INTRODUCTION

The Montgomery County Charter (Section 302) requires the County Executive to submit a comprehensive six-year program for capital improvements, called the Capital Improvements Program (CIP), not later than January 15 of each even-numbered calendar year or the next business day if January 15th falls on a weekend or a holiday. The Charter requires that the annual capital budget be consistent with the six-year program. In odd-numbered calendar years, the approved CIP, together with any amendments, continues to guide capital investment.

The CIP includes all capital projects and programs for all agencies for which the County sets tax rates or approves budgets or programs. The CIP includes:

- A statement of the objectives of capital programs;

- the relationship of capital programs to the County's long-range development plans;

- recommendations for capital projects and their construction schedules; and

- estimates of costs, anticipated revenue sources, and impacts of the capital program on County revenues and the operating budget.

The County Charter (Section 302) also provides that the CIP may be amended at any time. In practice, amendments to the CIP are limited to conform to the requirement for a biennial, or every other year, CIP. Criteria for amendments generally include: Use of funds from external sources; projects which address significant health or safety requirements; and economic development opportunities.

This section summarizes the CIP, its six-year projections of expenditures, and the fiscal policies and funding to support them. The complete County Executive's Recommended CIP is published as a separate document and may be found at https://www.montgomerycountymd.gov/omb/publications.html. The complete Approved CIP can be found on the same website.

PROGRAM OBJECTIVES

Capital program goals and objectives for departments within the Montgomery County Government are provided in the program description and objectives subsections contained in the various sections of the Recommended CIP document. For other government agencies (Montgomery County Public Schools, Montgomery College, Maryland-National Capital Park and Planning Commission (M-NCPPC), WSSC Water, Revenue Authority, and Housing Opportunities Commission), missions are more generally described, citing statutory authority, with agency capital programs supporting those goals. Further detail on the capital program goals and objectives for these agencies is contained in their CIP request documents, which may be obtained directly from each agency.

CAPITAL PROGRAM PLANNING

Planning Policies

Planning for capital improvements is tied to the County's continuing development and growth in population, number of households, and businesses. Land use master plans and sector plans for the County's geographic planning areas anticipate needs for roads, schools, and other facilities required by new or changing population. The County continues its efforts to improve the linkages between County planning activities, the CIP, and the Operating Budget.

General Plan and Master Plans and Sector Plans

The General Plan Refinement of FY94 recognized the importance of establishing priorities for the provision of public facilities. And the Thrive Montgomery 2050 General Plan approved by the County Council on October 25, 2022, recognized the need for more housing - particularly housing that was affordable to low and moderate-income households, improved transit services, community connections, racial equity, and sustainable communities. The CIP gives high priority to areas of greatest employment and residential density when allocating public investment. Some County master plans include phasing elements that provide guidance about the timing and sequence of capital facilities to develop a CIP that serves long-range needs. Copies of the County's General Plan, adopted master plans, and sector plans may be obtained directly from the M-NCPPC.

Growth and Infrastructure Policy

Overall planning policies involve an interdependence between the CIP as a budgeting document that allocates available public resources according to County priorities and the Growth and Infrastructure Policy, the main purpose of which is to manage the location and pace of private development. The Growth and Infrastructure Policy is designed to affect the staging of development approvals, matching the timing of private development with the availability of public facilities. It identifies the need for public facilities to support private development and constrains the number of private subdivision approvals to those that can be accommodated by existing and programmed public facilities.

In order to guide subdivision approvals under the Adequate Public Facilities Ordinance (APFO), the Growth and Infrastructure Policy tests the adequacy of several types of public facilities: transportation; schools; water and sewerage facilities; and police, fire, and health services. Copies of the County's currently approved Growth and Infrastructure Policy may be obtained directly from the M-NCPPC website.

Functional Plans

Functional plans anticipate needs for government functions and services ranging from provision of water and sewerage to solid waste disposal, libraries, parks, and recreation, and fire and rescue services. Other studies assess future educational, health, and human service needs. These plans are analyzed for likely new facilities or service delivery requirements and their potential operating costs which will eventually add to annual operating budgets.

Public Input

The five local Citizens' Advisory Boards are encouraged to provide the County Executive with their development priorities during the preparation of each CIP. The County Council holds public hearings after receipt of the County Executive's Recommended CIP before deliberations on the program begin. All Council work sessions are public, and residents are encouraged to attend to present their views. Efforts to solicit and incorporate input from communities that do not typically participate in these processes have increased with operating budget forums hosted in Spanish, Chinese, and Amharic; remote and in-person public input opportunities and targeted outreach to underrepresented communities.

Maryland Economic Growth, Resource Protection and Planning Act

The Maryland Economic Growth, Resource Protection and Planning Act requires local governments to review all construction projects that involve the use of State funds, grants, loans, loan guarantees, or insurance for consistency with existing local plans. The County Executive or the requesting agency affirms that all projects which are expected to receive State financial participation conform to relevant local plans. This language appears in the "Disclosures" portion of the relevant project description forms.

County Council and Planning Board Review

During the Council review process, the Planning Board provides comments to the Council regarding conformance with local plans, and a final determination as to consistency of projects with adopted County plans is made by the County Council. The Council adopts the CIP and approves a list of applicable State participation projects.

Fiscal Policies

Prior to considering specific projects for inclusion in the CIP, Montgomery County develops projections of total resources available to the County as a whole, and to the CIP as a subset of the whole. A variety of assumptions underpin these projections.

Economic Assumptions

Revenue projections depend largely on assumptions regarding economic activity, including employment, income, inflation, interest rates, construction, home sales, and other economic conditions.

Demographic Assumptions

The CIP is based on demographic assumptions based on data from Moody's Analytics and Woods & Poole Economics and are based on fiscal and economic data and analyses used or prepared by the Department of Finance. This forecast predicts that the County will continue to experience steady population growth. Besides general population changes, demographic forecasts anticipate the greatest enrollment growth shifting from the elementary school to the middle and high school levels.

Debt Capacity

To maintain its AAA bond rating, the County considers the following guidelines in deciding how much additional County general obligation debt may be issued in the six-year CIP period.

- Total debt, both existing and proposed, should be kept at about 1.5 percent of full market value (substantially the same as assessed value) of taxable real property in the County.

- Required annual debt service expenditures should be kept at about 10 percent of the County's total tax supported operating budget. The tax supported operating budget excludes proprietary funds and grants.

- Total debt outstanding and annual amounts issued, when adjusted for inflation, should not cause real debt per capita (i.e., after eliminating the effects of inflation) to rise significantly.

- The rate of repayment of bond principal should be kept at existing high levels and in the 60-75 percent range during any 10-year period.

- Total debt outstanding and annual amounts proposed should not cause the ratio of per capita debt to per capita income to rise significantly above its current level of about 3.5 percent.

The debt capacity schedule is displayed later in the Debt Service section.

Spending Affordability Assumptions

The County Charter (Section 305) requires that the Council adopt spending affordability guidelines for the capital and operating budgets. Spending affordability guidelines for the CIP have been interpreted in County law to be limits on the amount of general obligation debt and Park and Planning debt that may be approved for expenditure in the CIP. Spending affordability guidelines are adopted in odd-numbered calendar years and limit the amount of general obligation debt that may be approved for the first year, the second year, and for the entire six years of the CIP. Similar provisions cover the bonds issued by M-NCPPC.

The Montgomery and Prince George's County Councils adopt one-year spending limits for WSSC Water. These spending control limits include guidelines for new debt and annual debt service.

General Obligation Debt Limits

General obligation debt usually takes the form of bond issues. General obligation debt pledges general tax revenue for repayment. Montgomery County has maintained a AAA rating, the highest quality rating available, for its general obligation bonds. This top rating by Wall Street rating agencies, enjoyed by very few local governments in the Country, assures Montgomery County of a ready market for its bonds and the lowest available interest rates on that debt.

Impact of Capital Program on the Operating Budget

Capital improvement projects generate future operating budget costs in the following ways: (1) debt service; (2) current revenues that fund projects not eligible for debt financing, (3) PAYGO which offsets the need to issue debt; and (4) changes to the Operating Budget to support new or renovated facilities.

Debt Service

The annual payment of principal and interest on general obligation bonds and other long-term and shorter-term debt used to finance roads, schools, and other major projects is included in the operating budget as a required expenditure. The FY24 tax-supported debt service, as displayed later in the Debt Service section, is approximately $452.8 million.

Current Revenue and PAYGO

Certain CIP projects are funded directly with County Current Revenues to avoid costs of borrowing. These amounts are included in the operating budget as specific transfers to individual projects within the capital projects fund. PAYGO, or "pay as you go" funding, is an additional amount included in the operating budget as a direct bond offset to reduce the amount of borrowing required for project financing. The FY25 tax-supported Current Revenue and PAYGO are approximately $205.0 million and are displayed in the Schedule A-3.

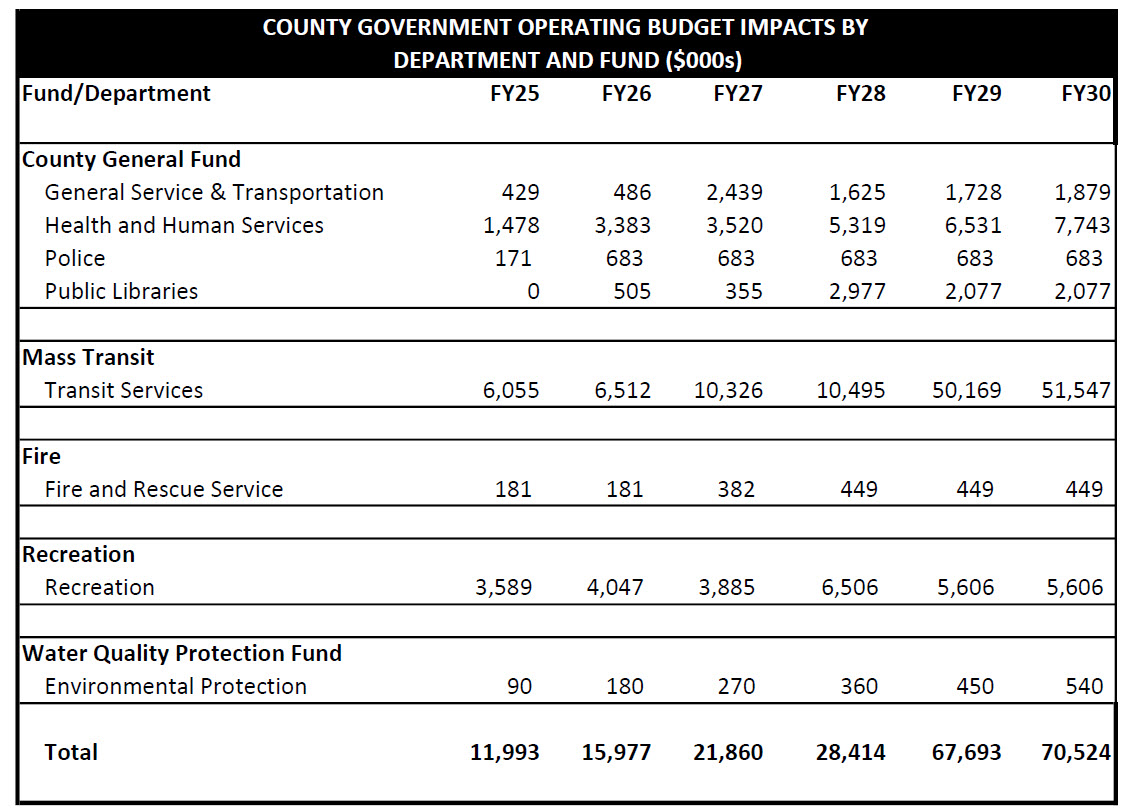

Operating Budget Impacts (OBI)

The construction of government buildings and facilities usually results in new annual costs for maintenance, utilities, and additional staffing required for facility management and operation. Whenever a new or expanded facility involves program expansion, as with new school buildings, libraries, or fire stations, the required staffing and equipment (principals, librarians, fire apparatus) represent additional operating budget expenditures.

The CIP includes analysis of these operating budget impacts to aid in review and decisions on the timing of public facilities and to more clearly show what a new building or road will cost in addition to its construction costs and any required debt service. The project description forms published in the Recommended FY25-30 CIP in January, display operating budget impacts of individual projects where applicable. The following chart summarizes the impact of the Recommended FY25-30 CIP on the operating budget expenditures of the related departments.

PROJECT COST PROJECTIONS

Departments and agencies estimate the cost of each proposed capital project in current dollars. For the most part, County agencies use contracted cost estimators to develop project costs, and those estimates are reviewed and verified by County staff. Recent cost changes for construction commodities have been included, and projects are escalated to the mid-point of construction. Inflation is estimated separately, and funds are set aside to allow for inflation-driven cost increases in later years. During each even-numbered calendar year, all existing and proposed projects are reviewed centrally for changes to cost, scope, and timing, and adjusted as necessary.

The County Charter (Section 307) provides for supplemental appropriations to address interim project cost increases. Unappropriated resources are set aside during the fiscal planning process to fund potential cost increases or for new projects which address urgent needs.

REVENUE SOURCES

The major revenue sources for the Capital Improvements Program are described in the Fiscal Policy section of the County Executive's Recommended CIP. There are four major types of revenue sources for the capital improvements program: current revenues (including PAYGO and recordation taxes); proceeds from bonds and other debt instruments; impact taxes paid to support increased transportation and school capacity needed as a result of development; and grants, contributions, reimbursements, or other funds from intergovernmental and other sources. In some cases, where both a public and a private goal may be achieved, the County enters partnerships with the private sector to finance and construct public facilities.

The specific funding sources for all expenditures are identified on each individual capital project description form.

Current Revenues

Current revenues from the General Fund are used for designated projects which involve broad public use and which fall outside any of the specialized funds. Generally, current revenues are used for the planning of capital projects.

PAYGO is current revenue set aside annually in the operating budget, but not appropriated. PAYGO is used to replace bonds for debt-eligible expenditures ("pay-as-you-go" financing) or when projects are not debt eligible or not eligible for tax-exempt financing. The County generally allocates PAYGO of at least ten percent of general obligation bonds planned for issue each year.

Bond Issues and Other Public Agency Debt

Bonds are used to spread the cost of construction of a public facility over time, such that those who benefit from it over time share in the costs. The County government and four of its agencies are authorized by State law and/or County Charter to issue debt to finance CIP projects. This debt may be either general obligation or self-supporting debt.

County government general obligation bonds are issued for a wide variety of functions such as transportation, public schools, community college, public safety, and other programs. These bonds are legally-binding general obligations of the County and constitute an irrevocable pledge of its full faith and credit and unlimited taxing power. The money to repay general obligation debt comes primarily from General Fund revenues, except that debt service on general obligation bonds, if any, issued for projects of Parking Districts, Liquor, or Solid Waste funds is supported from the revenues of those enterprises.

M-NCPPC is authorized to issue general obligation bonds, also known as Park and Planning bonds, for the acquisition and development of local and certain special parks and advance land acquisition, with debt limited to that supportable within tax rates established for the Commission.

County Revenue Bonds are bonds authorized by the County to finance specific projects such as parking garages and solid waste facilities, with debt service to be paid from pledged revenues received in connection with the projects. Proceeds from revenue bonds may be applied only to costs of projects for which they are authorized. They are considered separate from general obligation debt and do not constitute a pledge of the full faith and credit or unlimited taxing power of the County.

County revenue bonds have been used in the Bethesda and Silver Spring Parking Districts, supported by parking fees and fines together with parking district property taxes. County revenue bonds have also been issued for County Solid Waste Management facilities, supported with the revenues of the Solid Waste Disposal system.

The Montgomery County Revenue Authority has authority to issue revenue bonds and to otherwise finance projects through notes and mortgages with land and improvements serving as collateral. These are paid through revenues of the Authority's several enterprises, which include golf courses and the Montgomery County Airpark.

The County also uses the Revenue Authority as a conduit for alternative CIP funding arrangements for swim centers and the construction of the Montgomery County Conference Center. The County has entered into long-term leases with the Revenue Authority, and the County lease payments fund the debt service on these Revenue Authority bonds.

Other specialized bonds are used to finance a variety of public infrastructure, including water distribution and sewage collection lines and required support facilities, stormwater management, and affordable housing. These bonds are paid from non-tax sources including user charges and mortgages, which also cover all operating costs.

Intergovernmental Revenues

CIP projects may be funded in whole or in part through grants, matching funds, or cost sharing agreements with the Federal government, the State of Maryland, the County's incorporated municipalities, or regional consortia such as the Washington Metropolitan Area Transportation Authority (WMATA), WSSC Water, and the Washington Area Sewer Authority (WASA).

Federal Aid. Major projects that involve Federal aid include Metro, commuter rail, interstate highway interchanges, bridges, and various environmental construction or planning grants. Most Federal aid is provided directly to the State, and then redistributed to local jurisdictions.

Community Development Block Grant (CDBG) funds are received through annual formula allocations from the U.S. Department of Housing and Urban Development in response to a County application and are used for neighborhood improvements and facilities in areas where there is significant building deterioration, economic disadvantage, or other need for public intervention in the cycles of urban growth and change.

State Aid includes grants, matching funds, and reimbursements for eligible County expenditures for local projects in public safety, environmental protection, health and human services, courts and criminal justice, transportation, libraries, parkland acquisition and development, community college, and public school construction.

Municipal Financing. Some projects with specific benefits to an incorporated municipality within the County may include funding or other financing from that jurisdiction. Incorporated towns and municipalities, specifically Rockville, Gaithersburg, and Poolesville, have their own capital improvements programs and may participate in County projects where there is shared benefit.

Other Revenue Sources

The use of other revenue sources to fund CIP projects is normally conditioned upon specific legislative authority or project approval, including approval of appropriations for the projects. Approval of a project may be contingent upon actual receipt of the revenues planned to fund it, as in the case of private contributions that are not subject to law or agreement.

EXAMPLES OF CAPITAL PROJECTS

The CIP addresses the County's needs for basic infrastructure, education, transportation, and other critical facilities in the following ways:

SPOTLIGHT ON SIGNATURE INITIATIVES

Building Bus Rapid Transit System

- Funding to implement Veirs Mill Road Bus Rapid Transit (BRT) with completion in FY27.

- Funding to implement MD 355 Bus Rapid Transit (BRT) Central phase, with completion in FY29.

- Bolster funding to continue planning for BRT System Development.

- Support for study, conceptual design, preliminary engineering, and community outreach to solve a long-standing problem of accommodating new climate friendly bus technology and transit fleet growth for new planned Bus Rapid Transit routes, and to implement the Shady Grove Master Plan by constructing a new bus depot.

Preserving & Increasing Affordable Housing

- Increased funding for the Affordable Housing Acquisition and Preservation Project to preserve and increase the stock of affordable housing for the County.

- Boost funding to more than double the new Nonprofit Preservation Fund project to preserve existing affordable housing in developments at risk of rent escalation to higher market rents.

- Increased funding in loan repayments to the Affordable Housing Opportunity Fund to provide seed money to establish a public-private commitment of funds which will proactively leverage public and private capital to preserve affordable housing developments.

- Created a new Revitalization for Troubled and Distressed Common Ownership Communities project to provide financial and technical support for aging neighborhoods with homeowner and condominium associations to address delayed maintenance and rehabilitation of their common areas.

- Continued support for funding renovations of Housing Opportunities Commission affordable housing units.

Fighting Climate Change

- Replacement of 182 diesel and natural gas Ride On buses with zero-emissions buses in FY25-30 with the goal of a transition to a 100% zero-emissions fleet by 2035.

- Construction of a hydrogen generation and fueling site to provide green hydrogen fuel for Ride On buses.

- Funding for planning and preliminary design of a new zero-emissions Ride On bus depot.

- Enhance funding for projects to enhance energy conservation in County-owned facilities and to support implementation of the new Building Energy Performance Standards.

- Provide for new electric vehicle charging infrastructure for County government fleet.

Expanding Early Care and Education

- Funding for childcare playground improvements, Americans with Disabilities Act (ADA) remediation, and facility replacement.

- Support for the Blueprint for the Maryland's Future to expand full-day Pre-K education, which would create a standalone early childhood center in Whetstone Elementary School and rehabilitate Parkside Elementary School and the current Burtonsville Elementary School to become early childhood centers.

- Establish an Early Care and Education Facility Fund to provide financial resources and technical assistance for the expansion and enhancement of child care facilities in our community.

Improving Economic & Community Development

- Utilization of State Aid to build additional road infrastructure and site improvements in support of the County's plan to spur development of the North Bethesda area.

- Collaboration with the Henry M. Jackson Foundation to develop a co-branded innovation facility that will advance life science research, innovation, and commercialization in the North Bethesda region.

- Continued public-private partnership to develop the White Oak Science Gateway life science mixed use development.

- Utilization of State Aid to create a "village center" to support existing small businesses and create new opportunities for private investment at the Burtonsville Crossing Shopping Center site.

- Conversion of underutilized office space at the Germantown Innovation Center into small wet labs for early-stage biotechnology entrepreneurs, and pursuit of new State Aid to add additional wet labs to further accelerate the growth of the biotechnology industry.

- Allocate funding for the design and construction of retail space at the Wheaton M-NCPPC Headquarters building.

- Acquisition of property in the Glenmont Shopping Center area to advance the economic development goals of the Glenmont Sector Master Plan.

Advancing Racial Equity & Social Justice

- Continued funding of Digital Equity's Montgomery Connects project to help lower income residents access high-quality broadband services.

- Support for the deployment of Montgomery County's high-speed residential broadband internet service network, MoCoNet, at affordable housing developments.

- Recommend funding for affordable housing, transit, pedestrian safety, student health, education, culture, and economic development projects that can reduce racial disparities and inequities.

A GREENER COUNTY

Recycling and Resource Management

- Continued construction of upgrades to the Recycling Center, which will allow the County to process 100% of the material it generates rather than sending excess material out of state for processing.

- Improved capture of methane, a powerful greenhouse gas, from the decommissioned Gude Landfill, and install a toupee cap to prevent groundwater contamination.

- Upgrade of the leachate plant at the decommissioned Oaks Landfill which has reached the end of its useful life.

- Add funds for a New Organics Processing Facility to provide for improvements to divert compostable organics from the traditional waste stream.

Stormwater Management

- Significant investments to begin implementation of the comprehensive flood management plan to address this pressing issue. The first phase of the work will construct flood mitigation improvements in watersheds throughout the County most prone to flooding or particularly vulnerable to future flooding.

- Add a new Seven Locks Culvert project to replace failing culverts with larger diameter culverts to reduce the likelihood of flooding of the Scotland AME Zion Church during storm surges.

- New project that focuses on small scale repair and restoration work to prevent minor deficiencies from becoming larger, more costly projects in the future.

- Reduction of program costs through lower interest financing through Maryland Water Quality Revolving Loan funds.

- Installation of new stormwater management facilities and retrofit of old stormwater controls to prevent property damage, improve water quality, and protect habitat.

- Repair of major structures on public and private stormwater facilities accepted into the County's maintenance program.

Maryland-National Capital Park and Planning Commission

- Requested funding for a new park in Lyttonsville.

- Construction and renovation of hard surface trails, including community connections and trail amenities, and adding trail signage.

- Maintenance of the park system, addressing life-cycle issues and climate change with projects such as Energy Conservation: Non-Local parks.

- Restoration of stream valleys to support the County's stormwater management initiatives.

THRIVING YOUTH AND FAMILIES

Montgomery County Public Schools (MCPS)

- Provides a significant increase in the first four-years of the six-year period despite revenue shortfalls so that projects with cost increases can stay on schedule, progress can be made on the Blueprint for Maryland's Future goals, and infrastructure can be maintained.

- Funding and acceleration of appropriation to allow MCPS to enter into a prevailing wage construction contract for the Northwood High School Addition and Facility Upgrade project, which will have the benefit of maximizing State Aid participation to 40% of total costs.

- Funding for MCPS' Countywide infrastructure and systemic projects including Heating, Ventilation and Air Conditioning (HVAC), Roof Replacement, Planned Lifecycle Asset Replacement (PLAR), ADA Compliance, and Emergency Replacement of Major Building Components.

- Support for a study related to a distributed bus parking model for MCPS' bus fleet.

Montgomery College (MC)

- Continuation of the process of establishing a fourth College campus in East County.

- Beginning of Phase II of the Germantown Student Affairs Building Renovation and Addition.

- Increase in funding for the Collegewide Library Renovations to take advantage of State allowed escalation and mitigate inflationary costs.

- Addition of major construction costs for the Germantown Student Services Center in FY29.

- Increase in funding for Roof Replacement project.

Public Libraries

- Design and construction of a new library in Clarksburg, including funds for the evaluation and purchase of an alternate site.

- Planning and construction of six library refresh projects over the FY25-30 CIP cycle: Damascus Library, Silver Spring Library, Twinbrook Library, Rockville Library, Gaithersburg Library, and Olney Library. State Aid was also provided for a shade structure for Long Branch Library.

- Continued implementation of a 21st Century Library Enhancements project that will allow Public Libraries to respond to customer demands and library trends that require changes in the equipment and related furnishings of library buildings.

Health and Human Services

- Programs for four High School Wellness Centers, providing physical, mental health, and positive youth development services, and three new model centers supporting mental health and youth development services.

- Enhance funding for Linkages to Learning (LTL) sites at Twinbrook Elementary School, Whetstone Elementary School, and Eastern Middle School.

Recreation

- Completion of construction of the Silver Spring Recreation and Aquatic Center.

- Funding for design and construction of a new Western County Recreation Center to serve the Town of Poolesville and neighboring communities in Western Montgomery County.

- Boost funding to support remaining renovation project work at the Martin Luther King, Jr. Indoor Swim Center, including reconstruction of the pool deck for compliance with Americans with Disabilities Act requirements.

- Enhance funding for Net Zero energy conservation measures and to replace masonry, windows, and other building envelope components of the Kennedy Shriver Aquatic Center.

- Addition of funds to the Recreation Facilities Refurbishment projects to ensure that all indoor pools, outdoor pools, and recreation center facilities are refurbished through repair or replacement of facility components.

- Program construction funding for the Swimming Pools Slide Replacement project to ensure the safe pool operations.

- Recommend funding for a new Recreation Asset Replacement project to replace assets such as bleachers, kitchens, marquees, and partitions to ensure recreational assets are maintained.

- Creation of a new Recreation Facilities Playground Replacement project to replace and modernize playgrounds at recreation centers to ensure that these assets are well maintained and comply with national standards.

EASIER COMMUTES

Traditional Transit

- Additional funding in the Bus Priority Project to enhance Countywide bus system performance.

- Continued design and construction of the Great Seneca Science Corridor Transit Improvements, with Pink and Lime lines to launch service in FY25.

- Funding to support the construction of a mezzanine for the south entrance of the Bethesda Metrorail Station in coordination with the Purple Line project.

- Oversight and financial support for the Purple Line project which will provide significant economic and mobility benefits.

- Support efforts to improve the condition of Ride On bus stops.

- Funding to stabilize the historic Hoyles Mill, in addition to constructing a new bus loop and parking lot, at the Boyds MARC Station.

Pedestrian & Bicycle Facilities

- Funding for the US 29 Pedestrian and Bicycle Improvements for the design and construction of pedestrian and bicycle improvements to Flash stations along the US 29 corridor.

- Construction of new protected bicycle lanes in Downtown Bethesda to be known as the "Bethesda Circle" to support Vision Zero goals.

- Construction of a new shared use path along Good Hope Road including a pedestrian bridge at the intersection of Hopefield Road.

- Construction of a new sidewalk along Oak Drive from the southern intersection with MD 27 to John T. Baker Middle School to support Vision Zero goals.

- Funding added to Bicycle-Pedestrian Priority Area Improvements-Wheaton Central Business District to construct additional sub projects.

- Increase in funding to Bicycle-Pedestrian Area Improvements-Purple Line for the design and construction of improvements in areas adjacent to future Purple Line Stations.

- Continued funding for two Purple Line-related projects: Capital Crescent Trail and Silver Spring Green Trail.

- Continued funding for the Metropolitan Branch Trail, including a grade-separated bridge over Georgia Avenue to avoid a significant cost increase while still providing for safe roadway crossings for cyclists.

- Acceleration of the MD 355-Clarksburg Shared Use Path.

- Completion of the construction of the Franklin Avenue Sidewalk and MacArthur Blvd Bikeway Improvements.

- Partner with Maryland Department of Transportation State Highway Administration to design the Sandy Spring Bikeway, a ten-foot-wide shared use path on the north side of MD-108 from Dr. Bird Road to Norwood Road.

- Funding for the first phase of the Tuckerman Lane Sidewalk project along a portion of the south side of Tuckerman Lane.

Bridges & Roads

- New funding for Auth Lane Pedestrian Bridge, Brookville Road Bridge, Redland Road Bridge, and Schaeffer Road Bridge.

- Increased funding for Brighton Dam Road Bridge rehabilitation to reflect cost increases due to inflation and the addition of a new turnaround site, relocation of the existing crosswalk, and installation of additional streetlights.

- Increased funding for Glen Road Bridge to provide for increased stream restoration on the upstream side of the bridge and cost increases due to inflation.

- Increased funding for Bridge Design Program, Bridge Preservation Program, Brink Road Bridge, and Dennis Avenue Bridge.

- Maintained funding for Garrett Park Road Bridge and Mouth of Monocacy Road Bridge.

- Maintained funding to construct a new roadway between Spencerville Road (MD 198) and the School Access Road in Burtonsville.

- Completed sidewalk and streetscape improvements along MD 355 and Old Georgetown Road to improve mobility and safety for users of the North Bethesda Metro Station.

- Allocate funding for preliminary design of spot improvements on Goshen Road to address safety issues.

SAFE NEIGHBORHOODS AND VISION ZERO

Transportation

- Escalated funding for all Highway Maintenance road projects to prevent more costly rehabilitation work.

- Increased six-year funding for sidewalk and curbs by more than 15 % to support Vision Zero goals.

- Continued efforts to resurface residential and rural roads.

- Continued efforts to preserve street trees.

- New project for each Parking Lot District to expand and upgrade security cameras in County-owned parking garages so that patrons of our central business districts and community parking garages feel secure while using County facilities.

- Increased funding in the Neighborhood Traffic Calming project to expand implementation of traffic calming safety features.

- Increased funding in the Streetlighting Project to manage the increase in unit cost and the rising frequency of streetlight knockdowns.

- Continued efforts to modernize the central traffic signal control system to provide additional capabilities and tools to optimize traffic flow.

- Leverage efforts to install and upgrade streetlights Countywide to help improve pedestrian safety and reduce crime.

- Support for the Vision Zero initiative, with the continued design, construction, and maintenance of vehicular and pedestrian traffic signals to increase vehicular and pedestrian safety to reduce injuries and fatalities on all roads.

Police

- A new 6th District (Montgomery Village) Police Station is expected to open in Summer 2025.

- Completion of design of the 4th District (Wheaton) Police Station HVAC renovation project in FY24.

- Renovation, upgrade, and expansion of the Outdoor Firing Training Center to begin in FY26.

Correction and Rehabilitation

- Funding to design and construct a new Justice Center on the site of the former District One Police Station located at the north end of Seven Locks Road, including a Central Processing/Detention component to support processing new arrestees and detaining remanded individuals for up to 72 hours.

- Installation of wireless internet throughout the Montgomery County Correctional Facility (MCCF) and Community Corrections (CC) and wireless upgrades at the Montgomery County Detention Center.

- Program the planning of a Montgomery County Correctional Facility Refresh project to include medical unit modifications and remediation of clogged vents in inmate cells to address health and life safety needs, and paint and carpet replacement throughout the facility.

Fire and Rescue Services

- Design and construction of a new White Flint Fire Station to house units currently operating out of Rockville Station 23 which support the White Flint community. This project will include enhancements to achieve Net Zero construction.

- Continued apparatus replacement to meet critical needs: anticipated replacement over the six-year period of six aerial trucks, 40 EMS units (ambulances), 15 pumpers including two all-wheel drive brush trucks, four rescue squad/HAZMAT units, two tankers, and 13 support vehicles.

- Planning for the Rockville Fire Station 3 renovation project.

- Design and construction of female facility improvements at Gaithersburg Fire Station 8 and Silver Spring Fire Station 16 to expand and improve locker, shower, and restroom facilities to appropriately accommodate MCFRS personnel.

- Increased funding for heating, ventilation, and air conditioning (HVAC)/electrical replacement, resurfacing, and roof replacement to address critical improvements and maintenance.

- Funding to replace breathing air compressors that are outdated and support an essential part of fire fighters' personal protective equipment.

EFFECTIVE, SUSTAINABLE GOVERNMENT

WSSC Water

- Continued development of capital projects aimed to address long-term issues in water and sewer management.

- Fund projects whose purpose is to support the extensive water and sewer infrastructure and numerous support facilities, including addressing regulatory changes, regulatory mandates, health and safety issues, and business risk exposure.

- Completion of the Piscataway Bio-Energy project, the largest and most technically advanced project ever constructed by WSSC Water, to use innovative technology to recover resources and produce green energy.

- Expansion of the consolidated Laboratory Division Building and replacement of equipment in the building to accommodate increased workload.

- Replacement and upgrade of assets at the WSSC Water Support Center.

- Continuation in addressing the consent decrees related to the Potomac Water Filtration Plant to allow WSSC Water to meet new discharge limitations.

Technology and Enterprise Business Solutions

- Dense Wave Division Multiplexing (DWDM) Update project to replace the DWDM system to provide critical optical broadband network communications.

- Maintain investment in the FiberNet program.

- Continued investment in the FiberNet program while shifting all remaining funds from Cable Funds to General Funds to facilitate monetization of this system.

- Support implementation of a new County Building Network Wiring program to upgrade network wiring and equipment in County-owned buildings to eliminate bottlenecks and allow County users to fully utilize the FiberNet system.

- Funding for a new Public Safety Server Hardware program to replace end-of-life servers that provide critical on-premises public safety systems.

- Continued County Radio Life Cycle Replacement project to provide for the phased replacement of voice radio systems that have reached the end of their expected 10-year service life, used primarily by the County's public safety-first responder agencies.

General Government

- Support replacement of aging County building heating, ventilation, and air conditioning (HVAC) and electrical systems; life safety systems, elevator systems, and parking lots. Continued funding in support of Americans with Disability Act improvements, asbestos abatement, environmental compliance, facility site selection, facility planning, and planned life-cycle asset replacement.

- Expand funding for Building Envelope Repair and Roof Replacement in County buildings to improve energy efficiency and protect County assets from damage due to failures in these critical building systems.

- Funding for the historic Lincoln High School project for the design and construction of the building shell, including HVAC and electrical systems work.

- Replacement of audio/video systems in 18 Circuit Court courtrooms. These systems support remote hearings, assisted listening for individuals with hearing loss, and translation technology for non-English speakers and allow for electronic capture of the Court record.

- Completion of renovations of the Council Office Building.

- Add funds to support improvements to the Circuit Court North Tower to enhance the safety of the judges serving our community.

Revenue Authority

- Implementation of the next phase of the Airport Layout Plan and the Airport Capital Improvement Plan through land acquisitions.

- Continued improvement and maintenance to ensure the safety of all golf courses, including a new project to support Hampshire Greens Golf Course improvements.

- New project providing a new hangar at the north end of the Montgomery County Airpark, largely funded by the Federal Aviation Administration.

EXPLANATION OF THE CHARTS WHICH FOLLOW

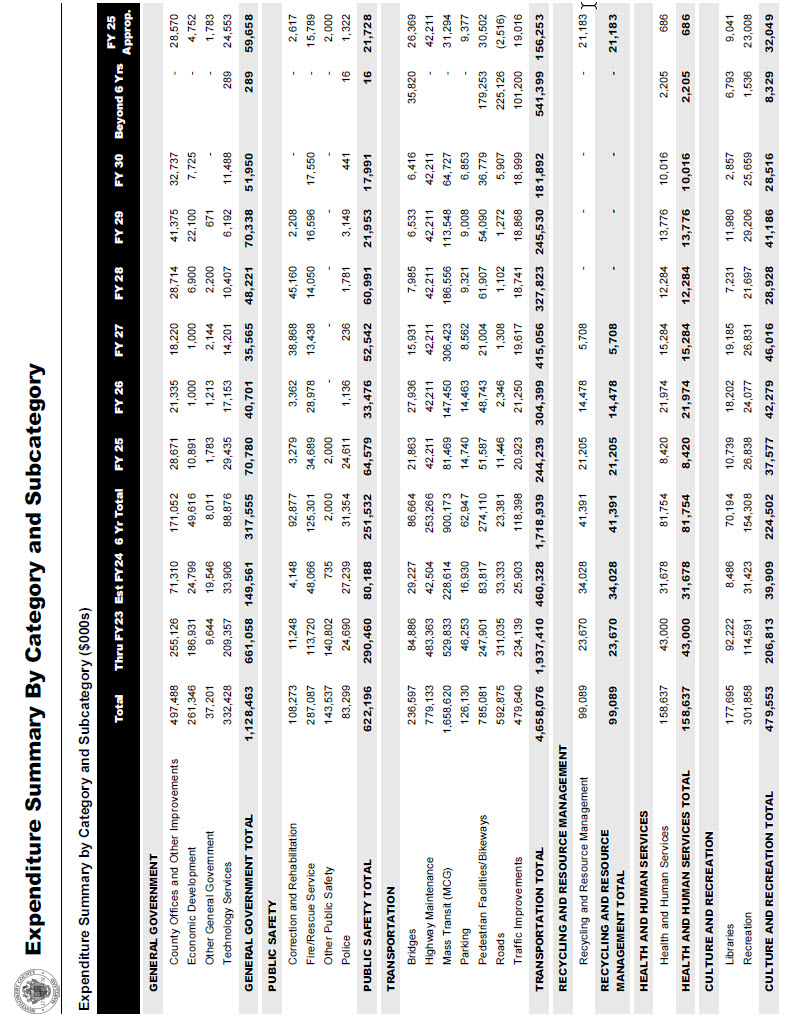

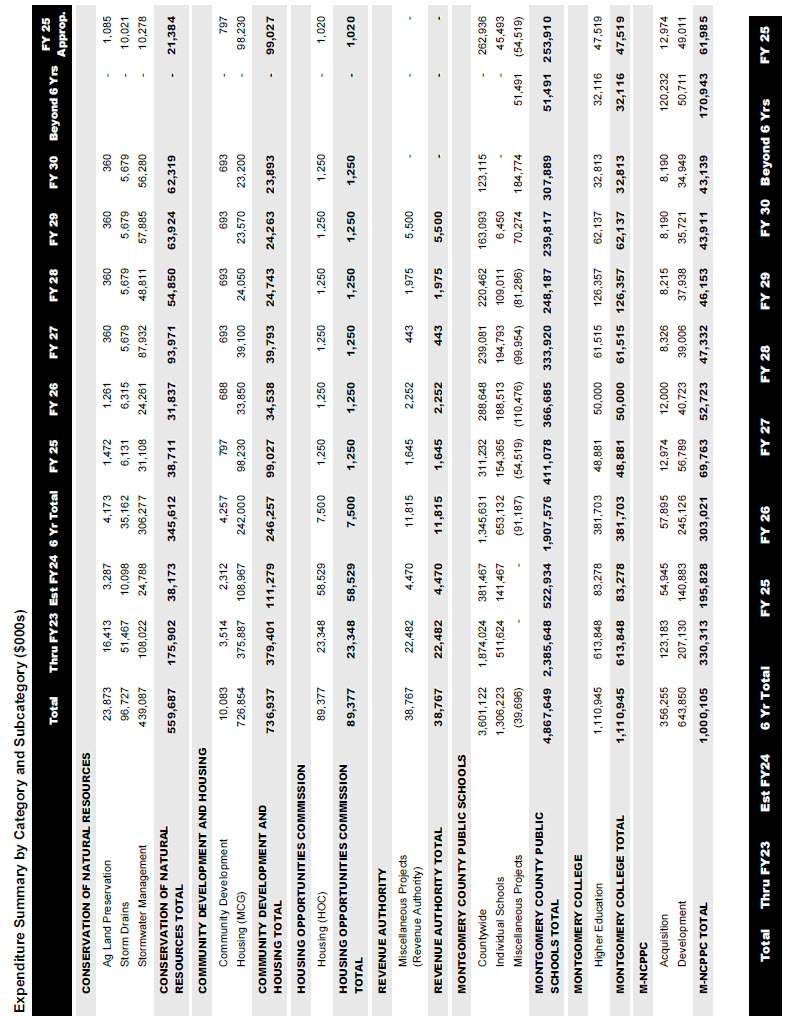

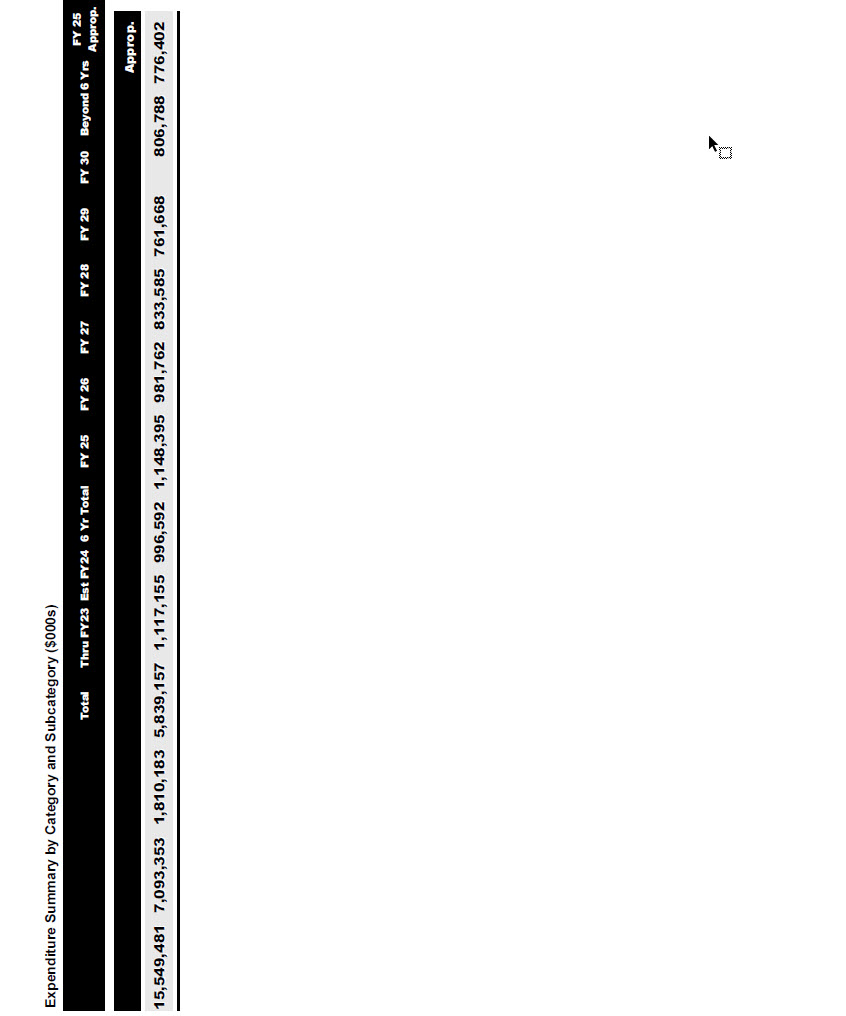

Expenditure Summary by Category and Sub-Category

The program expenditure summary report for the County Executive's Recommended FY25-30 CIP, as recommended in January, is included after the chapter narrative. The County Executive's Recommended FY25-30 CIP contains project description forms for each capital project which include a description, programmed expenditures, and funding sources.

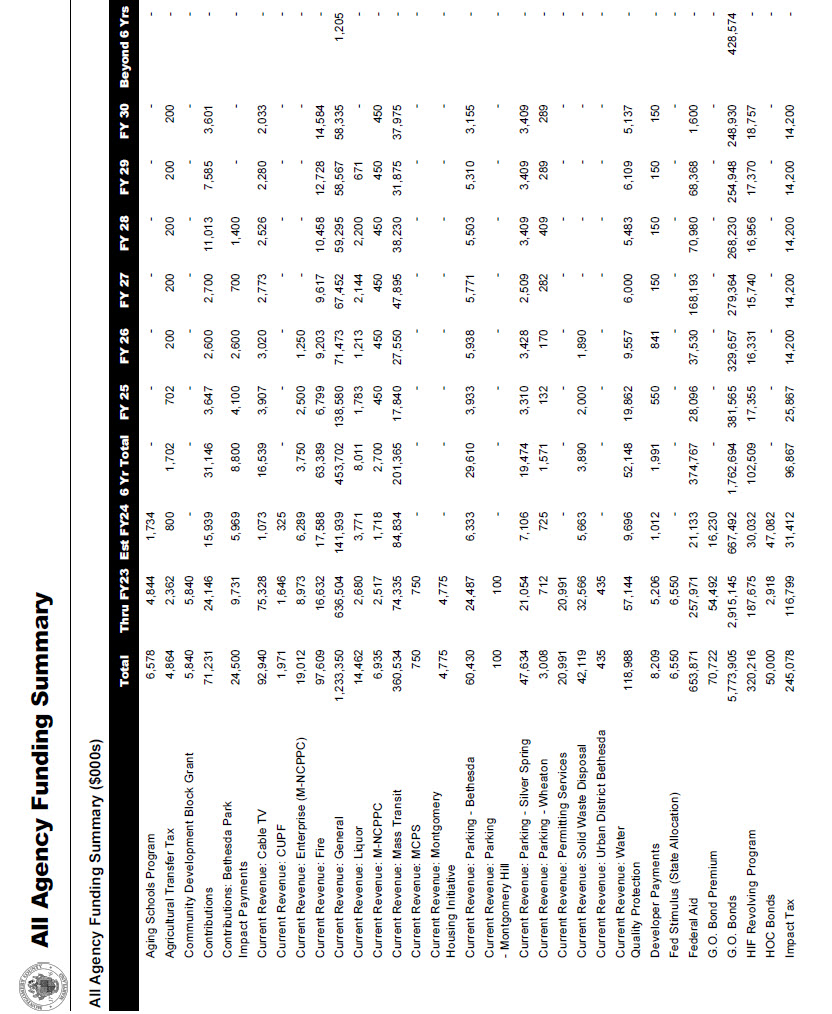

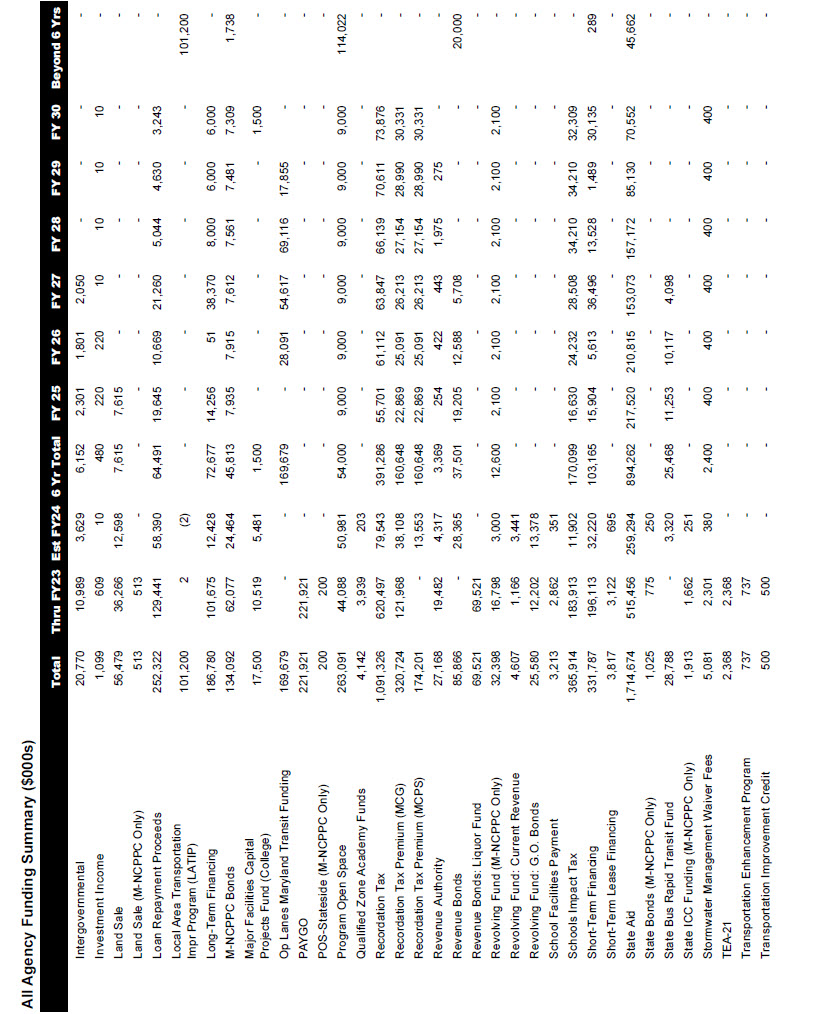

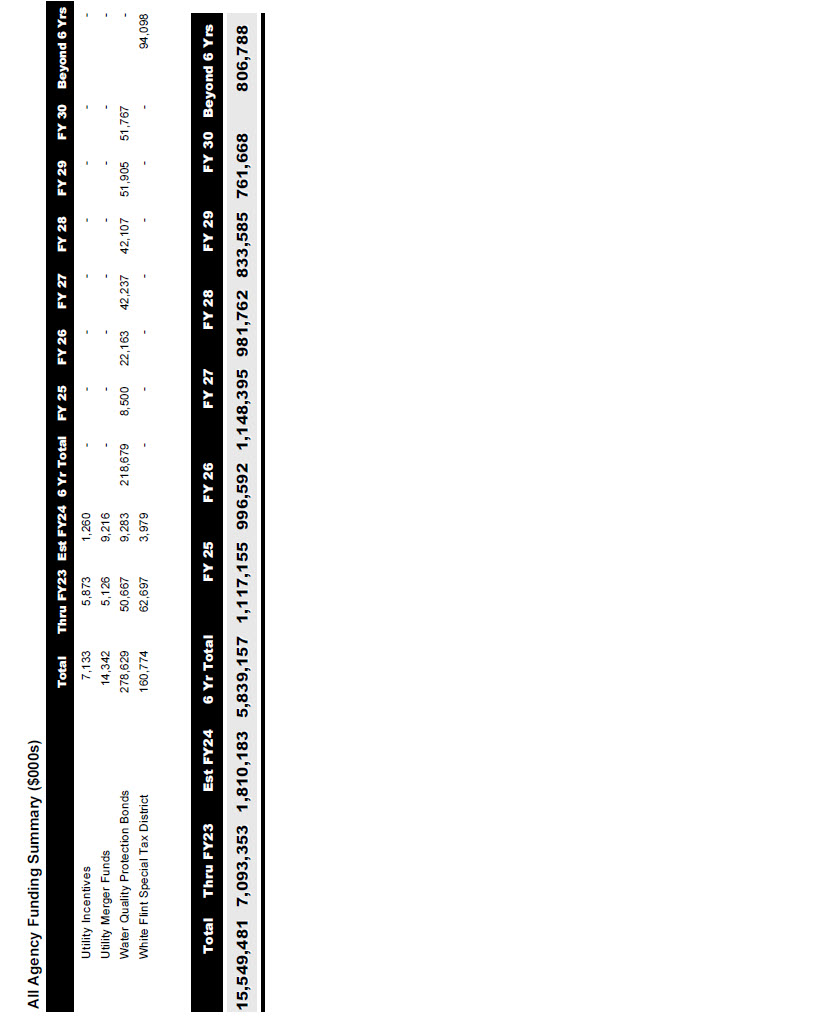

All Agency Funding Summary

The summary report listing recommended funding support from all sources for the County Executive's Recommended FY25-30 CIP, as recommended in January, is included after the Expenditure Summary by Category and Subcategory report. The County Executive's Recommended FY25-30 CIP contains project description forms for each capital project which include a description, programmed expenditures, and funding sources.