council, for transfers between departments, boards or commissions, or to new accounts.

In accordance with Bill 44-20, Racial Equity and Social Justice - Impact Statements - Advisory Committee Amendments, all supplemental/special appropriation requests include a Racial Equity Impact Assessment (REIA) by the Office of Racial Equity and Social Justice explaining how the appropriation advances racial equity and social justice.

Public Services Program (PSP)

Projections of County revenues relative to anticipated expenditure requirements constrain the level of public services affordable. The PSP looks to balance the growth in revenues, based on the County Executive's current revenue and fiscal policies, with the pressures affecting the future cost of services. The Charter (Section 302) requires the County Executive to submit an annual comprehensive six-year program for public services and fiscal policy. The PSP includes:

- a statement of program objectives;

- recommended levels of public service;

- an estimate of costs over the six-year period;

- a statement of revenue sources;

- estimated impact of the PSP on County revenues and the Capital Budget; and

- projected revenues and expenditures for all functions of the County government.

The Charter requires that the annual budget, submitted in conjunction with the PSP, be consistent with the six-year program.

Recommended levels of public service can be seen in the six-year projections of expenditures for each special fund. Expenditures are projected based on major known commitments. Actual costs, over time, are the result of several variables, including collective bargaining, government policy, and objectives of fairness between agencies and employee groups.

An estimate of the impact of the PSP on County revenues is included, where applicable, in the program descriptions or in the fiscal data for the department or agency. Impact on the program of the Capital Budget is included, where applicable, in the program descriptions; future fiscal impacts; or in facility plans, when the program or service delivery will require expanded, additional, or replacement facilities that are scheduled in the CIP.

BUDGETING FOR OUTCOMES

Creating an effective and sustainable County Government is one of the County Executive's top priorities. As a way to achieve that goal, the Executive is focused on how to use budgeting to drive innovation and turn resources into real results in Montgomery County.

This approach begins with using priority outcomes as a focal point for budgeting; connecting resources necessary to achieve those outcomes; using performance data and evidence to make budget decisions; fostering competition and collaboration; rewarding services that obtain results and shifting dollars from programs that are ineffective; engaging residents in the budget process; and focusing on the return on investment. Also, this approach includes evaluating the value of the services offered; evaluating what we are doing; identifying areas of duplication, inefficiencies, new opportunities, and how we can do things differently to obtain more or better results.

As an integral part of this approach, policy goals help shape budget decisions:

- Educational Opportunities for all

- Equity and Advancing Social Justice

- Economic Development Across the County

- Environmental Sustainability to Fight Climate Change

- Efficient and Effective Public Services

When allocating resources under this approach, budgeting maximizes the value of the dollars that are spent.

OPEN BUDGET

To replace, consolidate, and enhance numerous failing legacy financial systems, OMB developed an in-house budget analysis and statistical information application called BASIS. Using an intuitive and accessible user-interface design, BASIS provides residents, analysts, departments, and management with instant access to budget and performance data in a clear and concise fashion. This scalable solution ensures evolving budget needs are met in a cost-effective manner.

Open BASIS Budget features include:

- Interactive charts, visualizations, tables, maps and videos

- A Custom Google Search Engine for fast results finding

- Downloadable Publications, Individual Sections / Chapters

- Filter Previous Years' data and content

- Export & Discover data, tables, and visualizations

- Mobile (works on smartphones, tablets and desktops)

- American with Disabilities Act (ADA) Compliant

- Instantly translatable into 90+ languages

For more, please visit the following website (available throughout the year): http://montgomerycountymd.gov/openbudget

APPENDICES TO THIS SECTION

Government Structure

This section shows the organizational entities that compose Montgomery County Government.

Government Accounting Methods and Funds

This section describes the funds and accounting mechanisms used to manage County resources.

Spending Affordability Comparison

This section includes the Council approved spending affordability guidelines and allocations.

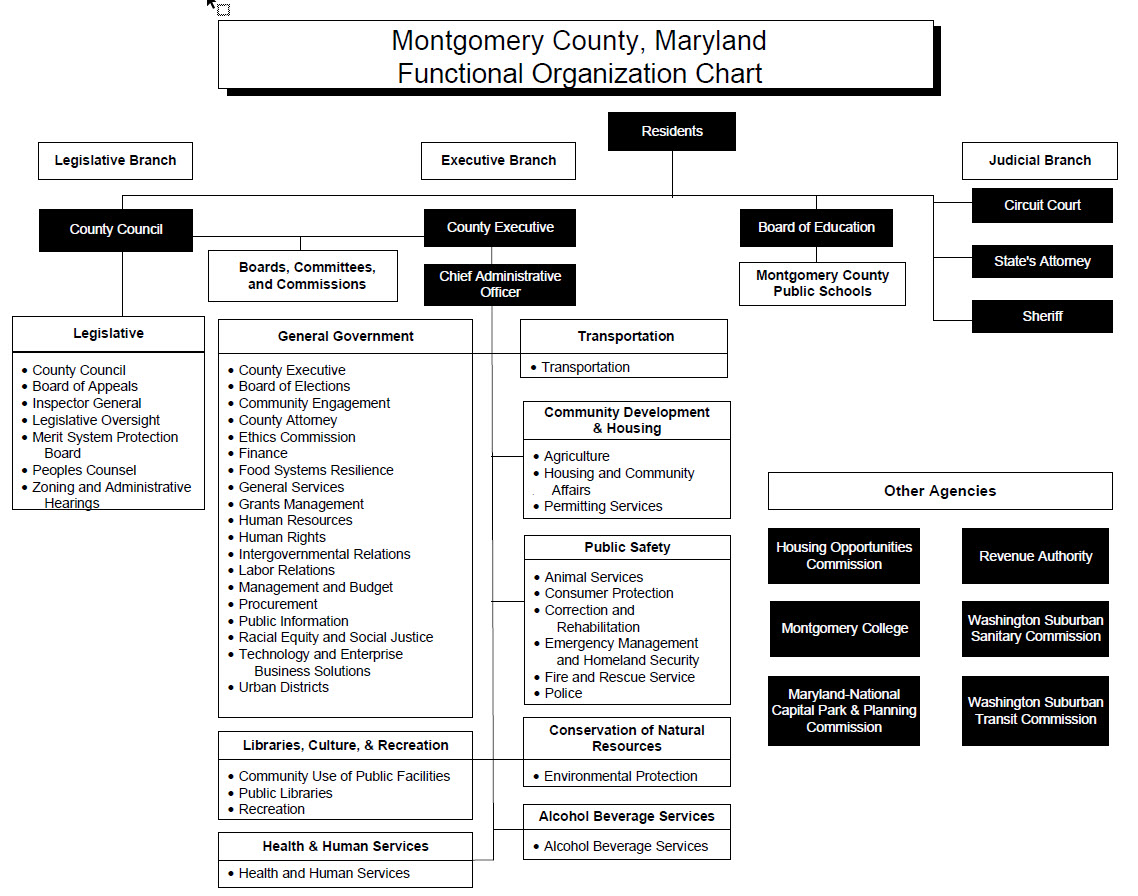

Montgomery County Functional Organization Chart

This chart displays the organizational structure of departments and agencies for the County government.

Montgomery County Government Public Documents

This table contains a list of all budget-related public documents, including the approximate dates of publication and how they may be obtained.

Montgomery County Map

This map displays the geographic area of Montgomery County.

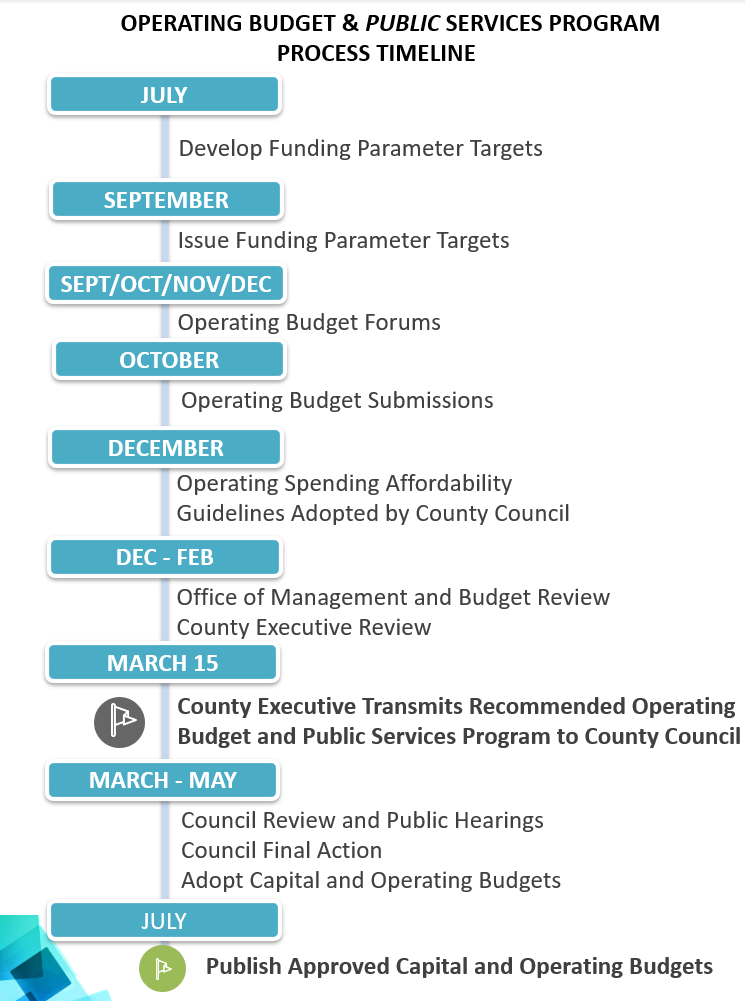

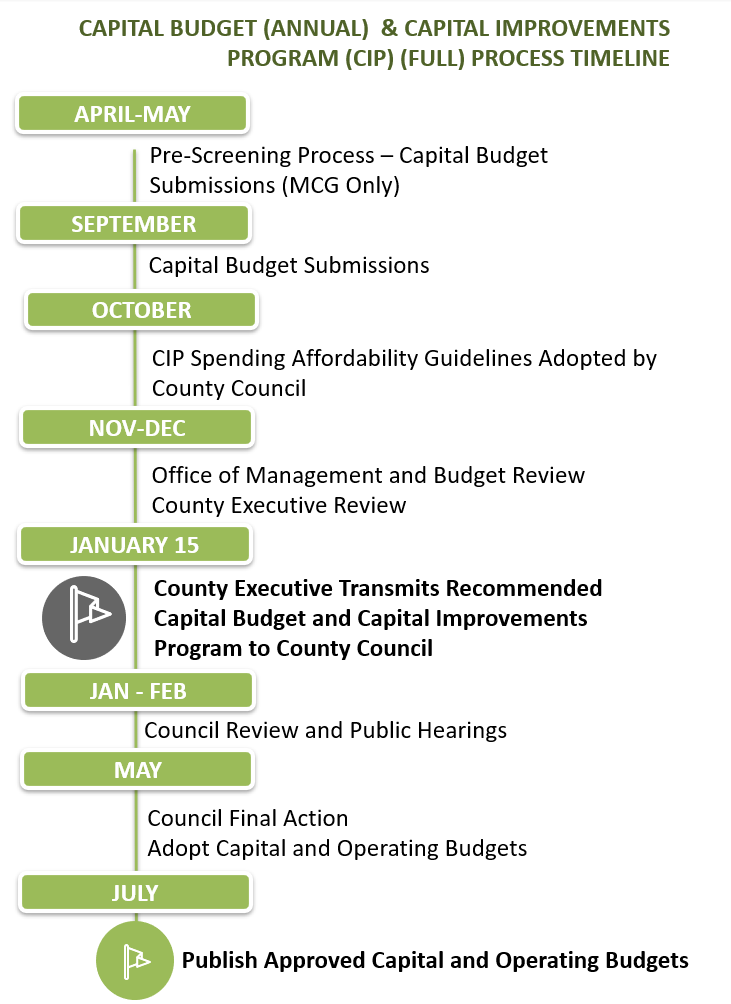

Budget Process Timeline

This timeline follows the Capital Budget/CIP and Operating Budget/PSP process from the start of the process in July/August to the final approval of the budgets in June for all agencies.

GOVERNMENT STRUCTURE

County Government Organization

Montgomery County includes several organizational components and joint ventures, including:

Montgomery County Government (MCG), which includes Executive departments (such as Recreation, Environmental Protection, and Police) and offices (such as County Attorney), the County Council's legislative offices and boards, the Circuit Court, and judicial offices;

Montgomery County Public Schools (MCPS), under the authority of the Board of Education (BOE);

Montgomery College (MC), the County's two-year community college, under the authority of its Board of Trustees;

Maryland-National Capital Park and Planning Commission (M-NCPPC), a bi-county agency which manages public parkland and provides land use planning, with administration shared with Prince George's County;

WSSC Water, a bi-county agency which provides water and sewer service to Montgomery and Prince George's Counties;

Housing Opportunities Commission (HOC), the County's public housing authority; and

Montgomery County Revenue Authority, a public corporation for self-supporting enterprises of benefit to the County.

Bethesda Urban Partnership, a not-for-profit organization, that executes service contracts for the benefit of one of the County's special taxing districts (Bethesda Urban District).

Along with M-NCPPC and WSSC, the following organizations are also considered joint ventures of the County: Washington Suburban Transit Commission (WSTC), Washington Metropolitan Area Transit Authority (WMATA), Metropolitan Washington Council of Governments (COG), and Northeast Maryland Waste Disposal Authority (NEMWDA).

An organization chart is included at the end of this section to assist the reader to understand the relationship between the Executive's Recommended Budget and the various agencies of government in Montgomery County.

GOVERNMENT ACCOUNTING METHODS AND FUNDS

The accounting records of Montgomery County Government for tax supported funds are maintained on a modified accrual basis, with revenues being recorded only when available and measurable, and expenditures recorded when goods or services are received and liabilities incurred. Accounting records for proprietary and trust funds are maintained on the accrual basis, with all revenues recorded when earned and expenses recorded at the time liabilities are incurred, without regard to receipt or payment of cash. The principal funds of the County government are:

| Tax Supported Funds | Non-Tax Supported Funds: |

|---|

MCPS: Current Fund | MCPS: Grant, Food Service, and other Enterprise Funds |

Montgomery College: Current and Emergency Repair Funds | Montgomery College: Grant, Continuing Education, Cable Television, and Auxiliary Funds |

M-NCPPC: Administration, Parks, and Advance Land Aquisition Revolving Fund (ALARF) Funds | M-NCPPC: Grant, Enterprise, Property Management, and Special Revenue Funds |

Montgomery County Government: General, Recreation, Urban Districts, Mass Transit, Fire Tax District, and Economic Development Funds | Montgomery County Government: Grant, Solid Waste (Collection and Disposal), Vacuum Leaf Collection, Parking Districts, Cable Television, Liquor Control, Permitting Services, Community Use of Public Facilities, Water Quality Protection, and Montgomery Housing Initiative Funds |

Debt Service associated with General and Special Tax Supported Funds | Debt Service associated with Non-Tax Supported Funds |

Current Revenue to the CIP including Pay As You Go (PAYGO) | Housing Opportunities Commission and Revenue Authority |

Revenue Stabilization Fund contributions | WSSC |

General Fund

The General Fund is the principal operating fund for the County government. It is used to account for all financial resources except those required by law, County policy, and generally accepted accounting principles to be accounted for in another fund.

Special Revenue Funds

Special revenue funds account for activities supported, in part, by special taxes on specific geographical areas, user charges or service fees from those benefiting from special services, or a combination of both. Special revenue funds have been established (listed below).

TAX SUPPORTED SPECIAL REVENUE FUNDS

Economic Development Fund: accounts for grant, loan, and loan repayment activity to assist in attracting and retaining business operations in Montgomery County.

Fire Tax District Fund: accounts for fiscal activity related to the receipt of dedicated property taxes for fire service and the provision of fire and rescue services throughout Montgomery County.

Mass Transit Facilities Fund: accounts for fiscal activity related to planning, developing, and operating County government transit programs.

Recreation Fund: accounts for the receipt and use of recreation taxes, program fees, and other resources for the County's Recreation District.

Revenue Stabilization Fund: accounts for the accumulation of resources during periods of economic growth and prosperity, when revenue collections exceed estimates. Funds may then be drawn upon during periods of economic slowdown, when collections fall short of revenue estimates.

Urban District Funds: account for the receipt and use of resources related to the maintenance and enhancement of the Bethesda, Silver Spring, and Wheaton business districts.

NON-TAX SUPPORTED SPECIAL REVENUE FUNDS

Cable TV Fund: accounts for fiscal activity related to the receipt and use of grants from the County's cable television franchisees (Comcast, RCN, and Verizon) and receipts due to the County over several years as the result of the transfer of ownership of the cable system from the original franchisee to the current owner. Franchise fee payments from the cable company are deposited in the Cable TV Fund and used to defray costs of cable-related activities of various departments and agencies of County government and to pay municipal co-franchisor expenses as required by County law. Income in excess of the Cable fund's operating requirements may be transferred to the General Fund and used to finance general government operations.

Grants Fund: accounts for the Federal and State grant-funded activities of the tax supported General Fund and Special Revenue Funds.

Montgomery Housing Initiative Fund: accounts for fiscal activity related to financing, supplementing, and constructing affordable residential facilities for eligible participants.

Water Quality Protection Fund: accounts for fiscal activity related to maintenance of certain stormwater management facilities, a related loan program to help property owners upgrade such facilities, and a water quality protection charge on certain properties.

Internal Service Funds

These funds are used for the financing of goods and services provided by one department or agency to other departments and agencies of the County government on a cost-reimbursement basis. The following are the Internal Service Funds used by Montgomery County Government:

Central Duplicating Fund: accounts for fiscal activity related to printing and postage services provided to the user agencies, including assessments to departments for mail services and "chargeback" transfers from departments using printing and photocopy services.

Employee Health Benefits Self Insurance Fund: accounts for fiscal activity related to health, life, vision, dental, and long-term disability insurance needs of the participating governmental agencies.

Motor Pool Fund: accounts for operating revenues and expenses related to the automotive and other motorized equipment needs of the user departments of Montgomery County Government.

Liability and Property Coverage Self-Insurance Fund: accounts for fiscal activity related to liability, property, and workers' compensation needs of participating governmental agencies.

Debt Service Fund: The Debt Service Fund accounts for fiscal activity related to the payment of principal, interest, and related costs of general obligation debt, long-term leases, and short-term financing.

Capital Projects Fund

The Capital Projects Fund accounts for fiscal activity related to the acquisition or construction of major capital facilities.

Permanent Funds

Permanent funds are used to account for resources that are legally restricted to the extent that only earnings, and not principal, may be used for purposes that support the reporting government's programs -- that is, for the benefit of the government or its citizenry.

Enterprise Funds

Enterprise funds account for activities: 1) that are financed with debt secured solely by a pledge of the net revenues from the fees and charges of the activity; 2) where the pricing policies of the activity establish fees and charges designed to recover its costs, including capital costs such as depreciation or debt service; or 3) in certain situations, where a fee is charged to users for goods and services. The following are the enterprise funds used by Montgomery County Government:

Community Use of Public Facilities Fund: accounts for fiscal activity related to making public space, such as schools, available to community organizations, commercial users, and others during non-school hours.

Alcohol Beverage Services Fund: the County's Alcohol Beverage Services (ABS) is the sole supplier of all wholesale sales of alcoholic beverages and retail sales of distilled spirits in the County. This fund accounts for the operations of the County government's liquor retail stores, the liquor warehouse, and the administration of the Alcohol Beverage Services. Income in excess of the ABS' operating requirements is transferred to the General Fund and used to finance general government operations.

Parking Lot District Funds: account for fiscal activity related to serving parking needs of those who work and shop in three central business/parking lot districts (Silver Spring, Bethesda, and Wheaton).

Permitting Services Fund: accounts for all fiscal activity related to the collection and use of building permit fees and other charges related to the development process.

Solid Waste Fund: accounts for fiscal activity of all solid waste disposal operations, including recycling, for the County and County contracted refuse collection within the Solid Waste Collection District.

Vacuum Leaf Collection Fund: provides two vacuum leaf collections to residents in the down County area during the late fall/winter months.

Fiduciary Funds

Fiduciary funds account for assets held by the County in a trustee capacity or as an agent for individual private organizations, other governmental units, and/or other funds. The following are the fiduciary funds used by Montgomery County Government:

Agency Funds: account for the administration of assets that are received by the County incidentally in connection with the discharge of its responsibilities. The County uses these funds for special assessment development districts and holding property tax payment.

Private-Purpose Trust Funds: include trust arrangements under which principal and income benefit individuals, private organizations, or other governments. Also included in these funds is the endowment fund for the Strathmore Hall Foundation, to which the County has made contributions and which provides funds for operation of the facility.

Investment Trust Fund: accounts for the external portion of the County's external investment pool that belongs to legally separate entities and non-component units.

Pension and Other Employee Benefit Trust Funds: account for resources that are required to be held in trust for the members and beneficiaries of such pension and employee benefit plans.

Other Special Revenue Funds

Other special revenue funds do not have appropriations within the operating budget; however, their fund balances are re-appropriated as part of the miscellaneous provisions of the appropriation resolution.

Drug Enforcement Forfeitures Fund: accounts for the receipt of cash and other property forfeited to the County during drug enforcement operations. Fund resources are used for law enforcement and drug education programs.

New Home Warranty Security Fund: accounts for the collection of warranty fees from builders and the payment of homeowner claims against builders.

Rehabilitation Loan Fund: a revolving loan fund, established with General Fund money, to help income-eligible homeowners finance rehabilitation required to make their homes conform to applicable Montgomery County Code requirements.

Restricted Donations Fund: accounts for donations and contributions received by the County that are restricted for use in specific County programs.

MONTGOMERY COUNTY PUBLIC DOCUMENTS

ANNUAL BUDGETS AND GROWTH POLICY INFORMATION

| DATE | ITEM | AVAILABILITY |

|---|

January 15th

(even calendar years)

| COUNTY EXECUTIVE'S RECOMMENDED CAPITAL BUDGET AND CAPITAL IMPROVEMENTS PROGRAM (CIP)

County Executive's Transmittal; Introductory Sections; County Government Departments; HOC; Revenue Authority; MCPS; Montgomery College; M-NCPPC; WSSC | www.montgomerycountymd.gov/omb

Reference copies at public libraries

Office of Management and Budget

(240.777.2800)

|

January 15th

(odd calendar years) | COUNTY EXECUTIVE'S RECOMMENDED CAPITAL BUDGET AND AMENDMENTS TO (PRIOR YEAR) CAPITAL IMPROVEMENTS PROGRAM

County Executive's Transmittal; Capital Budget; Amendments | www.montgomerycountymd.gov/omb |

| March 15th | COUNTY EXECUTIVE'S RECOMMENDED OPERATING BUDGET AND PUBLIC SERVICES PROGRAM

County Executive's Transmittal; Financial Summaries; Legislative, Judicial, Executive Branch Departments; MCPS; Montgomery College; M-NCPPC; WSSC | www.montgomerycountymd.gov/omb

Reference copies at public libraries

Office of Management and Budget

(240.777.2800)

|

| March 31st | FISCAL PLAN

Contains estimates of costs and revenues over the six-year planning period for all Montgomery County special and enterprise funds and many Agency funds. | www.montgomerycountymd.gov/omb

Office of Management and Budget

(240.777.2800) |

June 15th

(odd calendar years) | PLANNING BOARD RECOMMENDED GROWTH POLICY - STAFF DRAFT | Reference copies from M-NCPPC

(301.495.4610) |

mid-July

(even calendar years) | APPROVED OPERATING AND CAPITAL BUDGETS, AND APPROVED CAPITAL IMPROVEMENTS PROGRAM

PSP and CIP Appropriation and Approval Resolutions; Operating Budget, CIP and Capital Budget Summaries; Project Description Forms for County Government Programs, HOC, Revenue Authority, MCPS, Montgomery College, M-NCPPC, and WSSC | www.montgomerycountymd.gov/omb

Reference copies at public libraries

Office of Management and Budget

(240.777.2800)

|

mid-July

(odd calendar years) | APPROVED OPERATING AND CAPITAL BUDGETS, AND APPROVED AMENDMENTS TO THE CAPITAL IMPROVEMENTS PROGRAM

PSP and CIP Appropriation and Approval Resolutions; Operating and Capital Budget Summaries; and selected Project Description Forms for County Government Programs, HOC, Revenue Authority, MCPS, Montgomery College, M-NCPPC, and WSSC | Reference copies at public libraries

Office of Management and Budget

www.montgomerycountymd.gov/omb

(240.777.2800)

|

August 1

(odd calendar years) | PLANNING BOARD RECOMMENDED GROWTH POLICY - FINAL DRAFT | Reference copies from M-NCPPC

(301.495.4610) |

ANNUAL FINANCIAL, ECONOMIC AND OTHER SOURCES OF INFORMATION

| DATE | ITEM | AVAILABILITY |

|---|

| Late December | COMPREHENSIVE ANNUAL FINANCIAL REPORT | Reference copies at public libraries:

Department of Finance (240.777.8822)

www.montgomerycountymd.gov/finance

(on limited basis) |

| Quarterly | ECONOMIC INDICATORS | Department of Finance (240.777.8866)

www.montgomerycountymd.gov/finance |

| Monthly (To update the Economic Indicators Report) | ECONOMIC UPDATE | Department of Finance (240.777.8866)

www.montgomerycountymd.gov/finance |

| Annually | ANNUAL INFORMATION STATEMENT | Department of Finance (240.777.8822)

www.montgomerycountymd.gov/finance

(on limited basis) |

| Available throughout the year | MONTGOMERY COUNTY HISTORICAL SOCIETY INFORMATION | Montgomery County Historical Society (301.340.2825)

www.montgomeryhistory.org |

| Available throughout the year | MONTGOMERY COUNTY DEMOGRAPHIC INFORMATION | Maryland-National Capital Park and Planning Commission:

Montgomery County Planning Board (301.650.5600)

www.montgomeryplanning.org/research |